Prior to the COVID 19 recession, commercial bank deposits were subject to reserve requirements specified by the required reserve ratio. Banks with deposits larger than $127.5 million were required to hold 10% of bank deposit labilities either as vault cash or deposits of bank money at the Fed. If the required reserve ratio is 10%, what will happen to each to of the following if a new deposit of $10,000 in cash is made in a Louisville bank assuming that banks desire to hold zero excess deposits. (1) Total bank reserves when the deposit is made: (2) Loan made by the bank initially receiving the $10,000: (3) Total expansion of the money supply including the initial increase in bank reserves:

Prior to the COVID 19 recession, commercial bank deposits were subject to reserve requirements specified by the

- If the required reserve ratio is 10%, what will happen to each to of the following if a new deposit of $10,000 in cash is made in a Louisville bank assuming that banks desire to hold zero excess deposits.

(1) Total bank reserves when the deposit is made:

(2) Loan made by the bank initially receiving the $10,000:

(3) Total expansion of the money supply including the initial increase in bank reserves:

(4) Total amount of bank-created money (M1) created:

(5) The value of the deposit-expansion multiplier:

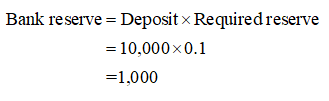

Required reserve is the percentage of money to the deposit that has to keep with the central bank.

Excess reserve is the remaining amount of deposit after made the required reserve.

1.

Total bank reserve can be calculated as follows.

Bank reserve increases to $1,000.

Step by step

Solved in 4 steps with 3 images