Balance Sheet May 31 108,554 =849 5,152 =SUM(Journa 3,450 -SUM(Journal 2,875 SUM(lournal 120,031 -SUM(B56:B59 135,700 SUMlournal 255,731 -SUM(860,B61 13,800 =SUM(Journal 1,554 =Journal!G21 111,000 =JournallG5 1,110 =SUMUournal! 127,464 =SUM(B63:866 Cash Accounts Receivable Inventory Prepaid Insurance Total Current Assets Equipment, Net of Accumulated Depreciation Total Assets Accounts Payable Wages Payable E Notes Payable 5 Interest Payable - Total Current Liabilities B Stock 9 Retained Earnings 0 Total Liabilities and Shareholders' Equity 116,000 =Journal!15 12,267 =B27 255,731 =SUM(B67:B69) $4 1 2 3 Link to the line item amount in the financial statement above: 74 75 Amount charged customers from selling inventory 76 Cash collected from customers 77 Earned but not yet collected from customers 78 Cash paid for insurance 79 Insurance paid for in advance but not yet used 80 Insurance used Amount n/a n/a n/a n/a n/a n/a 81 82 83 84

Balance Sheet May 31 108,554 =849 5,152 =SUM(Journa 3,450 -SUM(Journal 2,875 SUM(lournal 120,031 -SUM(B56:B59 135,700 SUMlournal 255,731 -SUM(860,B61 13,800 =SUM(Journal 1,554 =Journal!G21 111,000 =JournallG5 1,110 =SUMUournal! 127,464 =SUM(B63:866 Cash Accounts Receivable Inventory Prepaid Insurance Total Current Assets Equipment, Net of Accumulated Depreciation Total Assets Accounts Payable Wages Payable E Notes Payable 5 Interest Payable - Total Current Liabilities B Stock 9 Retained Earnings 0 Total Liabilities and Shareholders' Equity 116,000 =Journal!15 12,267 =B27 255,731 =SUM(B67:B69) $4 1 2 3 Link to the line item amount in the financial statement above: 74 75 Amount charged customers from selling inventory 76 Cash collected from customers 77 Earned but not yet collected from customers 78 Cash paid for insurance 79 Insurance paid for in advance but not yet used 80 Insurance used Amount n/a n/a n/a n/a n/a n/a 81 82 83 84

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

help fill out the bottom chart please

Transcribed Image Text:Net Change in Cash

Plus Beginning Cash Balance

Ending Cash Balance

21,088-SUM(B39,841,845)

87,466-lournaltES

108,554-SUM(847, 848)

***When preparing your Balance Sheet, do not forget your beginning balances!

Karry no Key, Inc.

Balance Sheet

May 31

2$

108,554 =849

Cash

Accounts Receivable

5,152 =SUM(JournallE13,Je

3,450 =SUMJournal!E9,Jou

2,875 -SUM(JournallE10,Jc

120,031 =SUM(856:B59)

135,700 SUMUournal!E7,Jou

255,731 =SUM(B60,B61)

13,800 =SUMJournal!G9,Jou

1,554 =Journal!G21

111,000 =JournallG5

1,110 -SUMJournal!G6,Jou

127,464 =SUM(B63:B66)

Inventory

Prepaid Insurance

Total Current Assets

Equipment, Net of Accumulated Depreciation

Total Assets

2$

Accounts Payable

Wages Payable

E Notes Payable

5 Interest Payable

7 Total Current Liabilities

2$

B Stock

9 Retained Earnings

0 Total Liabilities and Shareholders' Equity

116,000 =Journal!15

12,267 =B27

255,731 =SUM(B67:B69)

