Possible terms: Activity-Based Costing Appraisal or Inspection Costs Batch-Level Activities External Failure Costs Facility-Level Activities Just-in-Time System None of These are Correct Prevention Costs Unit-Level Activities Value Chain Value-Added Activity

Possible terms: Activity-Based Costing Appraisal or Inspection Costs Batch-Level Activities External Failure Costs Facility-Level Activities Just-in-Time System None of These are Correct Prevention Costs Unit-Level Activities Value Chain Value-Added Activity

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

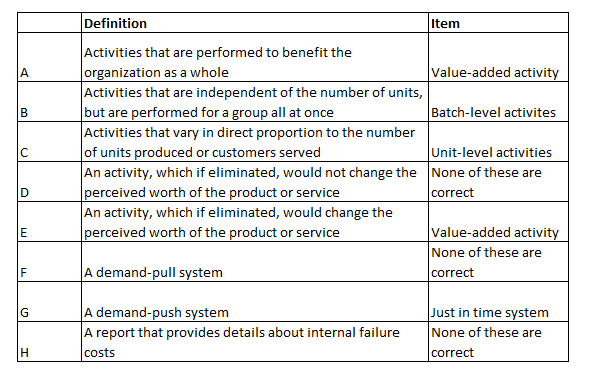

Match each definition with its related term by selecting the appropriate term in the dropdown provided. (Select "None of these are correct" if there is no term for the "Definition".)

Possible terms:

Activity-Based Costing

Appraisal or Inspection Costs

Batch-Level Activities

External Failure Costs

Facility-Level Activities

Just-in-Time System

None of These are Correct

Prevention Costs

Unit-Level Activities

Value Chain

Value-Added Activity

Transcribed Image Text:Definition

Term

A. Activities that are performed to benefit the organization as a whole.

B. Activities that are independent of the of the number of units, but are performed for a group all at once.

C. Activities that vary in direct proportion to the number of units produced or customers served.

D. An activity, which if eliminated, would not change the perceived worth of the product or service.

E. An activity, which if eliminated, would change the perceived worth of the product or service.

F. A demand-pull system.

G. A demand-push system.

H. A report that provides details about internal failure costs.

1. Costs incurred to keep quality problems from happening.

J. Costs incurred to identify defective products before they get to customers.

K. Costs that result from the defects caught during the inspection process.

L. Warranty costs, recalls, and product replacement costs.

A linked set of activities required to design, develop, produce, market, deliver the product to customers, and

M.

aftermarket service.

N. A process that involves analyzing the feasibility of a product to meet a projected life cycle cost.

A method that identifies the major activities that place demands on a company's resources and then assigns indirect

O.

costs to the products/services that create those demands.

Expert Solution

Step 1: Set A-H

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education