Snowflake Resorts is considering investing in a project that has a net investment of $240,000. This project will return positive net cash flows annually for the next 5 years of $80,000 per year. Snowflake Resorts requires a 12% return on all of its investments. The payback period of this investment is ________ years 5 3 4 2 The net present value of this project is $65,355 $48,384 $85,652 $57,635 The profitability index of this project is 2016 5924 7350 3852 When projects have scale differences, only the Net Present Value method will rank the projects correctly True False Fees paid to investment bankers and lawyers for issuing securities are called Component costs Issuance costs Security costs Licensing costs Purposes for considering a capital project may include which of the following Cost reductions Growth projects Government required projects All of the above When the weighted average cost of capital for a project is considered on an after tax basis, this is considered the ____________ cost of capital Preferred Marginal Actual Estimated The Snowflake Resort purchased 20 acres of land next to their current property for $250,000 in 2010. After a marketing survey was done last year costing $50,000, the owners are trying to decide whether to build an addition for $15,000,000 plus $500,000 for additional working capital, or sell the land for $2,000,000. What would their net investment be if they decide to build the project? 17,750,000 18,000,000 17,500,000 17,800,000

Snowflake Resorts is considering investing in a project that has a net investment of $240,000. This project will return positive net cash flows annually for the next 5 years of $80,000 per year. Snowflake Resorts requires a 12% return on all of its investments. The payback period of this investment is ________ years 5 3 4 2 The net present value of this project is $65,355 $48,384 $85,652 $57,635 The profitability index of this project is 2016 5924 7350 3852 When projects have scale differences, only the Net Present Value method will rank the projects correctly True False Fees paid to investment bankers and lawyers for issuing securities are called Component costs Issuance costs Security costs Licensing costs Purposes for considering a capital project may include which of the following Cost reductions Growth projects Government required projects All of the above When the weighted average cost of capital for a project is considered on an after tax basis, this is considered the ____________ cost of capital Preferred Marginal Actual Estimated The Snowflake Resort purchased 20 acres of land next to their current property for $250,000 in 2010. After a marketing survey was done last year costing $50,000, the owners are trying to decide whether to build an addition for $15,000,000 plus $500,000 for additional working capital, or sell the land for $2,000,000. What would their net investment be if they decide to build the project? 17,750,000 18,000,000 17,500,000 17,800,000

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

Snowflake Resorts is considering investing in a project that has a net investment of $240,000. This project will return positive net cash flows annually for the next 5 years of $80,000 per year.

Snowflake Resorts requires a 12% return on all of its investments.

- The payback period of this investment is ________ years

- 5

- 3

- 4

- 2

- The

net present value of this project is- $65,355

- $48,384

- $85,652

- $57,635

- The profitability index of this project is

- 2016

- 5924

- 7350

- 3852

- When projects have scale differences, only the Net Present Value method will rank the projects correctly

- True

- False

- Fees paid to investment bankers and lawyers for issuing securities are called

- Component costs

- Issuance costs

- Security costs

- Licensing costs

- Purposes for considering a capital project may include which of the following

- Cost reductions

- Growth projects

- Government required projects

- All of the above

- When the weighted average cost of capital for a project is considered on an after tax basis, this is considered the ____________ cost of capital

- Preferred

- Marginal

- Actual

- Estimated

- The Snowflake Resort purchased 20 acres of land next to their current property for $250,000 in 2010. After a marketing survey was done last year costing $50,000, the owners are trying to decide whether to build an addition for $15,000,000 plus $500,000 for additional working capital, or sell the land for $2,000,000. What would their net investment be if they decide to build the project?

- 17,750,000

- 18,000,000

- 17,500,000

- 17,800,000

Expert Solution

Honor code:

Hi there, Thanks for posting the question, But as per our Q&A honor code, We should answer the first three sub-parts when multiple sub-parts posted under single question. Hence, I have answered the first three sub-parts below. Please re-post the question for remaining sub-parts with complete information. One of our experts will help you. Thank you.

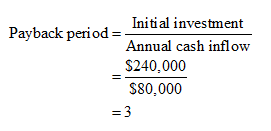

Calculate the payback period as follows:

Therefore, the payback period of an investment is 3 years (Option 2).

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education