Jenny's Cupcake Shop and Carrie's Cakes each operate a bakery close to each other in a small town in Florida. If Jenny rents ovens on her own, it will cost $36,000. If Carrie rents ovens on her own, it will cost $52,000. If they consolidate baking operations and share ovens, the total cost will be $66,000. Read the requirements. Requirements 1. Calculate Jenny's and Carrie's respective cost of the shared ovens under the stand-alone cost-allocation method. 2. Calculate Jenny's and Carrie's respective cost of the shared ovens using the incremental cost-allocation method assuming (a) Jenny is the primary party and (b) Carrie is the primary party. 3. Calculate Jenny's and Carrie's respective cost of the shared ovens using the Shapley value method. 4. Which method would you recommend Jenny and Carrie use to share the cost of the ovens? Why? х

Jenny's Cupcake Shop and Carrie's Cakes each operate a bakery close to each other in a small town in Florida. If Jenny rents ovens on her own, it will cost $36,000. If Carrie rents ovens on her own, it will cost $52,000. If they consolidate baking operations and share ovens, the total cost will be $66,000. Read the requirements. Requirements 1. Calculate Jenny's and Carrie's respective cost of the shared ovens under the stand-alone cost-allocation method. 2. Calculate Jenny's and Carrie's respective cost of the shared ovens using the incremental cost-allocation method assuming (a) Jenny is the primary party and (b) Carrie is the primary party. 3. Calculate Jenny's and Carrie's respective cost of the shared ovens using the Shapley value method. 4. Which method would you recommend Jenny and Carrie use to share the cost of the ovens? Why? х

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 1TP: Seda Sarkisian makes wedding cakes from her home. A customer has requested two duplicate wedding...

Related questions

Question

Transcribed Image Text:Jenny's Cupcake Shop and Carrie's Cakes each operate a bakery close to each other in a small town in Florida. If Jenny rents ovens

on her own, it will cost $36,000. If Carrie rents ovens on her own, it will cost $52,000. If they consolidate baking operations and

share ovens, the total cost will be $66,000.

Read the requirements.

Requirements

1.

Calculate Jenny's and Carrie's respective cost of the shared ovens under the stand-alone cost-allocation

method.

2. Calculate Jenny's and Carrie's respective cost of the shared ovens using the incremental cost-allocation method

assuming (a) Jenny is the primary party and (b) Carrie is the primary party.

3. Calculate Jenny's and Carrie's respective cost of the shared ovens using the Shapley value method.

4. Which method would you recommend Jenny and Carrie use to share the cost of the ovens? Why?

- X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

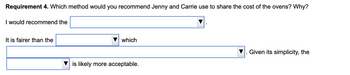

Transcribed Image Text:Requirement 4. Which method would you recommend Jenny and Carrie use to share the cost of the ovens? Why?

I would recommend the

It is fairer than the

which

is likely more acceptable.

Given its simplicity, the

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning