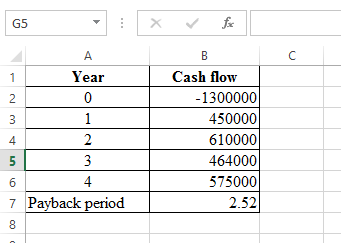

Jim Jones Sleepaway Camps, Inc. is looking for some payback period analysis for a new project in Janestown, Indiana. Suppose that the cost of acquiring the new camp, buildings, cabins, etc. and setting up trails and activities has an initial cost of $1.3M dollars but will generate the following cash-flows for the next four years: Year 1 $450,000 Year 2 $610,000 Year 3 $464,000 Year 4 $575,000 What is the payback period for this project

Jim Jones Sleepaway Camps, Inc. is looking for some payback period analysis for a new project in Janestown, Indiana. Suppose that the cost of acquiring the new camp, buildings, cabins, etc. and setting up trails and activities has an initial cost of $1.3M dollars but will generate the following cash-flows for the next four years:

Year 1 $450,000

Year 2 $610,000

Year 3 $464,000

Year 4 $575,000

What is the payback period for this project

The payback period alludes to what extent it takes for a speculator to hit breakeven to recoup the expense or initial investment of a venture, or to what extent it takes. Record and reserve chiefs utilize the restitution time frame to choose if speculation is to experience. Shorter paybacks mean increasingly appealing speculations while there is a less attractive quality for longer restitution periods. The payback period is dividing the amount of the investment by the annual cash flow.

Computation:

Hence, the payback period is 2.52 years.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images