3. Using the following information please prepare the 3 financial statements in proper form with headings. Keep in mind the rules that you have learned. MAKE UP A COMPANY NAME FOR THE HEADING AND USE 12/31/2021 AS THE DATE FOR THE STATEMENTS. Cash Supplies Computers Wages Payable Dividends Wages Expense Utilities Expense Insurance Expense $3,425 $380 $37,000 $1190 $5,200 $22,855 $2,715 $315 Accounts Receivable Equipment Accounts Payable Common Stock Revenues Rent Expense Supplies Expense Miscell. Expense $8,000 $305 $925 $29,000 $60,625 $9,150 $890 $1,505

3. Using the following information please prepare the 3 financial statements in proper form with headings. Keep in mind the rules that you have learned. MAKE UP A COMPANY NAME FOR THE HEADING AND USE 12/31/2021 AS THE DATE FOR THE STATEMENTS. Cash Supplies Computers Wages Payable Dividends Wages Expense Utilities Expense Insurance Expense $3,425 $380 $37,000 $1190 $5,200 $22,855 $2,715 $315 Accounts Receivable Equipment Accounts Payable Common Stock Revenues Rent Expense Supplies Expense Miscell. Expense $8,000 $305 $925 $29,000 $60,625 $9,150 $890 $1,505

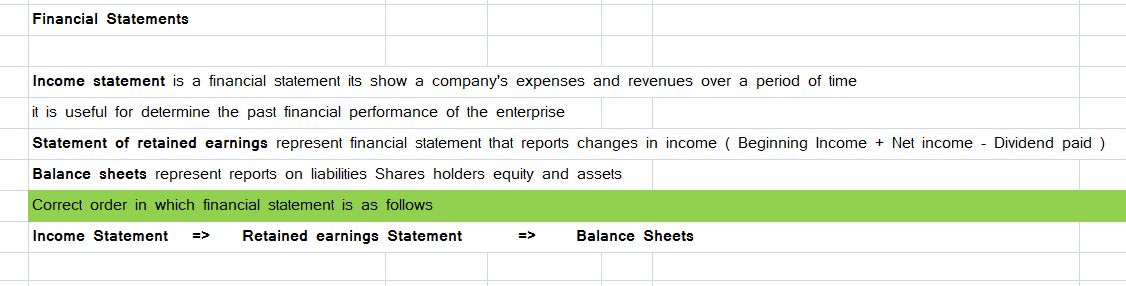

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:**Instructions for Preparing Financial Statements**

1. **Task:**

Using the table below, prepare three financial statements in proper form. Ensure to follow the rules you have learned. Create a fictional company name for heading purposes and use the date 12/31/2021 for the statements.

2. **Data Table:**

| Item | Amount |

|------------------------|---------|

| Cash | $3,425 |

| Supplies | $380 |

| Computers | $3,000 |

| Wages Payable | $1,190 |

| Dividends | $2,500 |

| Wages Expense | $2,855 |

| Utilities Expense | $2,715 |

| Insurance Expense | $315 |

| Accounts Receivable | $8,000 |

| Equipment | $305 |

| Accounts Payable | $925 |

| Common Stock | $29,000 |

| Revenues | $60,625 |

| Rent Expense | $9,150 |

| Supplies Expense | $980 |

| Miscellaneous Expense | $1,505 |

3. **Graph/Diagram Explanation:**

The table provided includes items that are typically part of an accounting balance sheet and income statement. There are assets, liabilities, expenses, and revenue lines which represent the financial activities of a company on the given date. Each value in the table is associated with a specific accounting category which will be used to compile comprehensive financial statements.

Expert Solution

Step 1

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education