Under normal conditions, Sarah spends $8.40 per unit of materials, and it will take 3.60 units of material per pair of shoes. During July, Sole Purpose Shoe Company incurred actual direct materials costs of $61,321 for 6,890 units of direct materials in the production of 2,200 pairs of shoes. Complete the following table, showing the direct materials variance relationships for July for Sole Purpose Shoe Company. If required, round your answers to two decimal places. When entering variances, use a negative number for a favorable cost variance, and a positive number for an unfavorable cost variance. Actual Cost Standard Cost Actual Quantity X Actual Price Actual Quantity X Standard Price Standard Quantity X Standard Price fill in the blank aa813e028057f8e_1 X $fill in the blank aa813e028057f8e_2 fill in the blank aa813e028057f8e_3 X $fill in the blank aa813e028057f8e_4 fill in the blank aa813e028057f8e_5 X $fill in the blank aa813e028057f8e_6 = $fill in the blank aa813e028057f8e_7 = $fill in the blank aa813e028057f8e_8 = $fill in the blank aa813e028057f8e_9 Direct Materials Variance: Direct Materials Variance: $fill in the blank aa813e028057f8e_14 $fill in the blank aa813e028057f8e_15 Total Direct Materials Variance: $fill in the blank aa813e028057f8e_18 Question Content Area Direct Labor Under normal conditions, Sarah pays her employees $8.50 per hour, and it will take 2.80 hours of labor per pair of shoes. During August, Sole Purpose Shoe Company incurred actual direct labor costs of $65,610 for 7,290 hours of direct labor in the production of 2,200 pairs of shoes. Complete the following table, showing the direct labor variance relationships for August for Sole Purpose Shoe Company. If required, round your answers to two decimal places. When entering variances, use a negative number for a favorable variance, and a positive number for an unfavorable variance. Actual Cost Standard Cost Actual Hours X Actual Rate Actual Hours X Standard Rate Standard Hours X Standard Rate fill in the blank 227e26f9bff2fe3_1 X $fill in the blank 227e26f9bff2fe3_2 fill in the blank 227e26f9bff2fe3_3 X $fill in the blank 227e26f9bff2fe3_4 fill in the blank 227e26f9bff2fe3_5 X $fill in the blank 227e26f9bff2fe3_6 = $fill in the blank 227e26f9bff2fe3_7 = $fill in the blank 227e26f9bff2fe3_8 = $fill in the blank 227e26f9bff2fe3_9 Direct Labor Variance: Direct Labor Variance: $fill in the blank 227e26f9bff2fe3_14 $fill in the blank 227e26f9bff2fe3_15 Total Direct Labor Variance: $fill in the blank 227e26f9bff2fe3_18

Variance Analysis

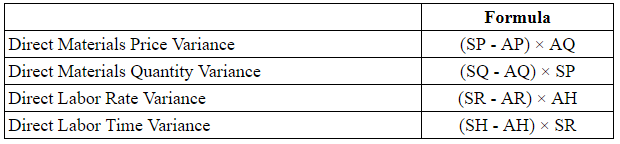

In layman's terms, variance analysis is an analysis of a difference between planned and actual behavior. Variance analysis is mainly used by the companies to maintain a control over a business. After analyzing differences, companies find the reasons for the variance so that the necessary steps should be taken to correct that variance.

Standard Costing

The standard cost system is the expected cost per unit product manufactured and it helps in estimating the deviations and controlling them as well as fixing the selling price of the product. For example, it helps to plan the cost for the coming year on the various expenses.

Under normal conditions, Sarah spends $8.40 per unit of materials, and it will take 3.60 units of material per pair of shoes. During July, Sole Purpose Shoe Company incurred actual direct materials costs of $61,321 for 6,890 units of direct materials in the production of 2,200 pairs of shoes.

Complete the following table, showing the direct materials variance relationships for July for Sole Purpose Shoe Company. If required, round your answers to two decimal places. When entering variances, use a negative number for a favorable cost variance, and a positive number for an unfavorable cost variance.

| Actual Cost | Standard Cost | |||||||||

| Actual Quantity |

X | Actual Price |

Actual Quantity |

X | Standard Price |

Standard Quantity |

X | Standard Price |

||

| fill in the blank aa813e028057f8e_1 | X | $fill in the blank aa813e028057f8e_2 | fill in the blank aa813e028057f8e_3 | X | $fill in the blank aa813e028057f8e_4 | fill in the blank aa813e028057f8e_5 | X | $fill in the blank aa813e028057f8e_6 | ||

| = $fill in the blank aa813e028057f8e_7 | = $fill in the blank aa813e028057f8e_8 | = $fill in the blank aa813e028057f8e_9 | ||||||||

|

|

|

|||||||||

| $fill in the blank aa813e028057f8e_14 | $fill in the blank aa813e028057f8e_15 | |||||||||

|

|

||||||||||

| $fill in the blank aa813e028057f8e_18 |

Question Content Area

Direct Labor

Under normal conditions, Sarah pays her employees $8.50 per hour, and it will take 2.80 hours of labor per pair of shoes. During August, Sole Purpose Shoe Company incurred actual direct labor costs of $65,610 for 7,290 hours of direct labor in the production of 2,200 pairs of shoes.

Complete the following table, showing the direct labor variance relationships for August for Sole Purpose Shoe Company. If required, round your answers to two decimal places. When entering variances, use a negative number for a favorable variance, and a positive number for an unfavorable variance.

| Actual Cost | Standard Cost | |||||||||

| Actual Hours |

X | Actual Rate |

Actual Hours |

X | Standard Rate |

Standard Hours |

X | Standard Rate |

||

| fill in the blank 227e26f9bff2fe3_1 | X | $fill in the blank 227e26f9bff2fe3_2 | fill in the blank 227e26f9bff2fe3_3 | X | $fill in the blank 227e26f9bff2fe3_4 | fill in the blank 227e26f9bff2fe3_5 | X | $fill in the blank 227e26f9bff2fe3_6 | ||

| = $fill in the blank 227e26f9bff2fe3_7 | = $fill in the blank 227e26f9bff2fe3_8 | = $fill in the blank 227e26f9bff2fe3_9 | ||||||||

|

|

|

|||||||||

| $fill in the blank 227e26f9bff2fe3_14 | $fill in the blank 227e26f9bff2fe3_15 | |||||||||

|

|

||||||||||

| $fill in the blank 227e26f9bff2fe3_18 |

Question Content Area

Budget Performance Report

Step by step

Solved in 3 steps with 5 images