Minden Company is a wholesale distributor of premium European chocolates. The company’s balance sheet as of April 30 is given below: Minden Company Balance Sheet April 30 Assets Cash $ 9,200 Accounts receivable 76,250 Inventory 49,750 Buildings and equipment, net of depreciation 228,000 Total assets $ 363,200 Liabilities and Stockholders’ Equity Accounts payable $ 63,750 Note payable 23,900 Common stock 180,000 Retained earnings 95,550 Total liabilities and stockholders’ equity $ 363,200 The company is in the process of preparing a budget for May and has assembled the following data: Sales are budgeted at $227,000 for May. Of these sales, $68,100 will be for cash; the remainder will be credit sales. One-half of a month’s credit sales are collected in the month the sales are made, and the remainder is collected in the following month. All of the April 30 accounts receivable will be collected in May. Purchases of inventory are expected to total $159,000 during May. These purchases will all be on account. Forty percent of all purchases are paid for in the month of purchase; the remainder are paid in the following month. All of the April 30 accounts payable to suppliers will be paid during May. The May 31 inventory balance is budgeted at $87,500. Selling and administrative expenses for May are budgeted at $79,500, exclusive of depreciation. These expenses will be paid in cash. Depreciation is budgeted at $6,000 for the month. The note payable on the April 30 balance sheet will be paid during May, with $105 in interest. (All of the interest relates to May.) New refrigerating equipment costing $11,800 will be purchased for cash during May. During May, the company will borrow $25,100 from its bank by giving a new note payable to the bank for that amount. The new note will be due in one year. Required: 1. Calculate the expected cash collections from customers for May. 2. Calculate the expected cash disbursements for merchandise purchases for May. 3. Prepare a cash budget for May. 4. Prepare a budgeted income statement for May. 5. Prepa

Please answer req part 4 and 5 and provide answers according to the images provided

Problem 8-19 (Algo) Cash Budget ; Income Statement; Balance Sheet [LO8-2, LO8-4, LO8-8, LO8-9, LO8-10]

Minden Company is a wholesale distributor of premium European chocolates. The company’s balance sheet as of April 30 is given below:

| Minden Company Balance Sheet April 30 |

|

| Assets | |

|---|---|

| Cash | $ 9,200 |

| 76,250 | |

| Inventory | 49,750 |

| Buildings and equipment, net of |

228,000 |

| Total assets | $ 363,200 |

| Liabilities and |

|

| Accounts payable | $ 63,750 |

| Note payable | 23,900 |

| Common stock | 180,000 |

| 95,550 | |

| Total liabilities and stockholders’ equity | $ 363,200 |

The company is in the process of preparing a budget for May and has assembled the following data:

-

Sales are budgeted at $227,000 for May. Of these sales, $68,100 will be for cash; the remainder will be credit sales. One-half of a month’s credit sales are collected in the month the sales are made, and the remainder is collected in the following month. All of the April 30 accounts receivable will be collected in May.

-

Purchases of inventory are expected to total $159,000 during May. These purchases will all be on account. Forty percent of all purchases are paid for in the month of purchase; the remainder are paid in the following month. All of the April 30 accounts payable to suppliers will be paid during May.

-

The May 31 inventory balance is budgeted at $87,500.

-

Selling and administrative expenses for May are budgeted at $79,500, exclusive of depreciation. These expenses will be paid in cash. Depreciation is budgeted at $6,000 for the month.

-

The note payable on the April 30 balance sheet will be paid during May, with $105 in interest. (All of the interest relates to May.)

-

New refrigerating equipment costing $11,800 will be purchased for cash during May.

-

During May, the company will borrow $25,100 from its bank by giving a new note payable to the bank for that amount. The new note will be due in one year.