2

3 Link to the line item amount in the financial statement above:

74

Amount

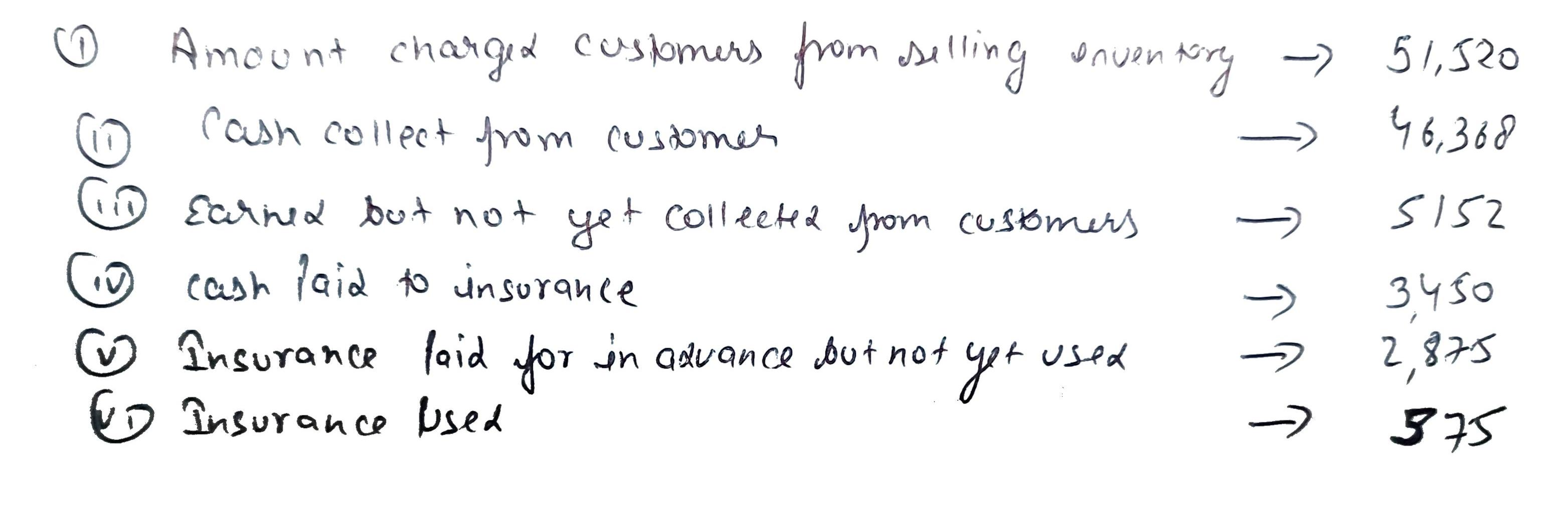

75 Amount charged customers from selling inventory

76 Cash collected from customers

n/a

n/a

n/a

n/a

n/a

n/a

77 Earned but not yet collected from customers

78 Cash paid for insurance

79 Insurance paid for in advance but not yet used

80 Insurance used

81

82

83

84

85

86

87

88

89

Instructions

lournal

Transcribed Image Text:1 12 Project (continued)

2 b NOT INSERT/DELETE ANY CELLS, ROWS OR COLUMNS IN THIS WORKBOOK; DOING SO WILL RESULT IN A SCORE OF 0.

3

Karry no Key, Inc.

Income Statement

For the Month Ended May 31

51,520 =Journall13

(36,800) =Journal!114

14,720 =SUM(B6,B7)

(1,554) =Journal!121

(1,150) =Journal!120

(575) =Journal!119

11,441 =SUM(B8:B11)

(555) -Journal!122

10,886 =SUM(B12,B13)

6 ales Revenue

7 ost of Goods Sold

8 ross Profit

9 ages Expense

10 epreciation Expense

11 surance Expense

12 perating Income

13 terest Expense

14 et Income

15

16

17

Karry no Key, Inc.

18

Statement of Shareholders' Equity

19

For the Month Ended May 31

116,000 =Journal!15

20 eginning Stock

21 ock Issued

-=0

22 hding Stock

116,000 =SUM(B20:B21)

23

2,511 =Journal!16

10,886 =B14

24 eginning Retained Earnings

25 et Income

26 jvidends

- 27 hding Retained Earnings

(1,130) =Journal!118

12,267 =SUM(B24;B26)

28

29 ptal Shareholders' Equity

2$

128,267 =SUM(B22,B27)

30

31

32

Karry no Key, Inc.

33

Statement of Cash Flows

34

For the Month Ended May 31

35 ash from Operating Activities:

36 ash Collected from Customers

37 ash Paid for Inventory

38 ash Paid for Insurance

39 ptal Cash from Operating Activities

2$

46,368 =Journal!E15

(20,700) =Journal!E17

(3,450) =Journal!E11

22,218 =SUM(836:B38)

40

41 ash from Investing Activities

-=0

42

43 ash from Finandng Activities

44 ash Paid for Dividends

45 et Cash from Financing Activities

(1,130) =Journal!E18

(1,130) =SUM(B44)

46

21,088 =SUM(B39,B41,B45)

47 et Change in Cash

48 us Beginning Cash Balance

87,466 =JournallES

Instructions

A Journal

A Statements

Ready

Expert Solution

Step 1

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education