Accounting Question

Q: If Morton Company expects to sell VCR's at $100 a unit with variable costs of $60 per unit and DVD's...

A: Formula to compute the weighted contribution margin:

Q: Gato Inc. had the following inventory situations to consider at January 31, its year-end.(a1)Identif...

A: FOB destination: When the seller bears the freight charges for the delivery of merchandise from the ...

Q: Average Rate of Return-Cost Savings Midwest Fabricators Inc. is considering an investment in equipme...

A: Hence, $9,100 is the amount of annual depreciation on equipment. It is obtained by the division of c...

Q: Parrish pg13 How do you find the missing amount for the unkown accounts 1) Revenues $8000 Dividends...

A: Retained earnings refers to the amount of net income which is left after paying dividend to the shar...

Q: Arley's Baker makes fat-free cookies that cost $1.50 each. Arley expects 15% of the cookies to fall ...

A: Markup price refers to the price difference in between the selling price of the product and its cost...

Q: Current Attempt in Progress Sunland Company sells its product for $90 per unit. During 2019, it prod...

A: In the above equation, ending inventory under variable costing is calculated by taking the differenc...

Q: Vaughn Manufacturing's contribution margin is $20 per unit for Product A and $35 for Product B. Prod...

A: Formula to compute the contribution margin per unit of limited resources for each product.

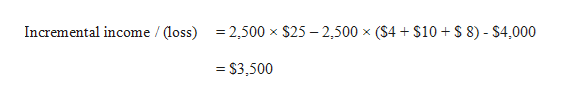

Q: Make or Buy A restaurant bakes its own bread for a cost of $160 per unit (100 loaves), including fix...

A: A technique which is used when the decision regarding choosing one of the alternatives is to be take...

Q: Optima Company is a high-technology organization that produces a mass-storage system. The design of ...

A: As per authoring guidelines we answer the first three parts of the question. Please repost the quest...

Q: Purchase-related transactions using perpetual inventory system The following selected transactions w...

A: Prepare journal entry (March 1st to March 18th).

Q: Current Attempt in Progress Swifty Corporation is contemplating the replacement of an old machine wi...

A: Sunk cost: Sunk cost is the cost that has been incurred as a result of past events and such cost may...

Q: Cash Budget The controller of Bridgeport Housewares Inc. instructs you to prepare a monthly cash bud...

A: A cash budget is prepared to ensure the sufficiency of cash in the company. It is prepared to calcul...

Q: 7-516. James did not have minimum essential coverage for any part of 2018. If James is single and ha...

A: Formula to calculate individual responsibility payment for the year 2018, is the greater amount of F...

Q: The following information is available for the first month of operations of Bahadir Company, a manuf...

A: Cost of goods sold has been calculated by taking the gross profit subtracted from the sales.

Q: Betty owns three separate IRA accounts with different banks. She wishes to consoli-date her three IR...

A: Taxpayers may need to transfer assets from one IRA to another IRA for variety of reasons. In a distr...

Q: On January 2, 2017, Criswell Acres purchased from Mifflinburg Farm Supply a new tractor that had a c...

A:

Q: Lease or sell Plymouth Company owns equipment with a cost of $550,000 and accumulated depreciation o...

A: Difference between Lease and Sale:Leasing is an arrangement wherein the owner of the asset permits a...

Q: Blossom Camera Shop Inc. uses the lower-of-cost-or-net realizable value basis for its inventory. The...

A: Compute inventory amount to be reported on Blossom camera shop’s financial statements using LCNRV ru...

Q: Machine Replacement Decision A company is considering replacing an old piece of machinery, which cos...

A: Differential analysis:

Q: Number 6 Tasty Time Cafeteria operates cafeteria food services in public buildings in the Midwest. T...

A: Requirement A: Compute the degree of operating leverage of Tasty Time Cafeteria for both personnel s...

Q: Katherine, a biology major at the University of Texas, wants to run for office one day and pretends ...

A: Calculation of EAUW for option 1:Given,n = 4 yearsSalvage Value = $2,000

Q: During the first month of operations ended August 31, Kodiak Fridgeration Company manufactured 46,00...

A: Income statement is a financial statement which is prepared to show the net loss or profit for the y...

Q: Optima Company is a high-technology organization that produces a mass-storage system. The design of ...

A: Prepare sales budget:

Q: The cash register tape for Tamarisk Industries reported sales of $8,103.30.Record the journal entry ...

