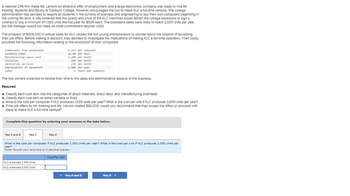

During their senior year at Clarkson College, two business students, Gerry Keating and Louise Lamont, began a part-time business making personal computers. They bought the various components from a local supplier and assembled the machines in the basement of a friend's house. Their only cost was $363 for parts; they sold each computer for $638. They were able to make three machines per week and to sell them to fellow students. The activity was appropriately called Keating & Lamont Computers (KLC). The product quality was good, and as graduation approached, orders were coming in much faster than KLC could fill them. A national CPA firm made Ms. Lamont an attractive offer of employment, and a large electronics company was ready to hire Mr. Keating. Students and faculty at Clarkson College, however, encouraged the two to make KLC a full-time venture. The college administration had decided to require all students in the schools of business and engineering to buy their own computers beginning in the coming fall term. It was believed that the quality and price of the KLC machines would attract the college bookstore to sign a contract to buy a minimum of 1,000 units the first year for $506 each. The bookstore sales were likely to reach 2,000 units per year, but the manager would not make an initial commitment beyond 1,000. The prospect of $506,000 in annual sales for KLC caused the two young entrepreneurs to wonder about the wisdom of accepting their job offers. Before making a decision, they decided to investigate the implications of making KLC a full-time operation. Their study provided the following information relating to the production of their computers. Components from wholesaler Assembly labor $ 231 per computer 14.80 per hour 2,200 per month Manufacturing space rent Utilities Janitorial services 420 per month 270 per month per year Depreciation of equipment Labor 2 hours per computer The two owners expected to devote their time to the sales and administrative aspects of the business. Required a. Classify each cost item into the categories of direct materials, direct labor, and manufacturing overhead. b. Classify each cost item as either variable or fixed. c. What is the cost per computer if KLC produces 1,000 units per year? What is the cost per unit if KLC produces 2,000 units per year? d. If the job offers for Mr. Keating and Ms. Lamont totaled $92,000, would you recommend that they accept the offers or proceed with plans to make KLC a full-time venture? Complete this question by entering your answers in the tabs below. 2,800 Req A and B Req C Req D Classify each cost item into the categories of direct materials, direct labor, and manufacturing overhead and as either variable or fixed. Cost Category: Components from wholesaler Assembly labor Manufacturing space rent Utilities Janitorial services Depreciation of equipment Type Req A and B Behavior Req C >

During their senior year at Clarkson College, two business students, Gerry Keating and Louise Lamont, began a part-time business making personal computers. They bought the various components from a local supplier and assembled the machines in the basement of a friend's house. Their only cost was $363 for parts; they sold each computer for $638. They were able to make three machines per week and to sell them to fellow students. The activity was appropriately called Keating & Lamont Computers (KLC). The product quality was good, and as graduation approached, orders were coming in much faster than KLC could fill them. A national CPA firm made Ms. Lamont an attractive offer of employment, and a large electronics company was ready to hire Mr. Keating. Students and faculty at Clarkson College, however, encouraged the two to make KLC a full-time venture. The college administration had decided to require all students in the schools of business and engineering to buy their own computers beginning in the coming fall term. It was believed that the quality and price of the KLC machines would attract the college bookstore to sign a contract to buy a minimum of 1,000 units the first year for $506 each. The bookstore sales were likely to reach 2,000 units per year, but the manager would not make an initial commitment beyond 1,000. The prospect of $506,000 in annual sales for KLC caused the two young entrepreneurs to wonder about the wisdom of accepting their job offers. Before making a decision, they decided to investigate the implications of making KLC a full-time operation. Their study provided the following information relating to the production of their computers. Components from wholesaler Assembly labor $ 231 per computer 14.80 per hour 2,200 per month Manufacturing space rent Utilities Janitorial services 420 per month 270 per month per year Depreciation of equipment Labor 2 hours per computer The two owners expected to devote their time to the sales and administrative aspects of the business. Required a. Classify each cost item into the categories of direct materials, direct labor, and manufacturing overhead. b. Classify each cost item as either variable or fixed. c. What is the cost per computer if KLC produces 1,000 units per year? What is the cost per unit if KLC produces 2,000 units per year? d. If the job offers for Mr. Keating and Ms. Lamont totaled $92,000, would you recommend that they accept the offers or proceed with plans to make KLC a full-time venture? Complete this question by entering your answers in the tabs below. 2,800 Req A and B Req C Req D Classify each cost item into the categories of direct materials, direct labor, and manufacturing overhead and as either variable or fixed. Cost Category: Components from wholesaler Assembly labor Manufacturing space rent Utilities Janitorial services Depreciation of equipment Type Req A and B Behavior Req C >

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:During their senior year at Clarkson College, two business students, Gerry Keating and Louise Lamont, began a part-time business

making personal computers. They bought the various components from a local supplier and assembled the machines in the basement

of a friend's house. Their only cost was $363 for parts; they sold each computer for $638. They were able to make three machines per

week and to sell them to fellow students. The activity was appropriately called Keating & Lamont Computers (KLC). The product quality

was good, and as graduation approached, orders were coming in much faster than KLC could fill them.

