The two queens of Lockdown Kingdom, Queen Corona and Queen Cevid, came together to form a business, The Lockdown Enterprise, to better the economic stance of the kingdom. In this business, they agreed to share profits and losses in the ratio of their opening capitals. Trial Balance as at 31 March, 2020 Debit (GHC ) 2,000,000 120,000 80,000 4,000 46,000 64,000 5,200 12,400 24,900 905,200 11,200 15,600 108,000 136,000 12,000 Particulars Land & Premises Furniture Inventory (1/04/19) Import duty on goods Wages of contract workers Salaries & wages of staff Credit (GHC ) Carriage for goods purchased Carriage for goods sold Discounts Purchases & Sales Rent Commission Bills receivable 12% Investment (1/10/19) Donation to National Pandemic Fund 10% Bank Loan Factory rent Receivables and Payables Bank Bad debts Provision for doubtful debt Rates and Taxes Brokerage Capital Accounts Queen Corona Queen Covid Current Accounts 25,080 2,375,220 13,000 17,400 112,000 64,000 920,000 240,000 728,000 ఈ6000 20,000 31,200 13,000 500,000 500,000 Queen Corona Queen Covid 20,000 128,000 4.658,700 4,658,700 Additional Information: Due to the economic recession at the moment, the partners estimated that more of their receivables may not be able to settle their debts. Hence, they wrote off additional debts of GHC 15,000 and agreed to maintain provisions for doubtful debts at 5%. ii. They agreed to provide for discount on receivables at 5% All property, plant and equipment are to be depreciated at 10% The business claimed insurance of GHC 21,000 for goods that were lost due to fire. The insurance claim, though admitted, had not been puid as at the year end. Queen Corona took goods amounting to GHC 17,400 for personal use. i. ii. iv. V. vi. Goods worth GHC 24,000 bought on 24/04/19 on credit were not rvcorded in the books. Outstanding salaries were GIIC 2,000 whereas wages of GHC 24,600 were paid in advance. The partners agreed to charge interest on capital at 6% and on drawings at 7% ix. Bills receivable of GHC 12,600 was dishonored. x. The inventory count at the year-end revealed goods worth GHC 300,000 vii. vii. Calculate the net profitvloss for Lockdown Enterprise

The two queens of Lockdown Kingdom, Queen Corona and Queen Cevid, came together to form a business, The Lockdown Enterprise, to better the economic stance of the kingdom. In this business, they agreed to share profits and losses in the ratio of their opening capitals. Trial Balance as at 31 March, 2020 Debit (GHC ) 2,000,000 120,000 80,000 4,000 46,000 64,000 5,200 12,400 24,900 905,200 11,200 15,600 108,000 136,000 12,000 Particulars Land & Premises Furniture Inventory (1/04/19) Import duty on goods Wages of contract workers Salaries & wages of staff Credit (GHC ) Carriage for goods purchased Carriage for goods sold Discounts Purchases & Sales Rent Commission Bills receivable 12% Investment (1/10/19) Donation to National Pandemic Fund 10% Bank Loan Factory rent Receivables and Payables Bank Bad debts Provision for doubtful debt Rates and Taxes Brokerage Capital Accounts Queen Corona Queen Covid Current Accounts 25,080 2,375,220 13,000 17,400 112,000 64,000 920,000 240,000 728,000 ఈ6000 20,000 31,200 13,000 500,000 500,000 Queen Corona Queen Covid 20,000 128,000 4.658,700 4,658,700 Additional Information: Due to the economic recession at the moment, the partners estimated that more of their receivables may not be able to settle their debts. Hence, they wrote off additional debts of GHC 15,000 and agreed to maintain provisions for doubtful debts at 5%. ii. They agreed to provide for discount on receivables at 5% All property, plant and equipment are to be depreciated at 10% The business claimed insurance of GHC 21,000 for goods that were lost due to fire. The insurance claim, though admitted, had not been puid as at the year end. Queen Corona took goods amounting to GHC 17,400 for personal use. i. ii. iv. V. vi. Goods worth GHC 24,000 bought on 24/04/19 on credit were not rvcorded in the books. Outstanding salaries were GIIC 2,000 whereas wages of GHC 24,600 were paid in advance. The partners agreed to charge interest on capital at 6% and on drawings at 7% ix. Bills receivable of GHC 12,600 was dishonored. x. The inventory count at the year-end revealed goods worth GHC 300,000 vii. vii. Calculate the net profitvloss for Lockdown Enterprise

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Topic Video

Question

Transcribed Image Text:The two queens of Lockdown Kingdom, Queen Corona and Queen Cevid, came together to form

a business, The Lockdown Enterprise, to better the economic stance of the kingdom. In this

business, they agreed to share profits and losses in the ratio of their opening capitals.

