Assume that you need $1,000 four years from today. Your bank compounds interest at an 8 percent annual rate. How much must you deposit one year from today to have a balance of $1,000 in your account four years from today? b. If you want to make equal payments each year, how large must each of the four payments be if the first deposit is made one year from today? c. If your father were to offer either to make the payments calculated in part (b) ($221.92) or to give you a lump sum of $750 in one year, which would you choose? d. e. If you have only $750 in one year, what interest rate, compounded annually, would you have to earn to have the necessary $1,000 four years from today? Suppose you can deposit only $186.29 each for the next four years, begin- ning in one year, but you still need $1,000 in four years. At what interest rate, with annual compounding, must you invest to achieve your goal?

Assume that you need $1,000 four years from today. Your bank compounds interest at an 8 percent annual rate. How much must you deposit one year from today to have a balance of $1,000 in your account four years from today? b. If you want to make equal payments each year, how large must each of the four payments be if the first deposit is made one year from today? c. If your father were to offer either to make the payments calculated in part (b) ($221.92) or to give you a lump sum of $750 in one year, which would you choose? d. e. If you have only $750 in one year, what interest rate, compounded annually, would you have to earn to have the necessary $1,000 four years from today? Suppose you can deposit only $186.29 each for the next four years, begin- ning in one year, but you still need $1,000 in four years. At what interest rate, with annual compounding, must you invest to achieve your goal?

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

100%

Please use excel to show your responses.

Transcribed Image Text:**9-24 Time Value of Money**

Assume that you need $1,000 four years from today. Your bank compounds interest at an 8 percent annual rate.

a. How much must you deposit one year from today to have a balance of $1,000 in your account four years from today?

b. If you want to make equal payments each year, how large must each of the four payments be if the first deposit is made one year from today?

c. If your father were to offer either to make the payments calculated in part (b) ($221.92) or to give you a lump sum of $750 in one year, which would you choose?

d. If you have only $750 in one year, what interest rate, compounded annually, would you have to earn to have the necessary $1,000 four years from today?

e. Suppose you can deposit only $186.29 each for the next four years, beginning in one year, but you still need $1,000 in four years. At what interest rate, with annual compounding, must you invest to achieve your goal?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Please show answers using excel

Transcribed Image Text:**f.** To help you reach your $1,000 goal, your father offers to give you $400 in one year. You will get a part-time job and make six additional payments of equal amounts each six months thereafter. If all of this money is deposited in a bank that pays 8 percent, compounded semiannually, how large must each of the six payments be?

**g.** What is the effective annual rate being paid by the bank in part (f)?

Solution

Follow-up Question

Where does the number 3 and number form highlighted on the picture comes from?

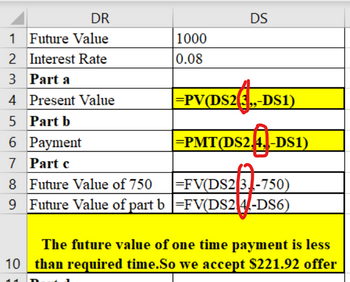

Transcribed Image Text:This spreadsheet segment provides calculations related to financial concepts, such as present value, payments, and future value, using Excel formulas. It highlights different parts of a financial analysis or plan. Here's a breakdown:

### Columns:

- **DR:** Describes the financial term.

- **DS:** Displays either the formula used or the calculated value.

### Rows:

1. **Future Value:** Set at 1000.

2. **Interest Rate:** Given as 0.08 (8%).

#### Part a:

3. **Present Value:**

- **Formula:** `=PV(DS2,3,-DS1)`

- This calculates the present value based on the specified interest rate and future value.

#### Part b:

5. **Payment:**

- **Formula:** `=PMT(DS2,4,-DS1)`

- This determines the regular payment amount needed for the future value goal, given the interest rate.

#### Part c:

7. **Future Value of 750:**

- **Formula:** `=FV(DS2,3,-750)`

- This calculates the future value of a $750 payment over a specified term with the interest rate.

8. **Future Value of part b:**

- **Formula:** `=FV(DS2,4,-DS6)`

- This finds the future value for the payments determined in Part b using the interest rate.

### Conclusion:

Highlighted in yellow at the bottom:

- **Statement:** "The future value of one-time payment is less than required time. So we accept $221.92 offer."

- This suggests a decision-making statement based on comparing calculated future values.

This sheet essentially demonstrates the use of financial functions in Excel for planning and decision-making, focusing on key financial metrics with the aid of formulas.

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education