A national CPA firm made Ms. Lamont an attractive offer of employment, and a large electronics company was ready to hire Mr.

Keating. Students and faculty at Clarkson College, however, encouraged the two to make KLC a full-time venture. The college

administration had decided to require all students in the schools of business and engineering to buy their own computers beginning in

the coming fall term. It was believed that the quality and price of the KLC machines would attract the college bookstore to sign a

contract to buy a minimum of 1,000 units the first year for $506 each. The bookstore sales were likely to reach 2,000 units per year,

but the manager would not make an initial commitment beyond 1,000.

The prospect of $506,000 in annual sales for KLC caused the two young entrepreneurs to wonder about the wisdom of accepting

their job offers. Before making a decision, they decided to investigate the implications of making KLC a full-time operation. Their study

provided the following information relating to the production of their computers.

Components from wholesaler

Assembly labor

2,200 per month

Manufacturing space rent

Utilities

420 per month

Janitorial services

270 per month

Depreciation of equipment

Labor

per year

2 hours per computer

The two owners expected to devote their time to the sales and administrative aspects of the business.

Required

a. Classify each cost item into the categories of direct materials, direct labor, and manufacturing overhead.

b. Classify each cost item as either variable or fixed.

c. What is the cost per computer if KLC produces 1,000 units per year? What is the cost per unit if KLC produces 2,000 units per year?

d. If the job offers for Mr. Keating and Ms. Lamont totaled $92,000, would you recommend that they accept the offers or proceed with

plans to make KLC a full-time venture?

$ 231 per computer

14.80 per hour

Complete this question by entering your answers in the tabs below.

Cost Category:

Components from wholesaler

Assembly labor

Manufacturing space rent

2,800

Req A and B

Req C

Req D

Classify each cost item into the categories of direct materials, direct labor, and manufacturing overhead and as either variable

or fixed.

Utilities

Janitorial services

Depreciation of equipment

Type

< Req A and B

Behavior

Req C >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Req C was not answered.

Transcribed Image Text:A national CPA firm made Ms. Lamont an attractive offer of employment, and a large electronics company was ready to hire Mr.

Keating. Students and faculty at Clarkson College, however, encouraged the two to make KLC a full-time venture. The college

administration had decided to require all students in the schools of business and engineering to buy their own computers beginning in

the coming fall term. It was believed that the quality and price of the KLC machines would attract the college bookstore to sign a

contract to buy a minimum of 1,000 units the first year for $506 each. The bookstore sales were likely to reach 2,000 units per year,

but the manager would not make an initial commitment beyond 1,000.

The prospect of $506,000 in annual sales for KLC caused the two young entrepreneurs to wonder about the wisdom of accepting

their job offers. Before making a decision, they decided to investigate the implications of making KLC a full-time operation. Their study

provided the following information relating to the production of their computers.

Components from wholesaler

Assembly labor

Manufacturing space rent

Utilities

Janitorial services

Depreciation of equipment

Labor

per year.

2 hours per computer

The two owners expected to devote their time to the sales and administrative aspects of the business.

Required

a. Classify each cost Item Into the categories of direct materials, direct labor, and manufacturing overhead.

b. Classify each cost Item as either variable or fixed.

$ 231 per computer

14.80 per hour.

2,200 per month

420 per month

270 per month

c. What is the cost per computer if KLC produces 1,000 units per year? What is the cost per unit If KLC produces 2,000 units per year?

d. If the job offers for Mr. Keating and Ms. Lamont totaled $92,000, would you recommend that they accept the offers or proceed with

plans to make KLC a full-time venture?

Complete this question by entering your answers in the tabs below.

Req C

2,800

Req A and B

What is the cost per computer if KLC produces 1,000 units per year? What is the cost per unit if KLC produces 2,000 units per

year?

Note: Round your answers to 2 decimal places.

KLC produces 1,000 Units

KLC produces 2,000 Units

Req D

Cost Per Unit

< Req A and B

Req D >

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education