(a) Fit a model with just size of firm as independent variable (Modell). (b) Interpret the coefficients in Modell (c) Fit a regression model with size and type of firm as independent variables (Model2) (d) With a proper plot show the effect of different type of firm on the number of months elapsed (e) Make proper interpretation based on the coefficients in Model2. (f) Run a significant test for the difference of number of months elapsed for different type of firm (mutual, stock) at level 0.05. Also find a 95% CI and interpret it. (g) Based on model 2, estimate the number of months elapsed for a firm with size 200 and type stock. Also find 90% CI and PI for it.

Since you have posted a question with multiple subparts, we will provide solution to the first three sub-parts as per our Q&A guidelines. Please repost the remaining sub parts separately.

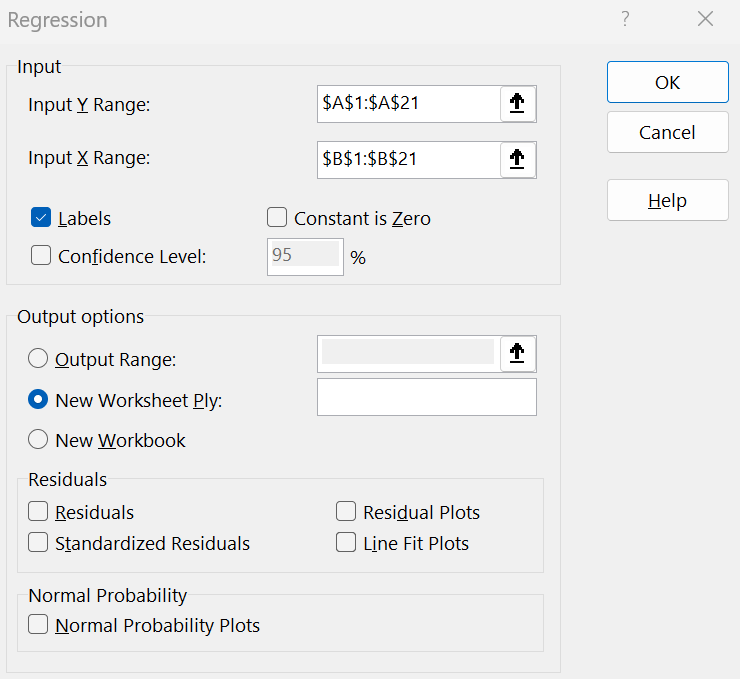

a) After entering the data in Excel go to Data>Data Analysis>Regression>choose the input range for Y and X and tick the "Labels" box>click "OK".

You get the following output:

| SUMMARY OUTPUT | ||||||||

| Regression Statistics | ||||||||

| Multiple R | 0.840777 | |||||||

| R Square | 0.706906 | |||||||

| Adjusted R Square | 0.690623 | |||||||

| Standard Error | 5.231489 | |||||||

| Observations | 20 | |||||||

| ANOVA | ||||||||

| df | SS | MS | F | Significance F | ||||

| Regression | 1 | 1188.167 | 1188.167 | 43.41371 | 3.45E-06 | |||

| Residual | 18 | 492.6326 | 27.36848 | |||||

| Total | 19 | 1680.8 | ||||||

| Coefficients | Standard Error | t Stat | P-value | Lower 95% | Upper 95% | Lower 95.0% | Upper 95.0% | |

| Intercept | 36.4821 | 2.844252 | 12.82661 | 1.71E-10 | 30.50656 | 42.45767 | 30.50656 | 42.45767 |

| x | -0.0939 | 0.014257 | -6.58891 | 3.45E-06 | -0.12389 | -0.06398 | -0.12389 | -0.06398 |

The equation of model 1 is:

, where

is the predicted number of months elapsed and x is the size of the firm (in millions).

b) In model 1, intercept = 36.4821 which is the average number of months elapsed for a firm with size of 0 million.

The slope coefficient is -0.0939. It means that for every extra million in size of the firm, the number of months elapsed decreases by 0.0939, on average.

Step by step

Solved in 3 steps with 5 images