1 Financial Statements And Business Decisions 2 Investing And Financing Decisions And The Accounting System 3 Operating Decisions And The Accounting System 4 Adjustments, Financial Statements, And The Quality Of Earnings 5 Communicating And Interpreting Accounting Information 6 Reporting And Interpreting Sales Revenue, Receivables And Cash 7 Reporting And Interpreting Cost Of Goods Sold And Inventory 8 Reporting And Interpreting Property, Plant And Equipment; Intangibles; And Natural Resources 9 Reporting And Interpreting Liabilities 10 Reporting And Interpreting Bond Securities 11 Reporting And Interpreting Stockholders' Equity 12 Statement Of Cash Flows 13 Analyzing Financial Statements A Reporting And Interpreting Investments In Other Corporations Chapter1: Financial Statements And Business Decisions

Chapter Questions Section: Chapter Questions

Problem 1Q Problem 2Q: 2. Briefly distinguish financial accounting from managerial accounting.

Problem 3Q Problem 4Q: 4. Briefly distinguish investors from creditors.

Problem 5Q: 5. What is an accounting entity? Why is a business treated as a separate entity for accounting... Problem 6Q: 6. Complete the following:

Name of Statement Alternative Title

a. Income statement a.... Problem 7Q: 7. What information should be included in the heading of each of the four primary financial... Problem 8Q: 8. What are the purposes of (a) the income statement, (b) the balance sheet, (c) the statement of... Problem 9Q: 9. Explain why the income statement and the statement of cash flows are dated “For the Year Ended... Problem 10Q Problem 11Q: 11. Briefly define net income and net loss.

Problem 12Q: 12. Explain the equation for the income statement. What are the three major items reported on the... Problem 13Q Problem 14Q Problem 15Q Problem 16Q Problem 17Q Problem 18Q Problem 19Q Problem 20Q Problem 1MCQ Problem 2MCQ Problem 3MCQ Problem 4MCQ Problem 5MCQ Problem 6MCQ Problem 7MCQ Problem 8MCQ: 8. Which of the following is true regarding the income statement?

The income statement is sometimes... Problem 9MCQ: 9. Which of the following is false regarding the balance sheet?

The accounts shown on a balance... Problem 10MCQ Problem 1ME: Matching Elements with Financial Statements M1-1

Match each element with its financial statement by... Problem 2ME: Matching Financial Statement Items to Financial Statement Categories

Mark each item in the following... Problem 3ME Problem 1E Problem 2E: Matching Financial Statement Items to Financial Statement Categories

According to its annual report,... Problem 3E Problem 4E: Honda Motor Corporation of Japan is a leading international manufacturer of automobiles,... Problem 5E: Completing a Balance Sheet and Inferring Net Income

Bennett Griffin and Chula Garza organized Cole... Problem 6E: Assume that you are the owner of Campus Connection, which specializes in items that interest... Problem 7E Problem 8E Problem 9E: Review the chapter explanations of the income statement and the balance sheet equations. Apply these... Problem 10E: Inferring Values Using the Income Statement and Balance Sheet Equations

Review the chapter... Problem 11E: Preparing an Income Statement and Balance Sheet

Painter Corporation was organized by five... Problem 12E Problem 13E: Plummer Stonework Corporation was organized on January 1, 2017. For its first two years of... Problem 14E Problem 1P: P1-1 Preparing an Income Statement, Statement of Stockholders’ Equity, and Balance Sheet

Assume that... Problem 2P: Analyzing a Student's Business and Preparing an Income Statement

During the summer between his... Problem 3P: Comparing Income with Cash Flow (Challenging)

Huang Trucking Company was organized on January 1. At... Problem 4P: Evaluating Data to Support a Loan Application (Challenging)

On January 1 of the current year, three... Problem 1AP: AP1-1 Preparing an Income Statement, Statement of Stockholders’ Equity, and Balance Sheet

LO 1-1... Problem 2AP: AP1-2 Analyzing a Student’s Business and Preparing an Income Statement

Upon graduation from high... Problem 3AP: Comparing Income with Cash Flow (Challenging)

