What would be the marginal tax rate for a single person who has the following taxable income? 1. $35,310 2. $67,710 3. $87,000 4. $111,750

Q: Chuck, a single taxpayer, earns $75,000 in taxable income and $10,000 in interest from an investment…

A: Introduction A tax is a governing firm's mandatory charge or another sort of levy placed on a…

Q: What is the amount of taxes for the head of a household with taxable income of $62,525

A: Taxable income refers Adjusted gross income (AGI) less (if any) any itemized deduction that is…

Q: What is the tax liability for a married couple with a taxable income of $92,225? What is the tax…

A: Tax rates for married couple: Tax rate Amount($) 10%…

Q: 28

A: The objective of this question is to calculate the marginal tax rate for Campbell, a single…

Q: Chuck , a single taxpayer earns $81,400 in taxable income and $13,600 in interest from an investment…

A: As per the Honor code of Bartleby we are bound to give the answer of first three sub part only,…

Q: For the person below, calculate the FICA tax and income tax to obtain the total tax owed. Then find…

A: FICA Tax: FICA stands for Federal insurance contribution act. It is mandatory as per U.S law in…

Q: What is the minimum tax that Pedro should pay to make the tax structure vertically equitable based…

A: The Vertically Equity tax structure is the most widely used structure in order to calculate and…

Q: Net pay refers to the amount of take-home pay after taxes and other deductions (healthcare, social…

A: Net pay is calculated by deducting the tax from the gross salary amount.

Q: 1. Chuck, a single taxpayer, earns $76,400 in taxable income and $11,500 in interest from an…

A: Tax rate schedule for 2023:

Q: Matteo, a single taxpayer has taxable income of $90,000. Using the US 2020 tax rate schedule. How…

A: Federal income tax is the tax levied by IRS (Internal Revenue service) on the annual taxable income…

Q: Calculate the following taxpayers’ tax liabilities using 2021 tax rate A single taxpayer had…

A: For the year 2021, Tax rates differes based on filing status of person. For single payers, tax rate…

Q: Using the following table, calculate the taxes for an individual with taxable income of $25,800.…

A: Tax is the amount of money paid by a tax payer to the appropriate tax authorities on the basis of…

Q: Chuck, a single taxpayer, earns $80,600 in taxable income and $16,100 in interest from an investment…

A: Taxable income refers to the income on which the taxpayer is liable to pay the desired tax as stated…

Q: Given the following tax structure: Salary $ 10,000 $ 20,000 Тахраyer Total tax $ 600 ??? Мае Pedro…

A: Minimum Tax - Minimum Tax is the additional alternate minimum tax imposed by the United States…

Q: QUESTION 3 Following is a partial personal taxable income schedule for a single filer: But Not…

A: Answer:- Taxable income meaning:- The term "taxable income" refers to income that is subject to…

Q: Given the following tax structure, what minimum tax would need to be assessed on Shameika to make…

A: Tax Rate=Total TaxTotal Salary×100

Q: What is the amount of the tax liability for a single person having taxable income of $59,200? Use…

A: Federal income tax As per IRS ,a taxpayer pays tax as a percentage of his/her income in layers…

Q: The tax rates for an individual for a particular year are shown below: Taxable Income Tax Rate $0 -…

A: The average tax rate refers to the percentage of one's total income that is paid in taxes. It is…

Q: what would the average tax rate for a person who paid taxes of $6,435 on taxable income of $40,780?

A: Tax Paid = $6,435Taxable Income = $40,780 Calculation of Average Tax Rate:

Q: Based on the following data, would Ann and Carl Wilton receive a refund or owe additional taxes? N

A: Federal income tax withheld is the portion of an individual's income that an employer withholds and…

Q: The amount of federal income taxes that you are required to pay is based on your filing status, your…

A: Taxable income refers to the income on which the taxpayer is liable to pay the desired tax as stated…

Q: Calculate the Federal and Provincial Income Tax for an individual who’s single with no kids and has…

A: calculation of final tax payable for this individual are as follows

Q: Given the following tax structure, what minimum tax would need to be assessed on Sham with respect…

A: In a progressive tax, the tax rate rises as taxable income increases.People with greater salaries…

Q: Use the following Total Tax / Annual Income relationship to determine which of the following is…

A: Given: Last year income for Beverly = $155,000 The given table shows the relationship between…

Q: Which of the following is the tax rate for Social Security? 10.1 % 6.2% 13.7 % 4.5%

A: The objective of the question is to identify the correct tax rate for Social Security among the…

Q: What would be the average tax rate for a married couple with income of $90,500? What would be the…

A: Tax Brackets are used to calculate the income tax liability based on the taxable income of taxpayers…

Q: minimum tax would need to be assessed on Shameika to make the tax progressive with respect to…

A: Progressive tax system is under which person with higher income pays higher and person with lower…

Q: What would be the tax liability for a single taxpayer who has a gross income of $55,300 (use the…

A: It is the amount that every person who comes under different tax brackets must pay and that amount…

Q: How did you get $12,974.50 for the Marginal tax rate part?

