Use the balance sheet and Income statement below: Assets Current assets: Cash and marketable securities Accounts receivable Inventory Total Fixed assets: Gross plant and equipment. Less: Accumulated depreciation. Net plant and equipment Other long-term assets Total Total assets Net sales. Less: Cost of goods sold Gross profits Less: Other operating expenses. $ 2021 Earnings before taxes (EBT) Less: Taxes Net income 86 203 327 85 195 305 $ 616 $ 585 CLANCY'S DOG BISCUIT CORPORATION Balance Sheet as of December 31, 2021 and 2020 (in millions of dollars) Less: Accumulated depreciation (2018) Earnings before interest and taxes (EBIT) Less: Interest $ $1,115 $910 174 127 $941 $783 162 162 $1.103 $945 $1,719 $1,530 2020 Earnings before interest, taxes, depreciation, and amortization (EBITDA) Less: Preferred stock dividends Net income available to common stockholders Less: Common stock dividends Addition to retained earnings, Per (common) share data: Earnings per share (EPS) Dividends per share (DPS) Book value per share (BVPS) Market value (price) per share (MVPS) CLANCY'S DOG BISCUIT CORPORATION Income Statement for Years Ending December 31, 2021 and 2020 (in millions of dollars). 2021 $ 920 403 $ 517 61 $ 456 47 $ 489 62 $ 347 145 $ 202 $6 $ 196 75 $ 121 $1.96 $0.75 $7.06 $8.09 Current liabilities: Accrued wages and taxes. Accounts payable Notes payable Total Long-term debt Stockholders' equity: Preferred stock (6 thousand shares) Common stock and paid-in surplus (100 thousand shares) Retained earnings Total Total liabilities and equity 2020 $830 366 $ 464 55 Liabilities and Equity $ 409 45 $364 56 $ 308 125 $ 183 $ 6 $ 177 75 $ 102 $1.77 $0.75 $5.85 $6.33 Prepare a statement of cash flows for Clancy's Dog Biscuit Corporation. (Enter your answers in millions of dollars. Amounts to be deducted should be Indicated with a minus sign.) $ $ 2021 62 168 145 $ 375 $ 632 6 120 586 $712 $1,719 $ $ 2020 55 155 145 355 $ $ 584 6 120 465 $ 591 $1,530 4

Use the balance sheet and Income statement below: Assets Current assets: Cash and marketable securities Accounts receivable Inventory Total Fixed assets: Gross plant and equipment. Less: Accumulated depreciation. Net plant and equipment Other long-term assets Total Total assets Net sales. Less: Cost of goods sold Gross profits Less: Other operating expenses. $ 2021 Earnings before taxes (EBT) Less: Taxes Net income 86 203 327 85 195 305 $ 616 $ 585 CLANCY'S DOG BISCUIT CORPORATION Balance Sheet as of December 31, 2021 and 2020 (in millions of dollars) Less: Accumulated depreciation (2018) Earnings before interest and taxes (EBIT) Less: Interest $ $1,115 $910 174 127 $941 $783 162 162 $1.103 $945 $1,719 $1,530 2020 Earnings before interest, taxes, depreciation, and amortization (EBITDA) Less: Preferred stock dividends Net income available to common stockholders Less: Common stock dividends Addition to retained earnings, Per (common) share data: Earnings per share (EPS) Dividends per share (DPS) Book value per share (BVPS) Market value (price) per share (MVPS) CLANCY'S DOG BISCUIT CORPORATION Income Statement for Years Ending December 31, 2021 and 2020 (in millions of dollars). 2021 $ 920 403 $ 517 61 $ 456 47 $ 489 62 $ 347 145 $ 202 $6 $ 196 75 $ 121 $1.96 $0.75 $7.06 $8.09 Current liabilities: Accrued wages and taxes. Accounts payable Notes payable Total Long-term debt Stockholders' equity: Preferred stock (6 thousand shares) Common stock and paid-in surplus (100 thousand shares) Retained earnings Total Total liabilities and equity 2020 $830 366 $ 464 55 Liabilities and Equity $ 409 45 $364 56 $ 308 125 $ 183 $ 6 $ 177 75 $ 102 $1.77 $0.75 $5.85 $6.33 Prepare a statement of cash flows for Clancy's Dog Biscuit Corporation. (Enter your answers in millions of dollars. Amounts to be deducted should be Indicated with a minus sign.) $ $ 2021 62 168 145 $ 375 $ 632 6 120 586 $712 $1,719 $ $ 2020 55 155 145 355 $ $ 584 6 120 465 $ 591 $1,530 4

