Big Bang Ltd is considering to invest in one of the two following projects to buy a new equipment. Each equipment will last 5 years and have no salvage value at the end. The company’s required rate of return for all investment projects is 8%. The cash flows of the projects are provided below. Equipment 1 Equipment 2 Cost $186,000 $195,000 Future Cash Flows Year 1 Year 2 Year 3 Year 4 Year 5 86 000 93 000 83 000 75 000 55 000 97 000 84 000 86 000 75 000 63 000 Big Bang’s net income in current year is $450,000. The company maintains a capital structure of 55% in equity funding and 45% in debt funding.

Big Bang Ltd is considering to invest in one of the two following projects to buy a new equipment. Each equipment will last 5 years and have no salvage value at the end. The company’s required rate of return for all investment projects is 8%. The cash flows of the projects are provided below. Equipment 1 Equipment 2 Cost $186,000 $195,000 Future Cash Flows Year 1 Year 2 Year 3 Year 4 Year 5 86 000 93 000 83 000 75 000 55 000 97 000 84 000 86 000 75 000 63 000 Big Bang’s net income in current year is $450,000. The company maintains a capital structure of 55% in equity funding and 45% in debt funding.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Big Bang Ltd is considering to invest in one of the two following projects to buy a new equipment. Each equipment will last 5 years and have no salvage value at the end. The company’s required rate of

|

|

Equipment 1 |

Equipment 2 |

|

Cost |

$186,000 |

$195,000 |

|

Future Cash Flows Year 1 Year 2 Year 3 Year 4 Year 5 |

86 000 93 000 83 000 75 000 55 000 |

97 000 84 000 86 000 75 000 63 000 |

Big Bang’s net income in current year is $450,000. The company maintains a capital structure of 55% in equity funding and 45% in debt funding.

Required:

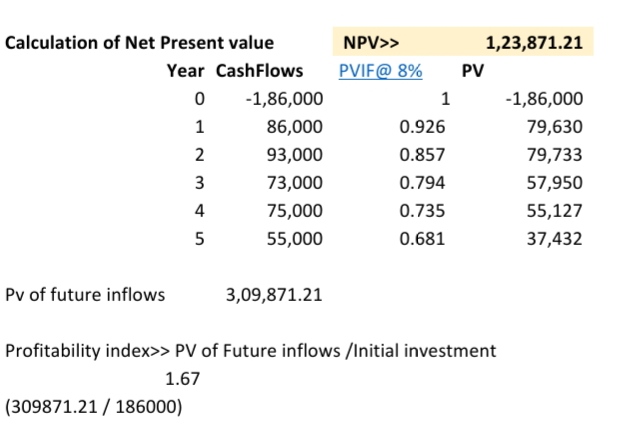

- Identify which option of equipment should the company accept based on

NPV method. (Note: Please round up the result of each calculation of PV to 2 decimal places only for simplification) - Identify which option of equipment should the company accept based on Profitability Index method. Which equipment option should the company finally choose if the company is facing soft capital rationing?

- How much dividend Big Bang Ltd can pay its shareholders given the chosen project you decided in question (c) and if the Residual Dividend Payout Policy applies?

Expert Solution

Working notes for equipment 1

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education