Randy and Randi Randall

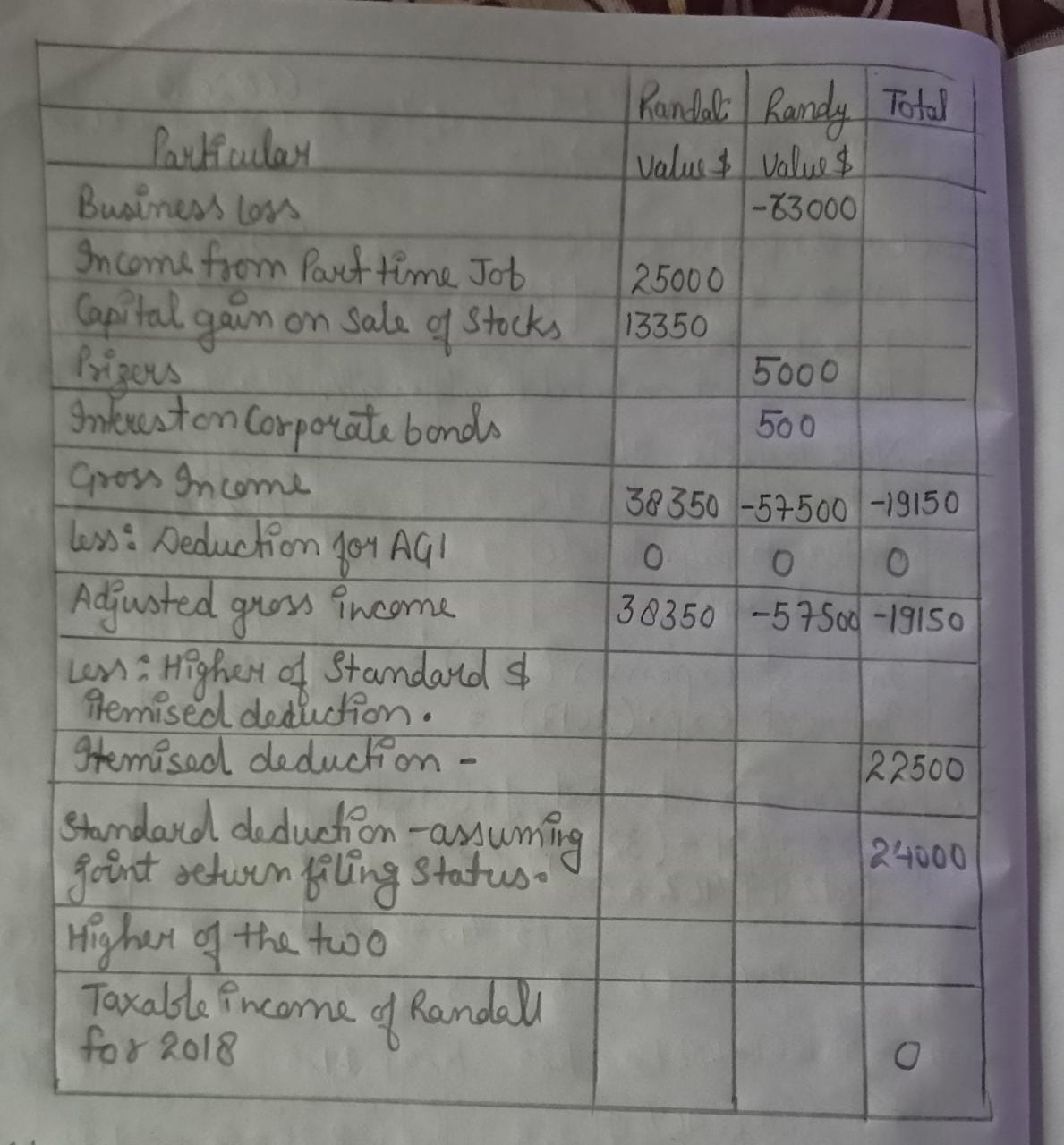

Randy and Randi Randall are the parents of two preschool children. They started a business in 2018, making and installing window treatments. For 2018, the business generated $75,000 in sales and incurred deductible expenses of $138,000.

Randi also works part-time as a hairstylist to help make ends meet. During 2018, she earned $25,000, and her employer withheld $2,000 in federal income taxes and $700 in state income taxes.

Randy won $5,000 in groceries in a contest at the local supermarket. He also earned $500 in interest on some corporate bonds that he inherited several years ago.

The Randalls sold a number of stocks that they had been holding for years and generated a

Required:

Show all your work. Ignore any self-employment taxes.

- Calculate the Randalls’ taxable income or loss for tax purposes.

- Calculate the Randalls’ net operating loss (NOL) for 2018.

- Assume that the Randalls have taxable income of $40,000 in 2019. Can they apply their NOL to it, and, if so, what is the amount that can be applied?

as per the given question

Net operative loss (NOL) could be a loss taken in a very amount wherever a company's allowable tax deductions ar bigger than its dutiable financial gain, leading to a negative dutiable financial gain. This typically occures once an organization inccurs additional expenses than revenues throughout that amount.

Explanation : Business loss of 1 relation will be offset against the financial gain of another relation subject to a limit of $500000 for 2018. thus dutiable financial gain of Randall is O assumptive they file return.

Step by step

Solved in 2 steps with 2 images