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:Use the balance sheet and Income statement below:

Assets

Current assets:

Cash and marketable securities

Accounts receivable

Inventory

Total

Fixed assets:

Gross plant and equipment

Less: Accumulated depreciation

Net plant and equipment

Other long-term assets

Total

Total assets

Net sales

Less: Cost of goods sold

Gross profits

Less: Other operating expenses

$

Earnings before taxes (EBT)

Less: Taxes

Net income

2021

Less: Common stock dividends

Addition to retained earnings

Per (common) share data:

Less: Accumulated depreciation (2018)

Earnings before interest and taxes (EBIT)

Less: Interest

Earnings per share (EPS)

Dividends per share (DPS)

86

203

327

85

195

305

$ 616 $ 585

CLANCY'S DOG BISCUIT CORPORATION

Balance Sheet as of December 31, 2021 and 2020

(in millions of dollars)

$1,115

174

$941

162

162

$1,103 $ 945

783

ITT

$1,719 $1,530

Ibrity

Less: Preferred stock dividends

Net income available to common stockholders

CLANCY'S DOG BISCUIT CORPORATION

Income Statement for Years Ending December 31, 2021 and 2020

(in millions of dollars)

Earnings before interest, taxes, depreciation, and

amortization (EBITDA)

2020

Book value per share (BVPS)

Market value (price) per share (MVPS)

$ 910

127

$

2021

$920

1000!

403

$517

Hot-do

61

$ 456

47

$ 409

62

$ 347

PRIHL

145

$ 202

$

6

$ 196

75

$ 121

$1.96

$0.75

$7.06

$8.09

Current liabilities:

Accrued wages and taxes

Accounts payable

Notes payable

Total

Long-term debt

Stockholders' equity:

Preferred stock (6 thousand shares)

Common stock and paid-in surplus (100 thousand shares)

Retained earnings

Total

Total liabilities and equity

2020

$ 830

eius

366

$ 464

55

$409

45

$364

56

$ 308

125

$183

Liabilities and Equity

$ 6

$ 177

75

$ 102

$1.77

$0.75

$5.85

$6.33

Prepare a statement of cash flows for Clancy's Dog Biscuit Corporation. (Enter your answers in millions of dollars. Amounts to be

deducted should be Indicated with a minus sign.)

2021

$ 62

168

145

$ 375

$632

$

6

120

586

712

$

$1,719

2020

$

55

155

145

$ 355

$ 584

6

120

465

$ 591

$1,530

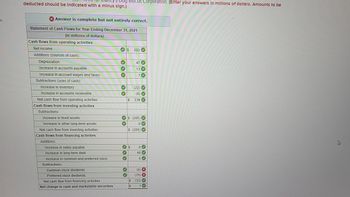

Transcribed Image Text:Prepare a statement of cash flows for Clancy's Dog Biscuit Corporation. (Enter your answers in millions of dollars. Amounts to be

deducted should be Indicated with a minus sign.)

x Answer is not complete.

Statement of Cash Flows for Year Ending December 31, 2021

Hem Om

(in millions of dollars)

Cash flows from operating activities

Net income

Additions (sources of cash):

Depreciation

Increase in accounts payable

Increase in accrued wages and taxes

Subtractions (uses of cash):

Increase in inventory

Increase in accounts receivable

Net cash flow from operating activities

Cash flows from investing activities

Subtractions:

Increase in fixed assets

Increase in other long-term assets

Net cash flow from investing activities

Cash flows from financing activities

Additions:

Increase in notes payable

Increase in long-term debt

Increase in common and preferred stock

Subtractions:

Common stock dividends

Preferred stock dividends

Net cash flow from financing activities

Net change in cash and marketable securities

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Common stock dividends .....

