Land Equipment Accumulated depreciation - equipment Liabilities and Shareholders' Equity Accounts payable Bonds payable Common shares Retained earnings Additional information: 1. 2. 3. 4. Additional information 2 4 5 6 86,400 280,800 PRONGHORN CORPORATION Statement of Cash Flows (71,280 ) Adjustments to reconcile net income to $644,760 $42,120 162,000 233,280 207,360 $644,760 108,000 216,000 (34,560 ) Net income for 2022 was $100,440. There were no gains or losses reported on the Cash dividends of $37,800 were declared and paid. Bonds payable amounting to $54,000 were redeemed for cash $54,000. The bonds premium or discount). Common shares were issued for $45,360 cash. $599,400 $50,760 216,000 187,920 144,720 $599,400 Net income for 2022 was $100.440 There were no gains or losses reported on the statement of income Cash dividends of $37,800 were declared and paid Bonds payable amounting to $54,000 were redeemed for cash $54,000. The bonds were originally issued at face value ino premium or discount) Common shares were issued for $45.360 cash No land was purchased during 2022 No equipment was disposed of during 2022 Prepare a statement of cash flows for 2022 using the indirect method. Show amounts that decrease cash flow with either a-signa -15,000 or in parenthesis eg (15.000) Shown below are comparative statements of financial position for Pronghorn Corporation. Assets Cash Accounts receivable Inventory Land PRONGHORN CORPORATION Statement of Financial Position December 31 Equipment Accumulated depreciation - equipment Liabilities and Shareholders' Equity Accounts payable Bonds payable Common shares Ratsins 2022 $73,440 91,800 183,600 86,400 280,800 (71,280) $644,760 $42,120 162,000 233,280 2021 $23,760 82,080 204,120 108,000 216,000 (34,560 ) $599,400 $50,760 216,000 187,920

Land Equipment Accumulated depreciation - equipment Liabilities and Shareholders' Equity Accounts payable Bonds payable Common shares Retained earnings Additional information: 1. 2. 3. 4. Additional information 2 4 5 6 86,400 280,800 PRONGHORN CORPORATION Statement of Cash Flows (71,280 ) Adjustments to reconcile net income to $644,760 $42,120 162,000 233,280 207,360 $644,760 108,000 216,000 (34,560 ) Net income for 2022 was $100,440. There were no gains or losses reported on the Cash dividends of $37,800 were declared and paid. Bonds payable amounting to $54,000 were redeemed for cash $54,000. The bonds premium or discount). Common shares were issued for $45,360 cash. $599,400 $50,760 216,000 187,920 144,720 $599,400 Net income for 2022 was $100.440 There were no gains or losses reported on the statement of income Cash dividends of $37,800 were declared and paid Bonds payable amounting to $54,000 were redeemed for cash $54,000. The bonds were originally issued at face value ino premium or discount) Common shares were issued for $45.360 cash No land was purchased during 2022 No equipment was disposed of during 2022 Prepare a statement of cash flows for 2022 using the indirect method. Show amounts that decrease cash flow with either a-signa -15,000 or in parenthesis eg (15.000) Shown below are comparative statements of financial position for Pronghorn Corporation. Assets Cash Accounts receivable Inventory Land PRONGHORN CORPORATION Statement of Financial Position December 31 Equipment Accumulated depreciation - equipment Liabilities and Shareholders' Equity Accounts payable Bonds payable Common shares Ratsins 2022 $73,440 91,800 183,600 86,400 280,800 (71,280) $644,760 $42,120 162,000 233,280 2021 $23,760 82,080 204,120 108,000 216,000 (34,560 ) $599,400 $50,760 216,000 187,920

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

It looks like you may have submitted a graded question that, per our Honor Code, experts cannot answer. We've credited a question to your account.

Your Question:

Please do not give solution in image format thanku

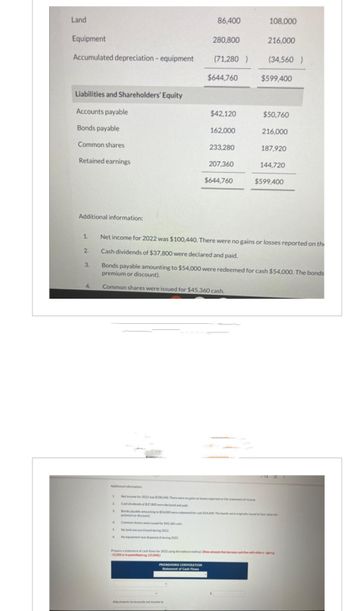

Transcribed Image Text:Land

Equipment

Accumulated depreciation - equipment

Liabilities and Shareholders' Equity

Accounts payable

Bonds payable

Common shares

Retained earnings

Additional information:

1.

2.

3.

4.

Additional information

2

4

5

6

86,400

280,800

PRONGHORN CORPORATION

Statement of Cash Flows

(71,280 )

Adjustments to reconcile net income to

$644,760

$42,120

162,000

233,280

207,360

$644,760

108,000

216,000

(34,560 )

Net income for 2022 was $100,440. There were no gains or losses reported on the

Cash dividends of $37,800 were declared and paid.

Bonds payable amounting to $54,000 were redeemed for cash $54,000. The bonds

premium or discount).

Common shares were issued for $45,360 cash.

$599,400

$50,760

216,000

187,920

144,720

$599,400

Net income for 2022 was $100.440 There were no gains or losses reported on the statement of income

Cash dividends of $37,800 were declared and paid

Bonds payable amounting to $54,000 were redeemed for cash $54,000. The bonds were originally issued at face value ino

premium or discount)

Common shares were issued for $45.360 cash

No land was purchased during 2022

No equipment was disposed of during 2022

Prepare a statement of cash flows for 2022 using the indirect method. Show amounts that decrease cash flow with either a-signa

-15,000 or in parenthesis eg (15.000)

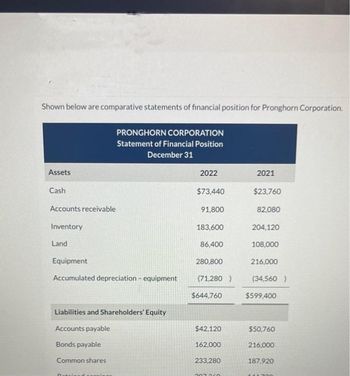

Transcribed Image Text:Shown below are comparative statements of financial position for Pronghorn Corporation.

Assets

Cash

Accounts receivable

Inventory

Land

PRONGHORN CORPORATION

Statement of Financial Position

December 31

Equipment

Accumulated depreciation - equipment

Liabilities and Shareholders' Equity

Accounts payable

Bonds payable

Common shares

Ratsins

2022

$73,440

91,800

183,600

86,400

280,800

(71,280)

$644,760

$42,120

162,000

233,280

2021

$23,760

82,080

204,120

108,000

216,000

(34,560 )

$599,400

$50,760

216,000

187,920

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,