An employee and employer cost-share pension plan contributions and health insurance premium payments. If the employee covers 35% of the pension plan contribution and 25% of the health insurance premium, what would be the employee’s total benefits responsibility if the total pension contribution was $900, and the health insurance premium was $375? Include the journal entry representing the payroll benefits accumulation for the employer in the month of February.

LO 12.5An employee and employer cost-share pension plan contributions and health insurance premium payments. If the employee covers 35% of the pension plan contribution and 25% of the health insurance premium, what would be the employee’s total benefits responsibility if the total pension contribution was $900, and the health insurance premium was $375?

Include the

Payroll accounting:

The process of payroll accounting includes the computation and payment of earnings of the employees and the payroll taxes to be paid to state and federal authorities as per applicable laws.

Payroll taxes:

Payroll taxes refer to the taxes which are equally contributed by employees and employer based on the salary and wages of the employees. Payroll taxes include taxes like federal tax, local income tax, state tax, social security tax and federal and state unemployment tax.

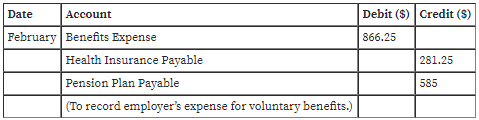

Prepare journal entry to represent employer’s contribution towards voluntary deductions, and also, compute the amount of employee’s total benefits responsibility.

Record payroll benefits accumulation for the employer:

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images