It’s September 2017. You are an oil distributor, planning to buy 350,000 barrels of crude oil from British Petroleum (BP) in February 2018 in exchange for a spot price prevailing at that time. Because February 2018 spot price is unknown today, your objective is to hedge this risk. The futures price of crude oil for February 2018 delivery is $75.40. Contract size for crude oil is 1000 barrels. Assume that there is no excessive volatility during delivery month. (a) If you were to hedge using futures market, would you enter short or long futures position in September 2017? Explain. (b) What contracts and how many contracts do you need? (c) Calculate total profit or loss on your futures position, if at the futures contract’s maturity in February 2018 spot price turns out to be $65.00 a barrel.

It’s September 2017. You are an oil distributor, planning to buy 350,000 barrels of crude oil from British Petroleum (BP) in February 2018 in exchange for a spot price prevailing at that time. Because February 2018 spot price is unknown today, your objective is to hedge this risk. The futures price of crude oil for February 2018 delivery is $75.40. Contract size for crude oil is 1000 barrels. Assume that there is no excessive volatility during delivery month.

(a) If you were to hedge using futures market, would you enter short or long futures position in September 2017? Explain.

(b) What contracts and how many contracts do you need?

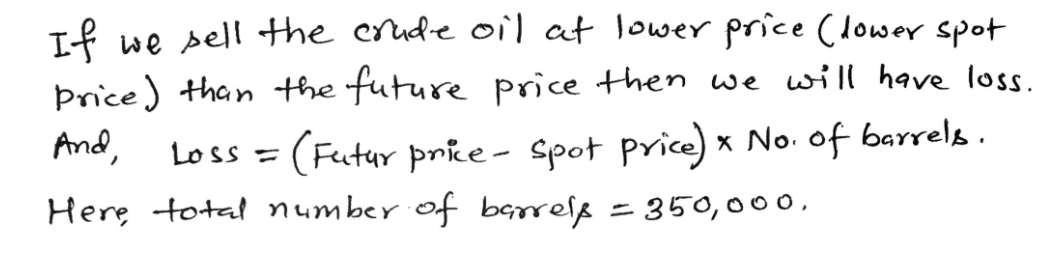

(c) Calculate total profit or loss on your futures position, if at the futures contract’s maturity in February 2018 spot price turns out to be $65.00 a barrel.

Step by step

Solved in 2 steps with 2 images