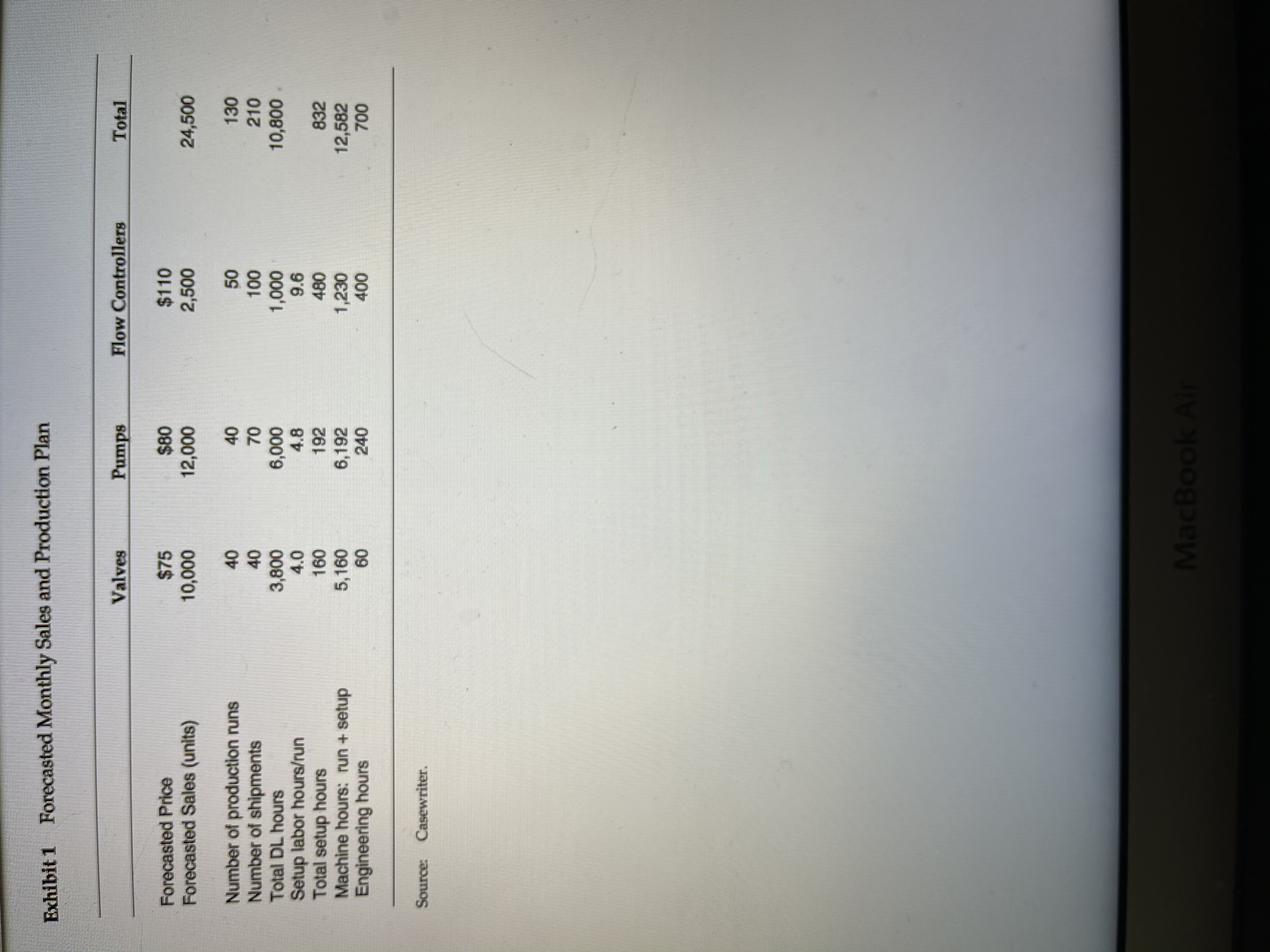

Sippican's senior executive committee met to consider the implications of its time-driven ABC model. Frankly, all had been shocked to learn that their apparently highest-margin product line, flow controllers, could actually be losing money because of its many shipments, short production runs, and heavy use of engineering time. The team contemplated action steps to restore profitability. After some deliberation, the executive team crafted a new strategy that involved the following principles: Improve Revenue Quality: Product Focus and Menu-Based Pricing Focus on core products: valves and pumps. Increase market share in valves by offering discounts for large orders. Reduce discounting for pumps, especially in small order sizes. Aggressively raise prices for small orders of flow controllers. Productivity Reduce setup times. Based on the new strategy, Peggy Knight developed the forecasted monthly sales and production plan shown in Exhibit 1. She wondered whether the shift in product mix, new pricing model, and forecasted productivity improvement in setup times would be sufficient to restore Sippican's historic margins. Sippican's machines were leased monthly and had staggered expiration times; Knight believed she could, on short notice, make 10%-15% adjustments up or down to accommodate changes in demand for machine capacity. Also, Knight felt that she had some flexibility with the size and composition of the labor force. The company had recently hired quite a few production employees on short-term contracts to meet the expanded demand for the newly introduced flow controller line.

Sippican's senior executive committee met to consider the implications of its time-driven ABC model. Frankly, all had been shocked to learn that their apparently highest-margin product line, flow controllers, could actually be losing money because of its many shipments, short production runs, and heavy use of engineering time. The team contemplated action steps to restore profitability. After some deliberation, the executive team crafted a new strategy that involved the following principles: Improve Revenue Quality: Product Focus and Menu-Based Pricing Focus on core products: valves and pumps. Increase market share in valves by offering discounts for large orders. Reduce discounting for pumps, especially in small order sizes. Aggressively raise prices for small orders of flow controllers. Productivity Reduce setup times. Based on the new strategy, Peggy Knight developed the forecasted monthly sales and production plan shown in Exhibit 1. She wondered whether the shift in product mix, new pricing model, and forecasted productivity improvement in setup times would be sufficient to restore Sippican's historic margins. Sippican's machines were leased monthly and had staggered expiration times; Knight believed she could, on short notice, make 10%-15% adjustments up or down to accommodate changes in demand for machine capacity. Also, Knight felt that she had some flexibility with the size and composition of the labor force. The company had recently hired quite a few production employees on short-term contracts to meet the expanded demand for the newly introduced flow controller line.