Required:

1. Calculate the expected cash collections from customers for May.

2. Calculate the expected cash disbursements for merchandise purchases for May.

3. Prepare a cash budget for May.

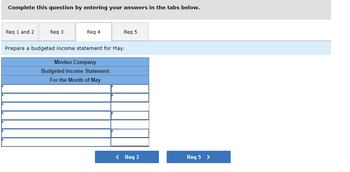

4. Prepare a

5. Prepare a budgeted balance sheet as of May 31.

![The image displays a template for a budgeted balance sheet of Minden Company as of May 31. Below is a transcription and explanation suitable for an educational website.

---

**Budgeted Balance Sheet Template for Minden Company**

**Date:** May 31

---

**Assets**

1. _____________________

2. _____________________

3. _____________________

4. _____________________

*Total assets*

[Space to Enter Total]

---

**Liabilities and Stockholders' Equity**

1. _____________________

2. _____________________

3. _____________________

4. _____________________

*Total liabilities and stockholders' equity*

[Space to Enter Total]

---

**Explanation:**

This balance sheet is divided into two main sections: **Assets** and **Liabilities and Stockholders' Equity**.

- **Assets** represent what the company owns. It includes categories such as cash, accounts receivable, inventory, and property.

- **Liabilities and Stockholders' Equity** represent what the company owes and the residual interest in the assets. Liabilities include obligations like loans and accounts payable. Stockholders' equity represents the owners' claim after liabilities are subtracted from assets.

Both sections have dedicated lines for detailed entries, allowing users to fill in specific amounts for various accounts.

The balance sheet concludes with lines to calculate the total assets and the total liabilities and stockholders' equity, ensuring that both sides balance, as required in accounting principles.

This template helps in planning future financial decisions by providing a structured view of the company's expected financial position.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F974c5538-3db8-4327-9554-477f1d67f083%2F10a88618-b3cf-4020-b79c-09c4f593c50f%2Fmyofpl_processed.png&w=3840&q=75)

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 6 images

For Req #4, Can you please highlight what items I should enter into the

3.33points

Item 2

Problem 8-19 (Algo) Cash Budget ; Income Statement; Balance Sheet [LO8-2, LO8-4, LO8-8, LO8-9, LO8-10]

Minden Company is a wholesale distributor of premium European chocolates. The company’s balance sheet as of April 30 is given below:

| Minden Company Balance Sheet April 30 |

|

| Assets | |

|---|---|

| Cash | $ 9,200 |

| 76,250 | |

| Inventory | 49,750 |

| Buildings and equipment, net of |

228,000 |

| Total assets | $ 363,200 |

| Liabilities and |

|

| Accounts payable | $ 63,750 |

| Note payable | 23,900 |

| Common stock | 180,000 |

| 95,550 | |

| Total liabilities and stockholders’ equity | $ 363,200 |

The company is in the process of preparing a budget for May and has assembled the following data:

-

Sales are budgeted at $227,000 for May. Of these sales, $68,100 will be for cash; the remainder will be credit sales. One-half of a month’s credit sales are collected in the month the sales are made, and the remainder is collected in the following month. All of the April 30 accounts receivable will be collected in May.

-

Purchases of inventory are expected to total $159,000 during May. These purchases will all be on account. Forty percent of all purchases are paid for in the month of purchase; the remainder are paid in the following month. All of the April 30 accounts payable to suppliers will be paid during May.

-

The May 31 inventory balance is budgeted at $87,500.

-

Selling and administrative expenses for May are budgeted at $79,500, exclusive of depreciation. These expenses will be paid in cash. Depreciation is budgeted at $6,000 for the month.

-

The note payable on the April 30 balance sheet will be paid during May, with $105 in interest. (All of the interest relates to May.)

-

New refrigerating equipment costing $11,800 will be purchased for cash during May.

-

During May, the company will borrow $25,100 from its bank by giving a new note payable to the bank for that amount. The new note will be due in one year.

Required:

1. Calculate the expected cash collections from customers for May.

2. Calculate the expected cash disbursements for merchandise purchases for May.

3. Prepare a cash budget for May.

4. Prepare a budgeted income statement for May.

5. Prepare a budgeted balance sheet as of May 31.