A random sample of the closing stock prices in dollars for a company in a recent year is listed below. Assume that o is $2.05. Construct the 90% and 99% confidence intervals for the population mean. Interpret the results and compare the widths of the confidence intervals. 20.05 17.97 17.49 16.95 21.71 16.51 The 90% confidence interval is ($.$). (Round to two decimal places as needed.) 22.72 20.45 17.81 15.54 16.34 15.41 18.73 19.13 15.67 16.84 O

A random sample of the closing stock prices in dollars for a company in a recent year is listed below. Assume that o is $2.05. Construct the 90% and 99% confidence intervals for the population mean. Interpret the results and compare the widths of the confidence intervals. 20.05 17.97 17.49 16.95 21.71 16.51 The 90% confidence interval is ($.$). (Round to two decimal places as needed.) 22.72 20.45 17.81 15.54 16.34 15.41 18.73 19.13 15.67 16.84 O

MATLAB: An Introduction with Applications

6th Edition

ISBN:9781119256830

Author:Amos Gilat

Publisher:Amos Gilat

Chapter1: Starting With Matlab

Section: Chapter Questions

Problem 1P

Related questions

Question

Transcribed Image Text:### Understanding Confidence Intervals in Stock Price Analysis

A random sample of the closing stock prices in dollars for a company in a recent year is provided below. Assume that the standard deviation (\( \sigma \)) is $2.05.

Your task is to construct the 90% and 99% confidence intervals for the population mean. Following this, interpret the results and compare the widths of the confidence intervals to understand the degree of confidence versus interval precision.

Here are the stock prices:

- 20.05

- 17.49

- 21.71

- 22.72

- 17.81

- 16.34

- 18.73

- 15.67

- 17.97

- 16.95

- 16.51

- 20.45

- 15.54

- 15.41

- 19.13

- 16.84

#### Calculating the Confidence Intervals

- **90% Confidence Interval**:

- The interval is represented as \( (\$, \$) \).

- (Round your final answers to two decimal places as needed.)

Understanding and correctly interpreting the confidence intervals is crucial to making informed decisions based on statistical data analysis. The width of the interval indicates the precision of the estimate—with narrower intervals showing more precise estimates but less confidence, and wider intervals offering greater confidence but less precision.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 2 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

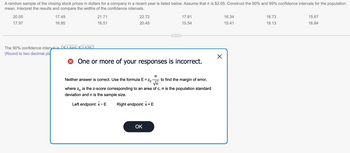

Hello, I submitted your answer and it says it incorrect. Our text book uses zcore tables up to 4 decimal places. and this is the explanation for why your answer is incorrect. Could you please review and inform me of how to find the answer? What is the correct answer?

Transcribed Image Text:A random sample of the closing stock prices in dollars for a company in a recent year is listed below. Assume that o is $2.05. Construct the 90% and 99% confidence intervals for the population

mean. Interpret the results and compare the widths of the confidence intervals.

20.05

17.97

17.49

16.95

The 90% confidence intervalis ($1.645 $2.576)).

(Round to two decimal pla

21.71

16.51

22.72

20.45

17.81

15.54

> One or more of your responses is incorrect.

O

Neither answer is correct. Use the formula E = Zc to find the margin of error,

√n

where Ze is the z-score corresponding to an area of c, o is the population standard

deviation and n is the sample size.

Left endpoint: x-E Right endpoint: x + E

OK

X

16.34

15.41

18.73

19.13

15.67

16.84

Solution

Recommended textbooks for you

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

Elementary Statistics: Picturing the World (7th E…

Statistics

ISBN:

9780134683416

Author:

Ron Larson, Betsy Farber

Publisher:

PEARSON

The Basic Practice of Statistics

Statistics

ISBN:

9781319042578

Author:

David S. Moore, William I. Notz, Michael A. Fligner

Publisher:

W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:

9781319013387

Author:

David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:

W. H. Freeman