onsider the following financial informationabout a retooling project at a computer manufacturing company:• The project costs $2.5 million and has a five-yearservice life.• The retooling project can be classified as sevenyear property under the MACRS rule.• At the end of the fifth year, any assets held for theproject will be sold. The expected salvage valuewill be about 10% of the initial project cost.• The firm will finance 40% of the project moneyfrom an outside financial institution at an interestrate of 10%. The firm is required to repay the loanwith five equal annual payments.• The firm’s incremental (marginal) tax rate on theinvestment is 35%.• The firm’s MARR is 18%.With the preceding financial information,(a) Determine the after-tax cash flows.(b) Compute the annual equivalent worth for thisproject.

onsider the following financial information

about a retooling project at a computer manufacturing company:

• The project costs $2.5 million and has a five-year

service life.

• The retooling project can be classified as sevenyear property under the MACRS rule.

• At the end of the fifth year, any assets held for the

project will be sold. The expected salvage value

will be about 10% of the initial project cost.

• The firm will finance 40% of the project money

from an outside financial institution at an interest

rate of 10%. The firm is required to repay the loan

with five equal annual payments.

• The firm’s incremental (marginal) tax rate on the

investment is 35%.

• The firm’s MARR is 18%.

With the preceding financial information,

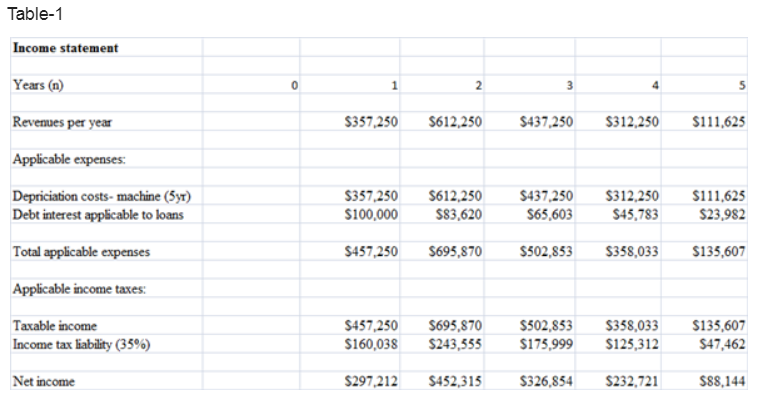

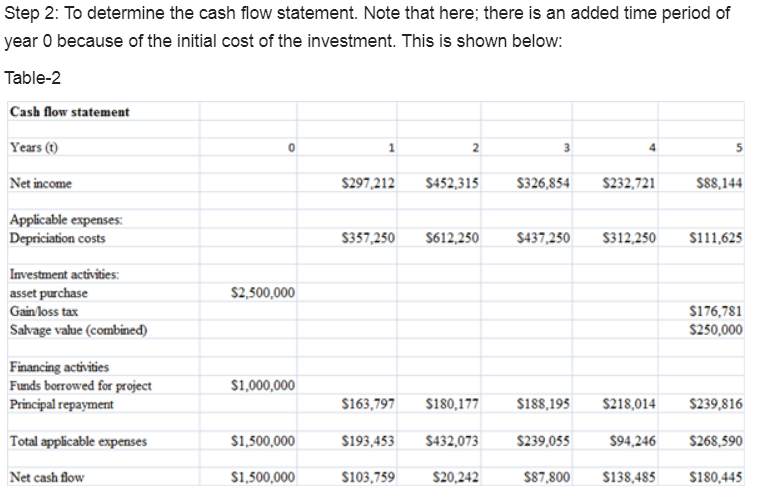

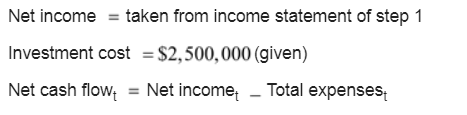

(a) Determine the after-tax cash flows.

(b) Compute the annual equivalent worth for this

project.

Step by step

Solved in 3 steps with 6 images