Shareholders of Hartley Corp are concerned that the company has recorded a reduced level of profits in 2020 compared to 2019. The Profit for the year has reduced from K272.4m to K5.9m. You have been requested by the concerned shareholder to prepare a detailed report analysing the financial performance Capital and reserves attributable to the Company's equity holders Share capital Share premium Retained earnings Non-current liabilities Deferred income tax STATEMENT OF FINANCIAL POSITION Total equity and non-current liabilities Non-current assets Prperty, plant and equipment Intangible assets Account receivable Current assets Inventories Trade and other receivables Current income tax Cash and cash equivalents Current liabilities Borrowings Trade and other paybles Total assets less current liabilities As at 31 December 2020 5,460 450,207 535,385 991,052 610,979 610,979 1,602,031 2,149,855 22,816 2,095 2,174,766 426,640 150,474 79,152 401,007 1,057,273 35,000 1,595,008 1,630,008 1,602,031 2019 5,460 450,207 584,047 1,039,714 635,648 635,648 1,675,362 2,059,246 24,601 2,083,847 486,667 255,294 10,542 225,942 978,445 32,761 1,354,169 1,386,930 1,675,362

Shareholders of Hartley Corp are concerned that the company has recorded a reduced level of profits in 2020 compared to 2019. The Profit for the year has reduced from K272.4m to K5.9m. You have been requested by the concerned shareholder to prepare a detailed report analysing the financial performance Capital and reserves attributable to the Company's equity holders Share capital Share premium Retained earnings Non-current liabilities Deferred income tax STATEMENT OF FINANCIAL POSITION Total equity and non-current liabilities Non-current assets Prperty, plant and equipment Intangible assets Account receivable Current assets Inventories Trade and other receivables Current income tax Cash and cash equivalents Current liabilities Borrowings Trade and other paybles Total assets less current liabilities As at 31 December 2020 5,460 450,207 535,385 991,052 610,979 610,979 1,602,031 2,149,855 22,816 2,095 2,174,766 426,640 150,474 79,152 401,007 1,057,273 35,000 1,595,008 1,630,008 1,602,031 2019 5,460 450,207 584,047 1,039,714 635,648 635,648 1,675,362 2,059,246 24,601 2,083,847 486,667 255,294 10,542 225,942 978,445 32,761 1,354,169 1,386,930 1,675,362

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

100%

Shareholders of Hartley Corp are concerned that the company has recorded a reduced level of

profits in 2020 compared to 2019. The Profit for the year has reduced from K272.4m to K5.9m. You

have been requested by the concerned shareholder to prepare a detailed report analysing the

financial performance

Prepare a

I) horizontal Analysis

II) Vertical Analysis of the Statement of Financial position .

Transcribed Image Text:Shareholders of Hartley Corp are concerned that the company has recorded a reduced level of

profits in 2020 compared to 2019. The Profit for the year has reduced from K272.4m to K5.9m. You

have been requested by the concerned shareholder to prepare a detailed report analysing the

financial performance

Capital and reserves attributable to the Company's equity holders

Share capital

Share premium

Retained earnings

Non-current liabilities

Deferred income tax

STATEMENT OF FINANCIAL POSITION

Total equity and non-current liabilities

Non-current assets

Prperty, plant and equipment

Intangible assets

Account receivable

Current assets

Inventories

Trade and other receivables

Current income tax

Cash and cash equivalents

Current liabilities

Borrowings

Trade and other paybles

Total assets less current liabilities

As at 31 December

2020

5,460

450,207

535,385

991,052

610,979

610,979

1,602,031

2,149,855

22,816

2,095

2,174,766

426,640

150,474

79,152

401,007

1,057,273

35,000

1,595,008

1,630,008

1,602,031

2019

5,460

450,207

584,047

1,039,714

635,648

635,648

1,675,362

2,059,246

24,601

2,083,847

486,667

255,294

10,542

225,942

978,445

32,761

1,354,169

1,386,930

1,675,362

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

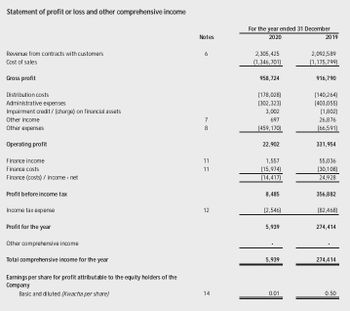

Prepare a Vertical and Horizontal Analysis of the Statement of Comprehensive Income.

Transcribed Image Text:Statement of profit or loss and other comprehensive income

Revenue from contracts with customers

Cost of sales

Gross profit

Distribution costs

Administrative expenses

Impairment credit/ (charge) on financial assets

Other income

Other expenses

Operating profit

Finance income

Finance costs

Finance (costs) / income.net

Profit before income tax

Income tax expense

Profit for the year

Other comprehensive income

Total comprehensive income for the year

Earnings per share for profit attributable to the equity holders of the

Company

Basic and diluted (Kwacha per share)

Notes

6

78

11

11

12

14

For the year ended 31 December

2020

2,305,425

(1,346,701)

958,724

(178,028)

(302,323)

3,002

697

(459,170)

22,902

1,557

(15,974)

(14,417)

8,485

(2,546)

5,939

5,939

0.01

2019

2,092,589

(1,175,799)

916,790

(140,264)

(403,055)

(1,802)

26,876

(66,591)

331,954

55,036

(30,108)

24,928

356,882

(82,468)

274,414

274,414

0.50

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education