Choice Chicken Company was organized on January 1. At... Problem 1CON Problem 1CP: CP1-1 Finding Financial Information

LO1-1

Refer to the financial statements of American Eagle... Problem 2CP: Finding Financial Information

Refer to the financial statements of Express, Inc. in Appendix C at... Problem 3CP: Refer to the financial statements of American Eagle Outfitters in Appendix B and Express, Inc. in... Problem 4CP Problem 5CP Problem 6CP Problem 7CP Problem 1Q

Related questions

Concept explainers

Current Attempt in Progress

Lily Company uses a standard cost accounting system. In 2022, the company produced 27,600 units. Each unit took several pounds of direct materials and 1.6 standard hours of direct labor at a standard hourly rate of $12.00. Normal capacity was 50,300 direct labor hours. During the year, 130,200 pounds of raw materials were purchased at $0.90 per pound. All materials purchased were used during the year.

If the materials price variance was $5,208 favorable, what was the standard materials price per pound?

(Round answer to 2 decimal places, e.g. 2.75.)

Standard materials price per pound

Definition Definition System of assigning an estimated cost to the product (instead of the actual cost) so that the product cost can be determined well in advance and the pricing of the product can be done on time. Since the actual cost cannot be predicted at the initial stage of the production process, the estimated cost is recorded in the books. Any deviation of the estimated cost of the actual cost is adjusted in the books at the end of the period.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Step 1 : Working notes

VIEW

Step 2 : Calculation of standard materials price per pound

VIEW

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

What was the standard cost per unit of product? (Round answer to 2 decimal places, e.g. 2.75.)

If the materials quantity variance was $18,612 unfavorable, what was the standard materials quantity per unit?

Hello, The Standard material price per pound you said is $0.90. This answer is not accepted. Can you please check for me? thanks

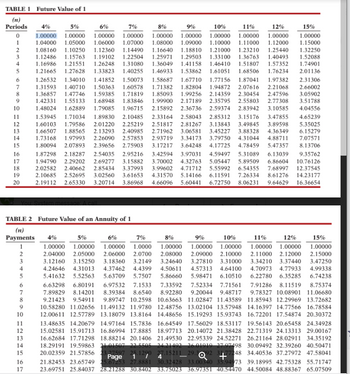

Transcribed Image Text: TABLE 1 Future Value of 1

(n)

Periods

0

1

2

3

4

5

67698H23

10

11

12

13

14

15

16

17

18

19

20

TABLE 2 Future Value of an Annuity of 1

(n)

Payments 4%

1

2

3

4

5

6

7

5%

6%

7%

1.00000 1.00000

8%

9% 10%

11%

12%

15%

1.00000 1.0000 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000

2.04000 2.05000 2.06000 2.0700 2.08000 2.09000 2.10000 2.11000 2.12000 2.15000

3.12160 3.15250 3.18360 3.2149 3.24640 3.27810 3.31000 3.34210 3.37440 3.47250

4.24646 4.31013 4.37462 4.4399 4.50611 4.57313 4.64100 4.70973 4.77933 4.99338

5.41632 5.52563 5.63709 5.7507 5.86660 5.98471 6.10510 6.22780 6.35285 6.74238

6.97532 7.1533 7.33592 7.52334 7.71561 7.91286 8.11519 8.75374

8.39384 8.6540 8.92280 9.20044 9.48717 9.78327 10.08901 11.06680

9.21423 9.54911 9.89747 10.2598 10.63663 11.02847 11.43589 11.85943 12.29969 13.72682

10.58280 11.02656 11.49132 11.9780 12.48756 13.02104 13.57948 14.16397 14.77566 16.78584

12.00611 12.57789 13.18079 13.8164 14.48656 15.19293 15.93743 16.72201 17.54874 20.30372

13.48635 14.20679 14.97164 15.7836 16.64549 17.56029 18.53117 19.56143 20.65458 24.34928

15.02581 15.91713 16.86994 17.8885 18.97713 20.14072 21.38428 22.71319 24.13313 29.00167

16.62684 17.71298 18.88214 20.1406 21.49530 22.95339 24.52271 26.21164 28.02911 34.35192