A: Marginal tax rate is the percentage tax paid on each additional dollar of income earned. In other…

Q: What is the tax liability for a single person with taxable income of $27,880? What is the tax…

A: Tax liability for a single person with taxable income of $27,880 Taxable Income = $27,880 Tax…

Q: Given the tax rate table below. For a person who has a taxable income of $70,000, what is the…

A: Taxable income = $70,000Tax Liability = [$9525 x 10%] + [($38700 - $9525) x 12%] + [ ($70000 -…

Q: What is the effective/average tax rate for a couple with 2 children and a taxable income of…

A: The effective or average tax rate is calculated as per the tax slabs for any given year. We will…

Q: Given the following tax structure, what minimum tax would need to be assessed on Shameika to make…

A: In a progressive tax, the tax rate raises as taxable income increases. People with greater salaries…

Q: a single individual in 2023 made $202,500. they had no dependents. what are this individual's…

A: The average tax rate indicate the overall tax rate. It is computed using the taxable income and tax…

Q: None

A: Please refer to these explanations for the answers: Taxable IncomeChuck's taxable income for federal…

Q: The 2009 U.S. tax rates for a single person are shown below f taxable icome is over- But not over-…

A: Exemptions and deductions both reduces the taxable income, but are not considered the same thing. A…

Q: Considering my financial situation and future plans, can you please compile a report which addresses…

A: Based on the information in the question, calculate the amount of tax John will pay to CRA without…

Q: Example 4-2 To compute the tax using the percentage method, follow the steps illustrated below.…

A: Calculate the federal income tax to withhold from the wages or salaries of each employee using…

Q: Your average tax rate a. equals your marginal tax rate. b. is none of these. c. is less than your…

A: Average tax rate is the total taxes paid divided by the taxable income, whereas marginal tax rate is…

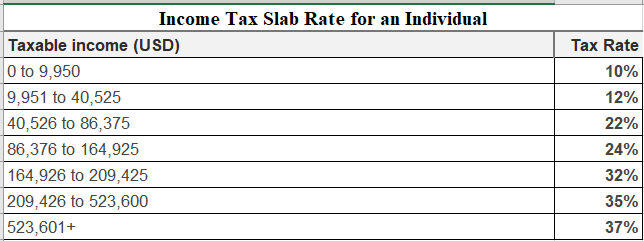

What would be the marginal tax rate for a single person who has the following taxable income?

1. $35,310

2. $67,710

3. $87,000

4. $111,750

The income tax is levied based on the following slab: -

Step by step

Solved in 2 steps with 3 images

- Problem 1-34 (LO 1-3) (Algo) Chuck, a single taxpayer, earns $75,200 in taxable income and $10,200 in interest from an investment in City of Heflin bonds. (Use the U.S tax rate schedule.) Required: a. How much federal tax will he owe? b. What is his average tax rate? c. What is his effective tax rate? d. What is his current marginal tax rate? Complete this question by entering your answers in the tabs below. Required A Required B Required C Answer is not complete. Federal tax Required D How much federal tax will he owe? Note: Do not round intermediate calculations. Round "Federal tax" to nearest whole dollar amount.Consider the following hypothetical income tax brackets for a single taxpayer. Assume for simplicity there are no exemptions or deductions. Income $0-$10,000 $10,000-$40,000 $40,000-$100,000 Over $100,000 Is this tax regressive, progressive, or proportional? The income tax is progressive Suppose Susan's income is $30,000. How much will she pay in income taxes? Susan will pay $ in income taxes. (Enter your response as an integer) Tax Rate 10% 20 35 50hi! for the tax on taxable income, I used the attached tax table, and found 6415+22%(61422-55900)=7630. Isn't that the way we should calculate the tax?

- The taxpayer's marginal federal and state tax rate is 25%. Which would the taxpayer prefer? a.$1.00 taxable income rather than $.75 tax-exempt income. b.$1.25 taxable income rather than $1.00 tax-exempt income. c.$1.40 taxable income rather than $1.00 tax-exempt income. d.$1.00 taxable income rather than $1.25 tax-exempt income.What is the alternative minimum tax (AMT) rate for individuals? 1 %. 7%. 12.3%. 20%.Given the following tax structure: Taxpayer Mae Salary $ 44,500 Pedro $ 68,500 Total Tax $ 3,738 ??? Required: a. What is the minimum tax that Pedro should pay to make the tax structure vertically equitable with respect to the amount of tax p b. This would result in what type of tax rate structure? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B What is the minimum tax that Pedro should pay to make the tax structure vertically equitable with respect to the amount of tax paid? Minimum tax $5,754 X mirod Required P

- Chuck, a single taxpayer, earns $80,200 in taxable income and $12,900 in interest from an investment in City of Heflin bonds. (Us the U.S tax rate schedule.) Required: a. How much federal tax will he owe? b. What is his average tax rate? c. What is his effective tax rate? d. What is his current marginal tax rate? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D How much federal tax will he owe? Note: Do not round intermediate calculations. Round "Federal tax" to nearest whole dollar amount. Federal tax1What would be the marginal tax rate for a single person who has a taxable income of: a) $31,560 b) $58,150 c) $66,450 d) $100,580 DO NOT INCLUDE % SIGN

- Problem 1-34 (LO 1-3) (Algo) Chuck, a single taxpayer, earns $77,100 in taxable income and $12,400 in interest from on investment in City of Heflin bonds. (Use the US tax.rate schedule) Required: a. How much federal tax will he owe? b. What is his average tax rate? c. What is his effective tax rate? d. What is his current marginal tax rate? Complete this question by entering your answers in the tabs below. Req A Reg B Req C Req D What is his average tax rate? (Do not round intermediate calculations. Round total tax to nearest whole dollar amount.) Choose Numerator Choose Denominator Average Tax Rate Taxable income Total expense Total profit Total tax Total incomeChuck a single taxpayer earns $78,000.00 in taxable income and $13, 300.00 in interest from an investment in city of heflin bonds. How much federal tax will he owe? What is his average tax rate? What is his effective tax rate? What is his current marginal tax rate?Use the tax table to determine each of the following values if your adjusted gross income is $20,000. Your tax liability if you are filing single using the standard deduction of $12,500 and have no adjustments, itemized deductions, or tax credits. Your tax liability if you are filing single using the standard deduction of $12,500, have a child tax credit of $500 and no other adjustments, deductions or credits.