Please answer parts 5-8 according to the images attached below. Highland Company produces a lightweight backpack that is popular with college students. Standard variable costs relating to a single backpack are given below: Standard Quantity or Hours Standard Price or Rate Standard Cost Direct materials ? $ 5.00 per yard $ ? Direct labor ? ? ? Variable manufacturing overhead ? $ 2 per direct labor-hour ? Total standard cost per unit $ ? Overhead is applied to production on the basis of direct labor-hours. During March, 780 backpacks were manufactured and sold. Selected information relating to the month’s production is given below: Materials Used Direct Labor Variable Manufacturing Overhead Total standard cost allowed* $ 15,600 $ 13,104 $ 2,496 Actual costs incurred $ 13,112 ? $ 5,491 Materials price variance ? Materials quantity variance $ 790 U Labor rate variance ? Labor efficiency variance ? Variable overhead rate variance ? Variable overhead efficiency variance ? *For the month's production. The following additional information is available for March’s production: Actual direct labor-hours 1,170 Difference between standard and actual cost per backpack produced during March $ 0.10 F Required: (Hint: It may be helpful to complete a general model diagram for direct materials, direct labor, and variable manufacturing overhead before attempting to answer any of the requirements.) 1. What is the standard cost of a single backpack? 2. What was the actual cost per backpack produced during March? 3. How many yards of material are required at standard per backpack? 4. What was the materials price variance for March if there were no beginning or ending inventories of materials? 5. What is the standard direct labor rate per hour? 6. What was the labor rate variance for March? The labor efficiency variance? 7. What was the variable overhead rate variance for March? The variable overhead efficiency variance? 8. Prepare a standard cost card for one backpack.

Please answer parts 5-8 according to the images attached below.

Highland Company produces a lightweight backpack that is popular with college students. Standard variable costs relating to a single backpack are given below:

| Standard Quantity or Hours | Standard Price or Rate | |||

|---|---|---|---|---|

| Direct materials | ? | $ 5.00 | per yard | $ ? |

| Direct labor | ? | ? | ? | |

| Variable manufacturing overhead | ? | $ 2 | per direct labor-hour | ? |

| Total standard cost per unit | $ ? |

Overhead is applied to production on the basis of direct labor-hours. During March, 780 backpacks were manufactured and sold. Selected information relating to the month’s production is given below:

| Materials Used | Direct Labor | Variable Manufacturing Overhead | ||

|---|---|---|---|---|

| Total standard cost allowed* | $ 15,600 | $ 13,104 | $ 2,496 | |

| Actual costs incurred | $ 13,112 | ? | $ 5,491 | |

| Materials price variance | ? | |||

| Materials quantity variance | $ 790 | U | ||

| Labor rate variance | ? | |||

| Labor efficiency variance | ? | |||

| Variable overhead rate variance | ? | |||

| Variable overhead efficiency variance | ? |

*For the month's production.

The following additional information is available for March’s production:

| Actual direct labor-hours | 1,170 | |

|---|---|---|

| Difference between standard and actual cost per backpack produced during March | $ 0.10 | F |

Required:

(Hint: It may be helpful to complete a general model diagram for direct materials, direct labor, and variable manufacturing overhead before attempting to answer any of the requirements.)

1. What is the standard cost of a single backpack?

2. What was the actual cost per backpack produced during March?

3. How many yards of material are required at standard per backpack?

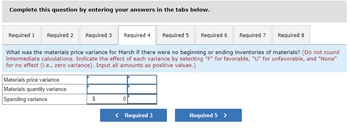

4. What was the materials price variance for March if there were no beginning or ending inventories of materials?

5. What is the standard direct labor rate per hour?

6. What was the labor rate variance for March? The labor efficiency variance?

7. What was the variable overhead rate variance for March? The variable overhead efficiency variance?

8. Prepare a standard cost card for one backpack.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Can you answer question #4?

Highland Company produces a lightweight backpack that is popular with college students. Standard variable costs relating to a single backpack are given below:

| Standard Quantity or Hours | Standard Price or Rate | |||

|---|---|---|---|---|

| Direct materials | ? | $ 5.00 | per yard | $ ? |

| Direct labor | ? | ? | ? | |

| Variable manufacturing overhead | ? | $ 2 | per direct labor-hour | ? |

| Total standard cost per unit | $ ? |

Overhead is applied to production on the basis of direct labor-hours. During March, 780 backpacks were manufactured and sold. Selected information relating to the month’s production is given below:

| Materials Used | Direct Labor | Variable Manufacturing Overhead | ||

|---|---|---|---|---|

| Total standard cost allowed* | $ 15,600 | $ 13,104 | $ 2,496 | |

| Actual costs incurred | $ 13,112 | ? | $ 5,491 | |

| Materials price variance | ? | |||

| Materials quantity variance | $ 790 | U | ||

| Labor rate variance | ? | |||

| Labor efficiency variance | ? | |||

| Variable overhead rate variance | ? | |||

| Variable overhead efficiency variance | ? |

*For the month's production.

The following additional information is available for March’s production:

| Actual direct labor-hours | 1,170 | |

|---|---|---|

| Difference between standard and actual cost per backpack produced during March | $ 0.10 | F |

Required:

(Hint: It may be helpful to complete a general model diagram for direct materials, direct labor, and variable manufacturing overhead before attempting to answer any of the requirements.)

1. What is the standard cost of a single backpack?

2. What was the actual cost per backpack produced during March?

3. How many yards of material are required at standard per backpack?

4. What was the materials price variance for March if there were no beginning or ending inventories of materials?

5. What is the standard direct labor rate per hour?

6. What was the labor rate variance for March? The labor efficiency variance?

7. What was the variable overhead rate variance for March? The variable overhead efficiency variance?

8. Prepare a standard cost card for one backpack.