Trial Balance as at 31 March, 2020

Debit (GHC )

2,000,000

120,000

80,000

4,000

46,000

64,000

5,200

12,400

24,900

905,200

11,200

15,600

108,000

136,000

12,000

Particulars

Land & Premises

Furniture

Inventory (1/04/19)

Import duty on goods

Wages of contract workers

Salaries & wages of staff

Credit (GHC )

Carriage for goods purchased

Carriage for goods sold

Discounts

Purchases & Sales

Rent

Commission

Bills receivable

12% Investment (1/10/19)

Donation to National Pandemic Fund

10% Bank Loan

Factory rent

Receivables and Payables

Bank

Bad debts

Provision for doubtful debt

Rates and Taxes

Brokerage

Capital Accounts

Queen Corona

Queen Covid

Current Accounts

25,080

2,375,220

13,000

17,400

112,000

64,000

920,000

240,000

728,000

ఈ6000

20,000

31,200

13,000

500,000

500,000

Queen Corona

Queen Covid

20,000

128,000

4.658,700

4,658,700

Additional Information:

Due to the economic recession at the moment, the partners estimated that more of their

receivables may not be able to settle their debts. Hence, they wrote off additional debts of

GHC 15,000 and agreed to maintain provisions for doubtful debts at 5%.

ii. They agreed to provide for discount on receivables at 5%

All property, plant and equipment are to be depreciated at 10%

The business claimed insurance of GHC 21,000 for goods that were lost due to fire. The

insurance claim, though admitted, had not been puid as at the year end.

Queen Corona took goods amounting to GHC 17,400 for personal use.

i.

ii.

iv.

V.

vi.

Goods worth GHC 24,000 bought on 24/04/19 on credit were not rvcorded in the books.

Outstanding salaries were GIIC 2,000 whereas wages of GHC 24,600 were paid in

advance.

The partners agreed to charge interest on capital at 6% and on drawings at 7%

ix. Bills receivable of GHC 12,600 was dishonored.

x. The inventory count at the year-end revealed goods worth GHC 300,000

vii.

vii.

Calculate the net profitvloss for Lockdown Enterprise

Expert Solution

Step 1

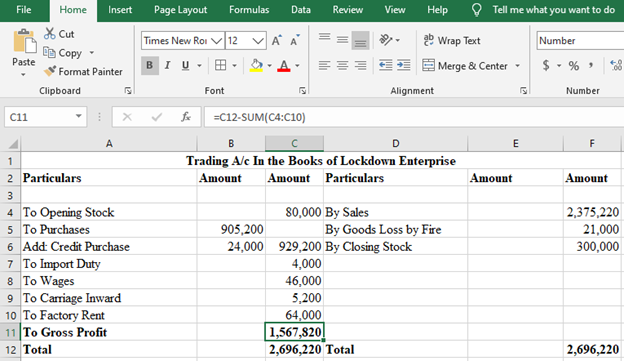

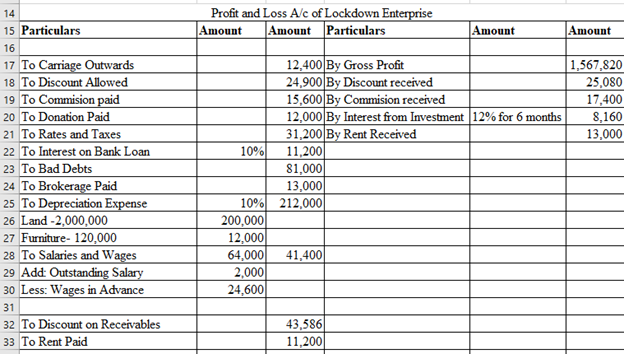

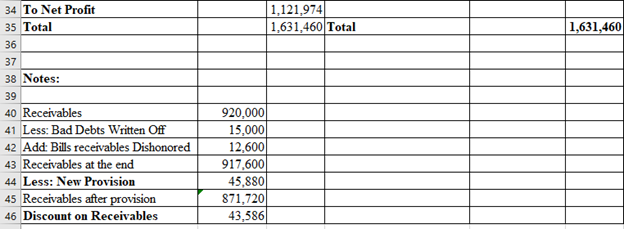

Calculating Net Loss or Profit:

Step by step

Solved in 2 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education