Question : A new company, is being established to manufacture and sell an electronic tracking device: the Trackit. The owners are excited about the future profits that the business will generate. They have forecast that sales will grow to 2,600 Trackits per month within five months and will be at that level for the remainder of the first year.The owners will invest a total of $250,000 in cash on the first day of operations (that is the first day of July). They will also transfer non-current assets into the company.Extracts from the company’s business plan are shown below.SalesThe forecast sales for the first five months are:Month Trackits (units)July 1,000August 1,500September 2,000October 2,400November 2,600The selling price has been set at $140 per Trackit.Sales receiptsSales will be mainly through large retail outlets. The pattern for the receipt of payment is expected to be as follows:Time of payment % of sales valueImmediately 15 *One month later 25Two months later 40Three months later 15The balance represents anticipated bad debts.* A 4% discount will be given for immediate paymentProductionThe budget production volumes in units are:July August September October1,450 1,650 2,120 2,4605Variable production costThe budgeted variable production cost is $90 per unit, comprising:$Direct materials 60Direct labour 10Variable production overheads 20Total variable cost 90Direct materials: Payment for purchases will be made in the month following receipt of materials. There will be no opening inventory of materials in July. It will be company policy to hold inventory at the end of each month equal to 20% of the following month’s production requirements.Direct labour will be paid in the month in which the production occurs.Variable production overheads: 65% will be paid in the month in which production occurs and the remainder will be paid one month later.Fixed overhead costsFixed overheads are estimated at $840,000 per annum and are expected to be incurred in equal amounts each month. 60% of the fixed overhead costs will be paid in the month in which they are incurred and 15% in the following month. The balance represents depreciation of noncurrent assets.Required:a) Prepare a cash receipts budget schedule for each of the first three months(July – September), including the total receipts per month. b) Prepare a material purchases budget schedule for each of the first threemonths (July – September), including the total purchases per month.c) Prepare a cash budget for the month of July. Include the owners’ cashcontributions Question 2 - Perfumes Ltd has two divisions: the Perfume Division and the Bottle Division. The company is decentralised and each division is evaluated as a profit centre. The Bottle Division produces bottles that can be used by the Perfume Division. The Bottle Division's variable manufacturing cost per unit is $3.00 and shipping costs are $0.20 per unit. The Bottle Division's external sales price is $4.00 per unit. No shipping costs are incurred on sales to the Perfume Division. The Perfume Division can purchase similar bottles in the external market for $3.50.The Bottle Division has sufficient capacity to meet all external market demands in addition to meeting the demands of the Perfume Division.Required:a) Using the general rule, determine the minimum transfer price. b) Assume the Bottle Division has no excess capacity and can sell everything produced externally. Would the transfer price change? c) Assume the Bottle Division has no excess capacity and can sell everything produced externally. What is the maximum amount Perfume Division would be willing to pay for the bottles? d) When is it more appropriate to use market-based transfer price rather than cost-based transfer price?

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Question :

A new company, is being established to manufacture and sell an electronic tracking device: the Trackit. The owners are excited about the future profits that the business will generate. They have

The owners will invest a total of $250,000 in cash on the first day of operations (that is the first day of July). They will also transfer non-current assets into the company.

Extracts from the company’s business plan are shown below.

Sales

The forecast sales for the first five months are:

Month Trackits (units)

July 1,000

August 1,500

September 2,000

October 2,400

November 2,600

The selling price has been set at $140 per Trackit.

Sales receipts

Sales will be mainly through large retail outlets. The pattern for the receipt of payment is expected to be as follows:

Time of payment % of sales value

Immediately 15 *

One month later 25

Two months later 40

Three months later 15

The balance represents anticipated

* A 4% discount will be given for immediate payment

Production

The budget production volumes in units are:

July August September October

1,450 1,650 2,120 2,460

5

Variable production cost

The budgeted variable production cost is $90 per unit, comprising:

$

Direct materials 60

Direct labour 10

Variable production

Total variable cost 90

Direct materials: Payment for purchases will be made in the month following receipt of materials. There will be no opening inventory of materials in July. It will be company policy to hold inventory at the end of each month equal to 20% of the following month’s production requirements.

Direct labour will be paid in the month in which the production occurs.

Variable production overheads: 65% will be paid in the month in which production occurs and the remainder will be paid one month later.

