Passion Limited operates a paint manufacturing plant, housing two distinct departments: the mixing department and the quality control department. The paint undergoes sequential processing in both of these departments. The company's process-costing system is structured around two primary cost categories: direct materials and conversion costs. Direct materials are introduced at the initial stages of the process, while conversion costs are gradually incurred throughout the process. After completion of the mixing department's tasks on the paint, the product is promptly forwarded to the quality control department. Passion employs the weighted-average method for process costing to calculate its manufacturing costs. Data for the mixing department for October 2020 are as follows: Physical Units Gallons of Paint Direct Materials Conversion Costs Work in process, October 1x 8,000 $1,400,000 $450,700 Started during October 2020 22,000 Completed during October 2020 25,500 Work in process, October 31y 4,500 Total costs added during October 2020 $4,700,000 2,555,500 ^x Degree of completion: direct materials, 100%; conversion costs, 60%. ^y Degree of completion: direct materials, 100%; conversion costs, 70%. Required: Compute equivalent units in the mixing department, for each cost category? Summarize total mixing department costs for October 2020 for each cost category, and calculate the cost per equivalent unit? Assign total costs to units completed and transferred out and to units in ending work in process? By reference to the above data: How does process costing differ from job costing, and in what types of industries is process costing typically used?

Process Costing

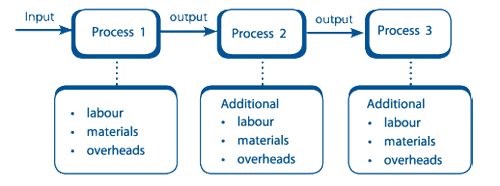

Process costing is a sort of operation costing which is employed to determine the value of a product at each process or stage of producing process, applicable where goods produced from a series of continuous operations or procedure.

Job Costing

Job costing is adhesive costs of each and every job involved in the production processes. It is an accounting measure. It is a method which determines the cost of specific jobs, which are performed according to the consumer’s specifications. Job costing is possible only in businesses where the production is done as per the customer’s requirement. For example, some customers order to manufacture furniture as per their needs.

ABC Costing

Cost Accounting is a form of managerial accounting that helps the company in assessing the total variable cost so as to compute the cost of production. Cost accounting is generally used by the management so as to ensure better decision-making. In comparison to financial accounting, cost accounting has to follow a set standard ad can be used flexibly by the management as per their needs. The types of Cost Accounting include – Lean Accounting, Standard Costing, Marginal Costing and Activity Based Costing.

Passion Limited operates a paint manufacturing plant, housing two distinct departments: the mixing department and the quality control department. The paint undergoes sequential processing in both of these departments.

The company's process-costing system is structured around two primary cost categories: direct materials and conversion costs. Direct materials are introduced at the initial stages of the process, while conversion costs are gradually incurred throughout the process. After completion of the mixing department's tasks on the paint, the product is promptly forwarded to the quality control department. Passion employs the weighted-average method for

Data for the mixing department for October 2020 are as follows:

| Physical Units | |||

| Gallons of Paint | Direct Materials | Conversion | |

| Costs | |||

| Work in process, October 1x | 8,000 | $1,400,000 | $450,700 |

| Started during October 2020 | 22,000 | ||

| Completed during October 2020 | 25,500 | ||

| Work in process, October 31y | 4,500 | ||

| Total costs added during October 2020 | $4,700,000 | 2,555,500 |

^x Degree of completion: direct materials, 100%; conversion costs, 60%.

^y Degree of completion: direct materials, 100%; conversion costs, 70%.

Required:

- Compute equivalent units in the mixing department, for each cost category?

- Summarize total mixing department costs for October 2020 for each cost category, and calculate the cost per equivalent unit?

- Assign total costs to units completed and transferred out and to units in ending work in process?

- By reference to the above data: How does process costing differ from

job costing , and in what types of industries is process costing typically used?

As per the Honor code of Bartleby we are bound to give the answer of the first three sub parts only, Please post the remaining sub part again Our other experts will assist you with that.

Process Costing :

Operation costing method employed to determine the value of a product at each process or stage of the production process, applicable where goods produced from a series of continuous operations or procedures. Process costing is employed by businesses that manufacture goods and where production is in repetitive inflow.

Equivalent Units: These are the units which is partially completed, in arriving at the correct cost we may calculate the equivalent units.

Step by step

Solved in 3 steps with 1 images