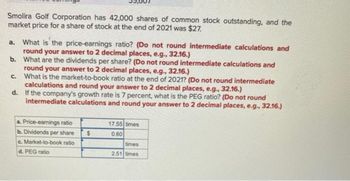

Smolira Golf Corporation has 42,000 shares of common stock outstanding, and the market price for a share of stock at the end of 2021 was $27. a. What is the price-earnings ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What are the dividends per share? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What is the market-to-book ratio at the end of 2021? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) d. If the company's growth rate is 7 percent, what is the PEG ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Price-earnings ratio b. Dividends per share $ c. Market-to-book ratio d. PEG ratio 17.55 times 0.60 times 2.51 times Some recent financial statements for Smolira Golf Corporation follow. es Assets Current assets Cash Accounts receivable Inventory Total SMOLIRA GOLF CORPORATION 2020 and 2021 Balance Sheets 2021 Liabilities and Owners' Equity Current liabilities 2020 $34,585 $38,020 17,901 27,946 3,670 42,712 $ 56,156 $108,678 Fixed assets Net plant and equipment $464,435 $ 519,933 Total assets SMOLIRA GOLF CORPORATION 2021 Income Cint $ 520,591 $628,611 Total liabilities and owners' equity Sales Cost of goods sold Depreciation Accounts payable Notes payable Other Taxable income Taxes (22%) Net income Total Long-term debt Owners' equity Common stock and paid-in surplus Accumulated retained earnings Total Earnings before interest and taxes Interest paid Dividends Retained earnings SMOLIRA GOLF CORPORATION 2021 Income Statement 2020 2021 $36,902 $42,682 19,208 $ 25,000 39,607 16,350 20,044 24,794 $76,154 $83,826 $116,000 $176,741 $ 55,200 $ 55,200 273,237 312,844 $328,437 368,044 $ 520,591 $628,611 $ 507,454 360,028 44,713 $102,713 19,883 $82,830 18,223 $ 64,607 Smolira Golf Corporation has 42,000 shares of common stants market wi

Smolira Golf Corporation has 42,000 shares of common stock outstanding, and the market price for a share of stock at the end of 2021 was $27. a. What is the price-earnings ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What are the dividends per share? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What is the market-to-book ratio at the end of 2021? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) d. If the company's growth rate is 7 percent, what is the PEG ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Price-earnings ratio b. Dividends per share $ c. Market-to-book ratio d. PEG ratio 17.55 times 0.60 times 2.51 times Some recent financial statements for Smolira Golf Corporation follow. es Assets Current assets Cash Accounts receivable Inventory Total SMOLIRA GOLF CORPORATION 2020 and 2021 Balance Sheets 2021 Liabilities and Owners' Equity Current liabilities 2020 $34,585 $38,020 17,901 27,946 3,670 42,712 $ 56,156 $108,678 Fixed assets Net plant and equipment $464,435 $ 519,933 Total assets SMOLIRA GOLF CORPORATION 2021 Income Cint $ 520,591 $628,611 Total liabilities and owners' equity Sales Cost of goods sold Depreciation Accounts payable Notes payable Other Taxable income Taxes (22%) Net income Total Long-term debt Owners' equity Common stock and paid-in surplus Accumulated retained earnings Total Earnings before interest and taxes Interest paid Dividends Retained earnings SMOLIRA GOLF CORPORATION 2021 Income Statement 2020 2021 $36,902 $42,682 19,208 $ 25,000 39,607 16,350 20,044 24,794 $76,154 $83,826 $116,000 $176,741 $ 55,200 $ 55,200 273,237 312,844 $328,437 368,044 $ 520,591 $628,611 $ 507,454 360,028 44,713 $102,713 19,883 $82,830 18,223 $ 64,607 Smolira Golf Corporation has 42,000 shares of common stants market wi

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Our experts need more information to provide you with a solution. some lines in the question was missed Please resubmit your question, making sure it's detailed and complete. We've credited a question to your account.

Your Question:

Stepwise

Transcribed Image Text:Smolira Golf Corporation has 42,000 shares of common stock outstanding, and the

market price for a share of stock at the end of 2021 was $27.

a. What is the price-earnings ratio? (Do not round intermediate calculations and

round your answer to 2 decimal places, e.g., 32.16.)

b.

What are the dividends per share? (Do not round intermediate calculations and

round your answer to 2 decimal places, e.g., 32.16.)

c.

What is the market-to-book ratio at the end of 2021? (Do not round intermediate

calculations and round your answer to 2 decimal places, e.g., 32.16.)

d.

If the company's growth rate is 7 percent, what is the PEG ratio? (Do not round

intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

a. Price-earnings ratio

b. Dividends per share $

c. Market-to-book ratio

d. PEG ratio

17.55 times

0.60

times

2.51 times

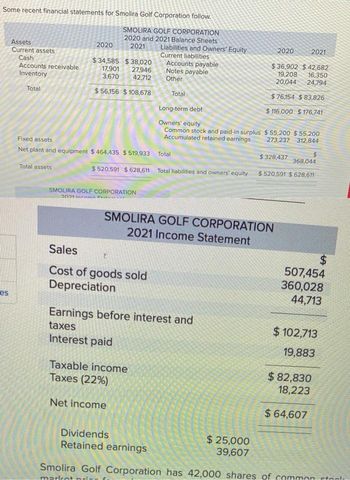

Transcribed Image Text:Some recent financial statements for Smolira Golf Corporation follow.

es

Assets

Current assets

Cash

Accounts receivable

Inventory

Total

SMOLIRA GOLF CORPORATION

2020 and 2021 Balance Sheets

2021 Liabilities and Owners' Equity

Current liabilities

2020

$34,585 $38,020

17,901

27,946

3,670

42,712

$ 56,156 $108,678

Fixed assets

Net plant and equipment $464,435 $ 519,933

Total assets

SMOLIRA GOLF CORPORATION

2021 Income Cint

$ 520,591 $628,611 Total liabilities and owners' equity

Sales

Cost of goods sold

Depreciation

Accounts payable

Notes payable

Other

Taxable income

Taxes (22%)

Net income

Total

Long-term debt

Owners' equity

Common stock and paid-in surplus

Accumulated retained earnings

Total

Earnings before interest and

taxes

Interest paid

Dividends

Retained earnings

SMOLIRA GOLF CORPORATION

2021 Income Statement

2020

2021

$36,902 $42,682

19,208

$ 25,000

39,607

16,350

20,044 24,794

$76,154 $83,826

$116,000 $176,741

$ 55,200 $ 55,200

273,237 312,844

$328,437

368,044

$ 520,591 $628,611

$

507,454

360,028

44,713

$102,713

19,883

$82,830

18,223

$ 64,607

Smolira Golf Corporation has 42,000 shares of common stants

market wi

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education