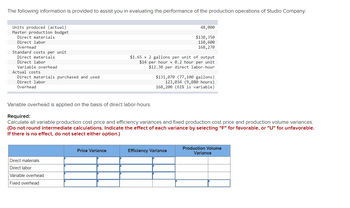

The following information is provided to assist you in evaluating the performance of the production operations of Studio Company: Units produced (actual) Master production budget Direct materials Direct labor Overhead Standard costs per unit Direct materials Direct labor Variable overhead Actual costs Direct materials purchased and used Direct labor Overhead Direct materials Direct labor Variable overhead Fixed overhead Price Variance 48,000 $130,350 110,600 168,270 $1.65 x 2 gallons per unit of output $14 per hour x 0.2 hour per unit $12.30 per direct labor-hour Variable overhead is applied on the basis of direct labor-hours. Required: Calculate all variable production cost price and efficiency variances and fixed production cost price and production volume variances. (Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either option.) $131,070 (77,100 gallons) 123,034 (9,080 hours) 168,200 (61% is variable) Efficiency Variance Production Volume Variance

The following information is provided to assist you in evaluating the performance of the production operations of Studio Company: Units produced (actual) Master production budget Direct materials Direct labor Overhead Standard costs per unit Direct materials Direct labor Variable overhead Actual costs Direct materials purchased and used Direct labor Overhead Direct materials Direct labor Variable overhead Fixed overhead Price Variance 48,000 $130,350 110,600 168,270 $1.65 x 2 gallons per unit of output $14 per hour x 0.2 hour per unit $12.30 per direct labor-hour Variable overhead is applied on the basis of direct labor-hours. Required: Calculate all variable production cost price and efficiency variances and fixed production cost price and production volume variances. (Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either option.) $131,070 (77,100 gallons) 123,034 (9,080 hours) 168,200 (61% is variable) Efficiency Variance Production Volume Variance

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Our experts are unable to provide you with a solution at this time. Try rewording your question, and make sure to submit one question at a time. We've credited a question to your account.

Your Question:

Please do not give solution in image format thanku

Transcribed Image Text:The following information is provided to assist you in evaluating the performance of the production operations of Studio Company:

Units produced (actual)

Master production budget

Direct materials

Direct labor

Overhead

Standard costs per unit

Direct materials

Direct labor

Variable overhead

Actual costs

Direct materials purchased and used

Direct labor

Overhead

Direct materials

Direct labor

Variable overhead

Fixed overhead

Price Variance

48,000

$130,350

110,600

168,270

$1.65 x 2 gallons per unit of output

$14 per hour x 0.2 hour per unit

$12.30 per direct labor-hour

Variable overhead is applied on the basis of direct labor-hours.

Required:

Calculate all variable production cost price and efficiency variances and fixed production cost price and production volume variances.

(Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, or "U" for unfavorable.

If there is no effect, do not select either option.)

$131,070 (77,100 gallons)

123,034 (9,080 hours)

168,200 (61% is variable)

Efficiency Variance

Production Volume

Variance

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College