A: (a)Prepare journal entry to record the following situation:Sales per cash register tape exceeds cash...

Q: Financial statement data for years ending December 31, 2019 and 2018, for Edison Company follow: ...

A: Hence, 1.8 times is the sales to assets ratio for 2019. It is obtained by the division of sales and ...

Q: Ran’s wage income is $47,350 in 2018. The combined employer and employee FICA tax rates that apply t...

A: Income tax: Income tax is a tax levied on an individual’s income (taxable income). It is a direct ta...

Q: Dividends Per Share Seacrest Company has 25,000 shares of cumulative preferred 1% stock, $100 par an...

A: Dividends:This is the amount of cash distributed to stockholders by a company out its earnings, acco...

Q: 1. The $1,779,000 note receivable is dated May 1, 2016, bears interest at 8%, and represents the bal...

A: The principal portion and interest on notes need to be accounted seperately. Interest on notes recei...

Q: An analysis of comparative balance sheets, the current year’s income statement, and the general ledg...

A: Statement of cash flows: This statement reports all the cash transactions which are responsible for ...

Q: Bonds Payable has a balance of $1,000,000, and Discount on Bonds Payable has a balance of $15,500. I...

A: Bonds payable are kind of long term debt generally issued by governments and corporations. The issue...

Q: Farley Bains, an auditor with Nolls CPAs, is performing a review of Splish Brothers Inc.’s Inventory...

A: Prepare a schedule for determining correct inventory as shown below:

Q: leigh meadows and byron leaff formed a partnership in which the partnership agreement provided for s...

A: Here, we will first of all set up columns for each partner and a column for total. The amount of net...

Q: Bonita Industries has two divisions Standard and Premium. Each division has hundreds of different ty...

A: Formula for calculating contribution margin ratio.

Q: Make-or-Buy, Traditional Analysis, Qualitative Considerations Apollonia Dental Services is part of a...

A:

Q: Presented below is information related to equipment owned by Davis Company at December 31, 2020. ...

A: Impairment of Assets:Impairment of an asset refers to sudden decrease of the present value of econom...

Q: Journalizing

A: Journal entries are as follows:

Q: On July 1, 2020, Splish Brothers Inc. invested $640,710 in a mine estimated to have 791,000 tons of ...

A: 1.Calculate the depletion cost per unit.

Q: Q. question 9

A: Hence, return on equity for 2021 is 6.9%. It is obtained by the division of net income and the avera...

Q: why is there generally a difference between the balance in a cash account on the company's books and...

A: The statement of Bank reconciliation is a report that matches the money balance on an organization's...

Q: Margin of Safety a. If Canace Company, with a break-even point at $386,900 of sales, has actual sale...

A: a. 1. Calculate the margin of safety (in Dollars).

Q: Andrews Company has $95,000 available to pay dividends. It has 2,000 shares of 10%, $100 par, prefer...

A: Cumulative dividends: This is a preferential right a preferred shareholder must receive current divi...

Q: Amy is a single taxpayer. Her income tax liability in the prior year was $5,178. Amy earns $50,000 o...

A: Income tax: Income tax is a tax levied on an individual’s income (taxable income). It is a direct ta...

Q: Gage’s accounting records included the following information: Inventory, 01-01-15 ...

A: Estimated loss from any shoplifted items:

Q: Operation Costing, Just-in-Time System and Backflush Costing 269 11. Exercises Exercise 1 (Operation...

A: The cost have been allocated between the given three products as follows

Q: Exercise 9-03 a On March 1, 2022, Sandhill Co. acquired real estate, on which it planned to constru...

A: Cost of land: Cost of land includes the cost of demolishing old warehouse, attorney fees of land and...

Q: so I was able to calculate the break-even sales due to the formula of break-even revenue but how wou...

A: Note: The calculation of gross profit, revised profit, and revised gross margin require information ...

Q: How do I go about finding the ending inventory using the lifo method?

A: In LIFO method, the inventory received last is despatched first and the ending inventory comprises o...

Q: I am struggling to solve this problem

A: Meaning of Fixed Overhead Spending Variance:Fixed Overhead spending variance is also known as fixed ...

Q: Identify Cost Graphs The following cost graphs illustrate various types of cost behavior: Cost Graph...

A: a. Total direct material cost- It will be Cost graph four as per the question, because with each ad...

Step by step

Solved in 2 steps with 2 images