The Greenspace Company started busi- ness on January 1, 2017. The company adopted a standard costing system for the production of ergonomic backpacks. Greenspace chose direct labor as the application base for overhead and decided to use the proration method to account for variances at year-end. In 2017, Greenspace expected to make and sell 160,000 backpacks; each was budgeted to use 2 yards of fabric and require 0.5 hours of direct labor work. The company expected to pay $2 per yard for fabric and compensate workers at an hourly wage of $12. Greenspace has no variable overhead costs, but budgeted $800,000 for fixed manufacturing overhead in 2017. In 2017, Greenspace actually made 180,000 backpacks and sold 144,000 of them for a total revenue of $2,592,000. The costs incurred were as follows: Fixed manufacturing costs Fabric costs (370,000 yards bought and used) Direct manufacturing labor costs (100,000 hours) $ 875,000 $ 758,500 $1,260,000

Variance Analysis

In layman's terms, variance analysis is an analysis of a difference between planned and actual behavior. Variance analysis is mainly used by the companies to maintain a control over a business. After analyzing differences, companies find the reasons for the variance so that the necessary steps should be taken to correct that variance.

Standard Costing

The standard cost system is the expected cost per unit product manufactured and it helps in estimating the deviations and controlling them as well as fixing the selling price of the product. For example, it helps to plan the cost for the coming year on the various expenses.

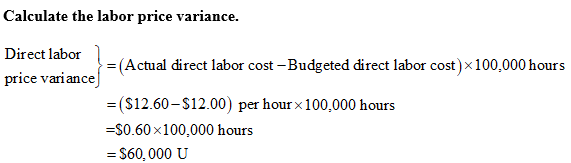

Compute Direct manufacturing labor price variance for 2017

The data required for the calculation of direct manufacturing labor price variance are given below:

Actual Labor hours is 100,000 hours and the actual labor cost is $1,260,000. The actual direct cost is $12.60 per hour ($1,260,000/100,0000).

The budgeted direct costs are $12 per hour, the actual units sold are 144,000 units, and the units produced are 180,000 units.

Step by step

Solved in 4 steps with 2 images