14 18.29191 19.59863 21.01507 22.5505 24.21402 26.01919 27.97498 30.09492 32.39260 40.50471

6.63298 6.80191

7.89829 8.14201

13

4

15 20.02359 21.57856 23 Page 25.1290 27.15211 29.392 377248 34.40536 37.27972 47.58041

21.82453 23.65749 25.67253 27.8881 30.32428 33.00340 35.94973 39.18995 42.75328 55.71747

23.69751 25.84037 28.21288 30.8402 33.75023 36.97351 40.54470 44.50084 48.88367 65.07509

8

9

10

11

12

5%

6%

7%

8%

9%

10%

11%

12%

1.00000

4%

1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000

1.04000 1.05000 1.06000 1.07000 1.08000 1.09000 1.10000 1.11000 1.12000

1.08160 1.10250 1.12360 1.14490 1.16640 1.18810 1.21000 1.23210 1.25440

1.12486 1.15763 1.19102 1.22504 1.25971 1.29503 1.33100 1.36763 1.40493

1.16986 1.21551 1.26248 1.31080 1.36049 1.41158 1.46410 1.51807 1.57352

1.21665 1.27628 1.33823 1.40255 1.46933 1.53862 1.61051 1.68506 1.76234

1.26532 1.34010 1.41852 1.50073 1.58687 1.67710 1.77156 1.87041 1.97382

1.31593 1.40710 1.50363 1.60578 1.71382 1.82804 1.94872 2.07616 2.21068

1.36857 1.47746 1.59385 1.71819 1.85093 1.99256 2.14359 2.30454 2.47596

1.42331 1.55133 1.68948 1.83846 1.99900 2.17189 2.35795 2.55803 2.77308

1.48024 1.62889 1.79085 1.96715 2.15892 2.36736 2.59374 2.83942 3.10585

1.53945 1.71034 1.89830 2.10485 2.33164 2.58043 2.85312 3.15176 3.47855

1.60103 1.79586 2.01220 2.25219 2.51817 2.81267 3.13843 3.49845 3.89598

1.66507 1.88565 2.13293 2.40985 2.71962 3.06581 3.45227 3.88328 4.36349

1.73168 1.97993 2.26090 2.57853 2.93719 3.34173 3.79750 4.31044 4.88711

1.80094 2.07893 2.39656 2.75903 3.17217 3.64248 4.17725 4.78459 5.47357

2.54035 2.95216 3.42594 3.97031 4.59497 5.31089 6.13039

1.94790 2.29202 2.69277 3.15882 3.70002 4.32763 5.05447 5.89509 6.86604

2.02582 2.40662 2.85434 3.37993 3.99602 4.71712 5.55992 6.54355 7.68997 12.37545

2.10685 2.52695 3.02560 3.61653 4.31570 5.14166 6.11591 7.26334 8.61276 14.23177

2.19112 2.65330 3.20714 3.86968 4.66096 5.60441 6.72750 8.06231 9.64629 16.36654

1.87298 2.18287

9.35762

10.76126

! +5

16

17

15%

1.00000

1.15000

1.32250

1.52088

1.74901

2.01136

2.31306

2.66002

3.05902

3.51788

4.04556

4.65239

5.35025

6.15279

7.07571

8.13706

Transcribed Image Text: 17

18

19

20

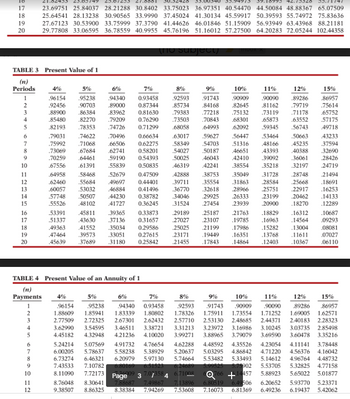

TABLE 3 Present Value of 1

(n)

Periods 4%

1234 in

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

1

2

3

4

5

6

7

8

9

21.82453

149 25.67255 21.8881 30.32428 33.00340 35.9497. 39.18993 42.13328

23.69751 25.84037 28.21288 30.8402 33.75023 36.97351 40.54470 44.50084 48.88367 65.07509