And

Preferred stock dividends.....

Great on how you explained everything. Appreciate it.

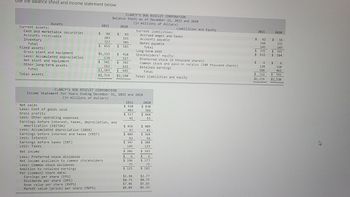

Transcribed Image Text:is

deducted should be Indicated with a minus sign.)

x Answer is complete but not entirely correct.

Statement of Cash Flows for Year Ending December 31, 2021

(in millions of dollars)

Cash flows from operating activities

Net income

Additions (sources of cash):

P

Depreciation

Increase in accounts payable

Increase in accrued wages and taxes

Subtractions (uses of cash):

Increase in inventory

Increase in accounts receivable

Net cash flow from operating activities

Cash flows from investing activities

Subtractions:

Increase in fixed assets

Increase in other long-term assets

Net cash flow from investing activities

Cash flows from financing activities

Additions:

s Dog Biscult Corporation. (Enter your answers in millions of dollars. Amounts to be

16-17

Increase in notes payable

Increase in long-term debt

Increase in common and preferred stock

Subtractions:

Common stock dividends

Preferred stock dividends

Net cash flow from financing activities

Net change in cash and marketable securities

$ 202

47

$

WH

(22)

(8)

$ 239

13

7

$ (205)

0

$ (205)

69

0

48

0

(6)

(75)

$

(33)

$ 1

X

X

×››>

Transcribed Image Text:Use the balance sheet and Income statement below:

Assets

Current assets:

Cash and marketable securities

Accounts receivable

Inventory

Total

Fixed assets:

Gross plant and equipment

Less: Accumulated depreciation

Net plant and equipment

Other long-term assets

Total

Total assets

Net sales

Less: Cost of goods sold

Gross profits

Less: Other operating expenses

$

86

203

327

$ 616

2021

$1,115

174

941

162

$1,103

$1,719

$

Earnings per share (EPS)

Dividends per share (DPS)

Book value per share (BVPS)

Market value (price) per share (MVPS)

Less: Accumulated depreciation (2018)

Earnings before interest and taxes (EBIT)

Less: Interest

Earnings before taxes (EBT)

Less: Taxes

Earnings before interest, taxes, depreciation, and

amortization (EBITDA)

CLANCY'S DOG BISCUIT CORPORATION

Balance Sheet as of December 31, 2021 and 2020

(in millions of dollars)

Net income

Less: Preferred stock dividends

Net income available to common stockholders

Less: Common stock dividends

Addition to retained earnings.

Per (common) share data:

2020

$ 85

195

305

$ 585

$

CLANCY'S DOG BISCUIT CORPORATION

Income Statement for Years Ending December 31, 2021 and 2020

(in millions of dollars)

910

127

$ 783

162

$945

$1,530

2021

$ 920

403

$ 517

61

$ 456

47

$ 409

62

$ 347

145

$ 202

$

6

$196

75

$121

$1.96

$0.75

$7.06

$8.09

Current liabilities:

Accrued wages and taxes

Accounts payable

Notes payable

Total

Long-term debt

Stockholders' equity:

Preferred stock (6 thousand shares)

Common stock and paid-in surplus (100 thousand shares)

Retained earnings

Total

Total liabilities and equity.

2020

$ 830

366

$ 464

55

$ 409

45

$364

56

$ 308

125

$183

Liabilities and Equity

$ 6

$ 177

75

$ 102

$1.77

$0.75

$5.85

$6.33

2021

$ 62

168

145

$ 375 $

$ 632

$

6

120

586

$ 712

$1,719

2020

$ 55

155

145

355

584

$ 6

120

465

$591

$1,530

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education