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Hi and thanks for your question! Unfortunately we cannot answer this particular question due to its complexity.

We've credited a question back to your account. Apologies for the inconvenience.

Your Question:

Analyze and evaluate the business strategy of the company based on the SWOT analysis. Help estimate the resource demands from Knight's forecasted sales and production plan in exhibit 1.

Based on the revised cost and profitability estimates, what are some actions that should be taken by the company's management team to improve the company's profitability?

Help prepare a pro forma product line income statement based on the new line.

Lastly, what is the magnitude of the change in profit with the new plan in relation to the change in production and sales under the previous plan? (Any comments)

please refer to the two images to help answer my questions and use appropriate formulas.

thank you, need help ASAP

Transcribed Image Text:Sippican's senior executive committee met to consider the implications of its time-driven ABC

model. Frankly, all had been shocked to learn that their apparently highest-margin product line, flow

controllers, could actually be losing money because of its many shipments, short production runs,

and heavy use of engineering time. The team contemplated action steps to restore profitability.

After some deliberation, the executive team crafted a new strategy that involved the following

principles:

Improve Revenue Quality: Product Focus and Menu-Based Pricing

Focus on core products: valves and pumps.

Increase market share in valves by offering discounts for large orders.

Reduce discounting for pumps, especially in small order sizes.

Aggressively raise prices for small orders of flow controllers.

Productivity

Reduce setup times.

Based on the new strategy, Peggy Knight developed the forecasted monthly sales and production

plan shown in Exhibit 1. She wondered whether the shift in product mix, new pricing model, and

forecasted productivity improvement in setup times would be sufficient to restore Sippican's historic

margins. Sippican's machines were leased monthly and had staggered expiration times; Knight

believed she could, on short notice, make 10%-15% adjustments up or down to accommodate

changes in demand for machine capacity. Also, Knight felt that she had some flexibility with the size

and composition of the labor force. The company had recently hired quite a few production

employees on short-term contracts to meet the expanded demand for the newly introduced flow

controller line.

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, management and related others by exploring similar questions and additional content below.Recommended textbooks for you