25.64541 28.13238 30.90565 33.9990 37.45024 41.30134 45.59917 50.39593 55.74972 75.83636

27.67123 30.53900 33.75999 37.3790 41.44626 46.01846 51.15909 56.93949 63.43968 88.21181

29.77808 33.06595 36.78559 40.9955 45.76196 51.16012 57.27500 64.20283 72.05244 102.44358

10

11

12

.96154

.92456

5%

6%

.95238 .94340

.89000

.90703

.88900 .86384 .83962

.85480 .82270

.82193 .78353

.79031 .74622 .70496

.71068 .66506 0.62275

.67684 .62741 0.58201

.75992

.73069

.70259

.64461

.59190

0.54393

.67556

.61391

55839

0.50835

.64958

.62460

.60057

.57748 .50507

55526 .48102

7%

0.93458

0.87344

0.81630

0.76290

.79209

.74726 0.71299

.58468

52679

0.47509

.55684 49697 0.44401

.53032 46884

0.41496

49363

47464

.45639 .37689

TABLE 4 Present Value of an Annuity of 1

(n)

Payments

44230

41727

.53391 .45811 .39365 0.33873

.51337

.41552

.43630 .37136 0.31657

.35034 0.29586

.39573 .33051 0.27615

.31180 0.25842

(no subject)

0.38782

0.36245

0.66634 .63017

.58349 .54703

54027 .50187

50025

46043

.46319

.42241

3

8%

9%

10%

11%

.92593 .91743 .90909

.90090

.84168

.82645

.81162

.75132 .73119

.68301

.62092

.85734

.79383

.73503

.68058

.77218

.70843

.64993

.59627 56447

42888

38554

.38753 .35049

.39711 .35554 .31863

.36770 .32618 28966

.34046

29925

31524

27454

29189 25187

27027

23107

25025

21199

19449

23171

21455 .17843

12%

15%

.89286 .86957

.79719

.71178

.65873 .63552

.59345

.56743

.53464

.50663

.43233

.48166 45235

.37594

51316

46651 43393 40388

.32690

42410 .39092 .36061 .28426

.24719

35218 .32197

26333

23939

31728 .28748

28584 .25668

25751 .22917

23199 .20462

20900

.18270

21763 .18829

.16312

.19785 .16963 .14564

.17986 .15282

.16351 .13768

.14864 .12403

.75614

.65752

.57175

49718

.13004

.11611

10367

21494

.18691

.16253

.14133

.12289

.10687

.09293

.08081

07027

.06110

5%

6%

7%

8%

9%

10%

11%

15%

12%

.86957

4%

.96154 .95238 94340 0.93458 .92593 91743 .90909 .90090 89286

1.88609 1.85941 1.83339 1.80802 1.78326 1.75911 1.73554 1.71252 1.69005 1.62571

2.77509 2.72325 2.67301 2.62432 2.57710 2.53130 2.48685 2.44371 2.40183 2.28323

3.62990 3.54595 3.46511 3.38721 3.31213 3.23972 3.16986 3.10245 3.03735 2.85498

4.45182 4.32948 4.21236 4.10020 3.99271 3.88965 3.79079 3.69590 3.60478 3.35216

5.24214 5.07569 4.91732 4.76654 4.62288 4.48592 4.35526 4.23054 4.11141 3.78448

6.00205 5.78637 5.58238 5.38929 5.20637 5.03295 4.86842 4.71220 4.56376 4.16042

6.73274 6.46321 6.20979 5.97130 5.74664 5.53482 5.33493 5.14612 4.96764 4.48732

7.43533 7.10782 6.80169 6.51523 6.24689 5.99525 5.75902 5.53705 5.32825 4.77158

8.11090 7.72173

Page

5.88923 5.65022 5.01877

Ⓒ766 +14457

8.76048 8.30641 7.88687 7.49867 7.13896 6.80519 6.49506 6.20652

9.38507 8.86325 8.38384 7.94269 7.53608 7.16073 6.81369 6.49236

7.36009 7.073584 6.71008

5.93770 5.23371

6.19437 5.42062