How reliable are mutual funds that invest in bonds? This depends on the bond fund you buy. A random sample of annual percentage returns for mutual funds holding short-term U.S. government bonds is shown below. 4.5 4.6 1.8 9.8 -0.8 4.1 10.5 4.2 3.5 3.9 9.8 -1.2 7.3 Use a calculator to verify that s2 ≈ 14.047 for the preceding data. A random sample of annual percentage returns for mutual funds holding intermediate-term corporate bonds is shown below. -0.1 3.4 20.5 7.6 -0.1 18.8 -3.4 10.5 8.0 -0.9 2.6 14.9 -6.5 8.2 18.8 14.2 Use a calculator to verify that s2 ≈ 71.648 for returns from mutual funds holding intermediate-term corporate bonds. Use ? = 5% to test the claim that the population variance for annual percentage returns of mutual funds holding short-term government bonds is different from the population variance for mutual funds holding intermediate-term corporate bonds. How could your test conclusion relate to the question of reliability of returns for each type of mutual fund? (a) What is the level of significance? Find the value of the sample F statistic. (Use 2 decimal places.) What are the degrees of freedom? dfN dfD

How reliable are mutual funds that invest in bonds? This depends on the bond fund you buy.

A random sample of annual percentage returns for mutual funds holding short-term U.S. government bonds is shown below.

| 4.5 | 4.6 | 1.8 | 9.8 | -0.8 | 4.1 | 10.5 |

| 4.2 | 3.5 | 3.9 | 9.8 | -1.2 | 7.3 |

Use a calculator to verify that s2 ≈ 14.047 for the preceding data.

A random sample of annual percentage returns for mutual funds holding intermediate-term corporate bonds is shown below.

| -0.1 | 3.4 | 20.5 | 7.6 | -0.1 | 18.8 | -3.4 | 10.5 |

| 8.0 | -0.9 | 2.6 | 14.9 | -6.5 | 8.2 | 18.8 | 14.2 |

Use a calculator to verify that s2 ≈ 71.648 for returns from mutual funds holding intermediate-term corporate bonds.

Use ? = 5% to test the claim that the population variance for annual percentage returns of mutual funds holding short-term government bonds is different from the population variance for mutual funds holding intermediate-term corporate bonds. How could your test conclusion relate to the question of reliability of returns for each type of mutual fund?

What are the degrees of freedom?

| dfN | |

| dfD |

|

Given:

The government bond is taken as group 1.

The corporate bond is taken as group 2.

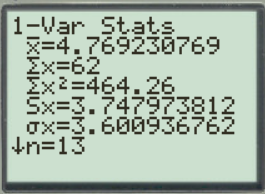

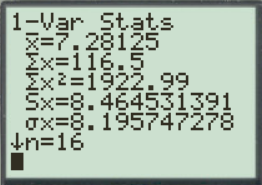

Step-by-step procedure to obtain the mean and standard deviation using a Ti83 calculator.

· Press STAT.

· Select Edit.

· Enter the values in L1.

· Enter the values in L2.

· Press STAT and Choose CALC.

· Select 1-Var Stats.

· To select the variable L1, Press 2-nd, and then press 1.

· Press Enter.

· Press STAT and Choose CALC.

· Select 1-Var Stats.

· To select the variable L1, Press 2-nd, and then press 2.

· Press Enter

The output is given below

The output for government bond

The output for corporate bond

Hypothesis:

H0: The population variance for annual percentage returns of mutual funds holding short-term government bonds is not different from the population variance for mutual funds holding intermediate-term corporate bonds.

H1: The population variance for annual percentage returns of mutual funds holding short-term government bonds is different from the population variance for mutual funds holding intermediate-term corporate bonds.

a) Level of significance =0.05.

Test statistic

F-statistic =0.2

Degrees of freedom

Critical value

using the excel formula "(=F.INV.RT(0.05/2,12,15),(=F.INV(0.05/2,12,15)))" critical value are (0.315,2.963)

Step by step

Solved in 3 steps with 2 images