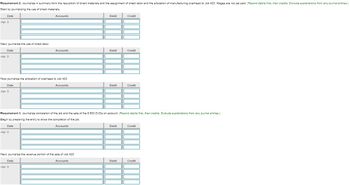

Root Technology Co. manufactures DVDs for computer software and entertainment companies. Root uses job order costing. On April 2, Root began production of 5,500 DVDs, Job 423, for Diorama Pictures for $1.30 sales price per DVD. Root promised to deliver the DVDs to Diorama Pictures by April 5. Root incurred the following direct costs: i (Click the icon to view additional information.) (Click the icon to view the costs.) Read the requirements Requirement 1. Prepare a job cost record for Job 423. Calculate the predetermined overhead allocation rate (round to two decimal places); then allocate manufacturing overhead to the job. Begin by determining the total amount of direct materials and direct labor incurred on the job. Next, calculate the predetermined overhead allocation rate and apply manufacturing overhead to the job. Lastly. compute the total cost of Job 423 and the cost per DVD. Job Cost Record - X Job No. 423 Customer Name Job Description Date Promised 4-5 Date 4-2 4-2 4-3 Totals Requisition Number 63 64 74 Diorama 5,500 DVDs Direct materials $ Amount 372 675 126 Date Started 4-2 Direct labor Labor Time Record Number 655 656 Accounts Amount $ 140 Date Completed 4-3 Manufacturing overhead allocated Date 4-3 labor cost Overall Cost Summary 260 Direct materials Direct labor Manufacturing overhead Allocated Total Job Cost Cost per DVD Rate of direct Requirement 2. Journalize in summary form the requisition of direct materials and the assignment of direct labor and the allocatio entries.) Start by journalizing the use of direct materials. Date Debit Amount Credit Data table Date 4/02 4/03 Date 4/02 4/02 4/03 Labor Time Record No. 655 656 Materials Requisition No. 63 64 74 More info Description 10 hours @ $14 per hour S 20 hours @ $13 per hour Print Description $ 31 lbs polycarbonate plastic @ $12 per lb. 25 lbs acrylic plastic @ $27 per lb. 3 lbs refined aluminum @ $42 per lb Amount 140 260 Done Amount 372 675 126 Root Technology allocates manufacturing overhead to jobs based on the relation between estimated overhead of $600,000 and estimated direct labor costs of $480,000. Job 423 was completed and shipped on April 3. - X de explanations from any journal

Process Costing

Process costing is a sort of operation costing which is employed to determine the value of a product at each process or stage of producing process, applicable where goods produced from a series of continuous operations or procedure.

Job Costing

Job costing is adhesive costs of each and every job involved in the production processes. It is an accounting measure. It is a method which determines the cost of specific jobs, which are performed according to the consumer’s specifications. Job costing is possible only in businesses where the production is done as per the customer’s requirement. For example, some customers order to manufacture furniture as per their needs.

ABC Costing

Cost Accounting is a form of managerial accounting that helps the company in assessing the total variable cost so as to compute the cost of production. Cost accounting is generally used by the management so as to ensure better decision-making. In comparison to financial accounting, cost accounting has to follow a set standard ad can be used flexibly by the management as per their needs. The types of Cost Accounting include – Lean Accounting, Standard Costing, Marginal Costing and Activity Based Costing.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps