(a) Compute the net present value of this investment. (b) Should the machinery be purchased?

(a) Compute the net present value of this investment. (b) Should the machinery be purchased?

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

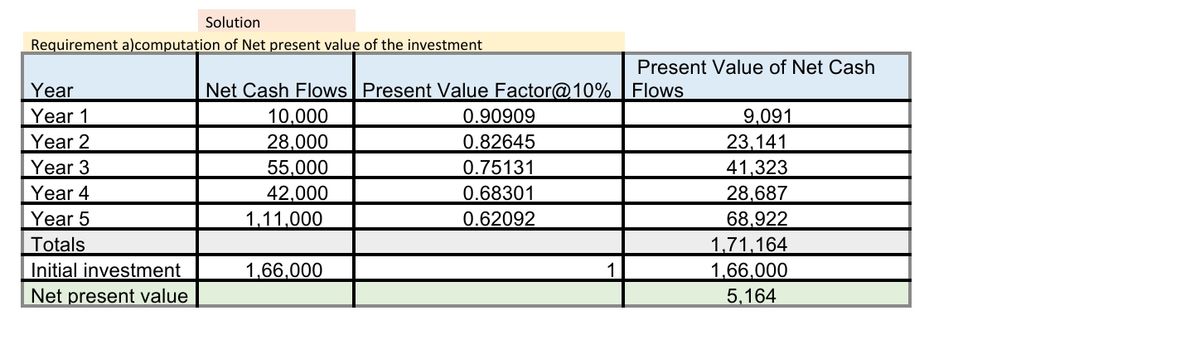

A company is considering a $166,000 investment in machinery with the following net

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

|---|---|---|---|---|---|

| Net Cash Flow | $10,000 | $28,000 | $55,000 | $42,000 | $111,000 |

(a) Compute the

(b) Should the machinery be purchased?

Transcribed Image Text:### Net Present Value Calculation

This table provides a structured format for calculating the Net Present Value (NPV) of a series of cash flows over five years. The table is divided into three main columns, labeled as follows:

- **Year:** Indicates the specific year from Year 1 to Year 5.

- **Net Cash Flows:** To be filled with the expected cash flows for each year.

- **Present Value Factor:** To be filled with the discount factor specific to each year, as per the discount rate used for NPV calculation.

- **Present Value of Net Cash Flows:** Calculated by multiplying the Net Cash Flows by the Present Value Factor for each year.

### Details of the Table:

1. **Year 1 to Year 5:** This section records the cash flows and their discounted values for each individual year.

2. **Totals:** Sum of the present value of net cash flows over the five years.

3. **Initial Investment:** An entry for the initial cost or investment for the project or investment being analyzed.

4. **Net Present Value:** Resulting value indicating the profitability of the investment, calculated as the total present value of net cash flows minus the initial investment.

This framework is essential for financial analysis and investment decision-making, allowing for the assessment of the time value of money and the overall value of future cash flows today.

Expert Solution

Step 1

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education