Fixed overhead costs

Fixed overheads are estimated at $840,000 per annum and are expected to be incurred in equal amounts each month. 60% of the fixed overhead costs will be paid in the month in which they are incurred and 15% in the following month. The balance represents

Required:

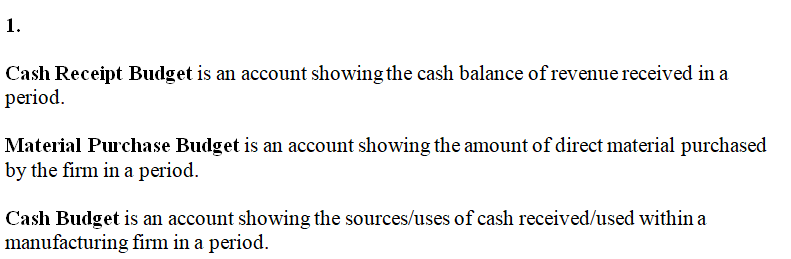

a) Prepare a cash receipts budget schedule for each of the first three months

(July – September), including the total receipts per month.

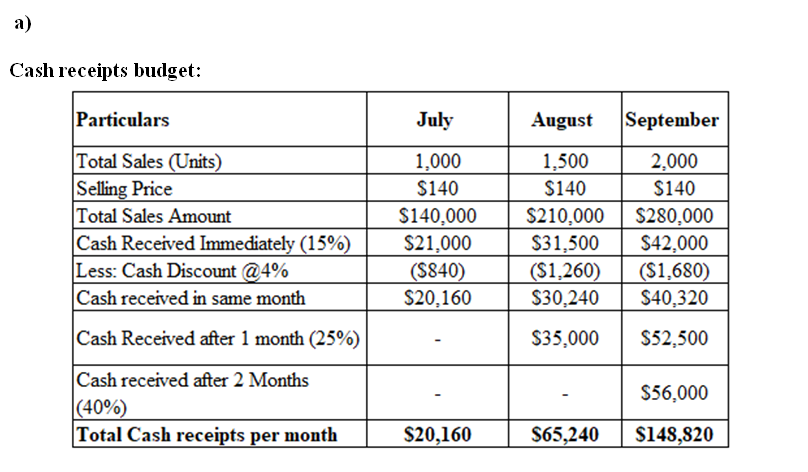

b) Prepare a material purchases budget schedule for each of the first three

months (July – September), including the total purchases per month.

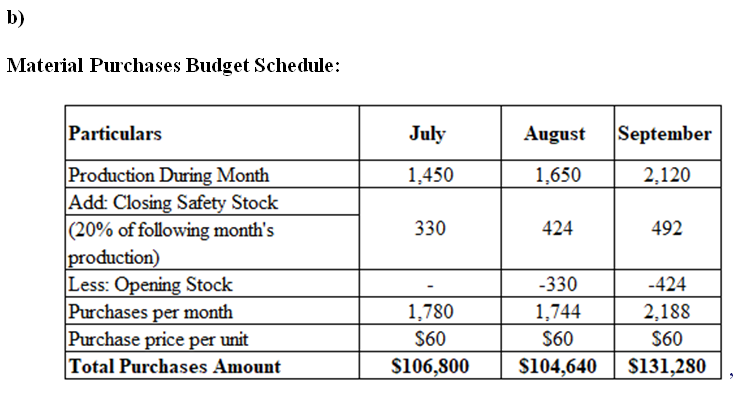

c) Prepare a

contributions

Question 2 -

Perfumes Ltd has two divisions: the Perfume Division and the Bottle Division. The company is decentralised and each division is evaluated as a profit centre. The Bottle Division produces bottles that can be used by the Perfume Division. The Bottle Division's variable

The Bottle Division has sufficient capacity to meet all external market demands in addition to meeting the demands of the Perfume Division.

Required:

a) Using the general rule, determine the minimum transfer price.

b) Assume the Bottle Division has no excess capacity and can sell everything produced externally. Would the transfer price change?

c) Assume the Bottle Division has no excess capacity and can sell everything produced externally. What is the maximum amount Perfume Division would be willing to pay for the bottles?

d) When is it more appropriate to use market-based transfer price rather than cost-based transfer price?

Step by step

Solved in 5 steps with 7 images