с 1 2 Standards for one of Patterson, Incorporated's products is shown below, along with actual cost data for the month: 3 4 Direct materials: 5 Standard 6 Actual 7 Direct labor: 8 Standard 9 Actual 10 Variable overhead: 11 Standard 2.4 yards @ 3.0 yards @ 0.6 hours @ 0.5 hours @ D 0.6 hours @ 0.5 hours @ E $2.75 per yard $2.70 per yard $18.00 per hour $22.00 per hour $7.00 per hour $7.10 per hour $6.60 10.80 4.20 G $21.60 $8.10 11.00 12 Actual 13 Total cost per unit 14 Excess of actual cost over standard cost per unit 15 16 Actual production for the month 13,500 units 17 Variable overhead is assigned to products based on direct labor hours. There was no beginning or ending inventory of materials for the month. 18 19 Required: 20 Using formulas, compute the following. Input all numbers as positive amounts. 21 (Hint: This can be done using the ABS function). 22 23 (Use cells A5 to G14 and cell B16 from the given information, as well as cells A27 to D62 to complete this question. All formulas must return positive values. For each variance, 3.55 H $22.65 $1.05

с 1 2 Standards for one of Patterson, Incorporated's products is shown below, along with actual cost data for the month: 3 4 Direct materials: 5 Standard 6 Actual 7 Direct labor: 8 Standard 9 Actual 10 Variable overhead: 11 Standard 2.4 yards @ 3.0 yards @ 0.6 hours @ 0.5 hours @ D 0.6 hours @ 0.5 hours @ E $2.75 per yard $2.70 per yard $18.00 per hour $22.00 per hour $7.00 per hour $7.10 per hour $6.60 10.80 4.20 G $21.60 $8.10 11.00 12 Actual 13 Total cost per unit 14 Excess of actual cost over standard cost per unit 15 16 Actual production for the month 13,500 units 17 Variable overhead is assigned to products based on direct labor hours. There was no beginning or ending inventory of materials for the month. 18 19 Required: 20 Using formulas, compute the following. Input all numbers as positive amounts. 21 (Hint: This can be done using the ABS function). 22 23 (Use cells A5 to G14 and cell B16 from the given information, as well as cells A27 to D62 to complete this question. All formulas must return positive values. For each variance, 3.55 H $22.65 $1.05

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

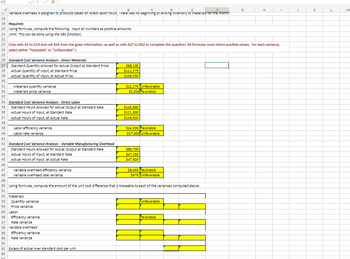

I need help filling out the remainder cells:

Transcribed Image Text:6

Actual

7 Direct labor:

8 Standard

A

9 Actual

10 Variable overhead:

11 Standard

B

1

2 Standards for one of Patterson, Incorporated's products is shown below, along with actual cost data for the month:

3

4 Direct materials:

5 Standard

12 Actual

13 Total cost per unit

14 Excess of actual cost over standard cost per unit

С

19 Required:

20 Using formulas, compute the following. Input all numbers as positive amounts.

21 (Hint: This can be done using the ABS function).

22

2.4 yards @

3.0 yards @

0.6 hours @

0.5 hours @

D

0.6 hours @

0.5 hours @

E

$2.75 per yard

$2.70 per yard

$18.00 per hour

$22.00 per hour

$7.00 per hour

$7.10 per hour

F

$6.60

10.80

4.20

$21.60

15

16 Actual production for the month

13,500 units

17 variable overhead is assigned to products based on direct labor hours. There was no beginning or ending inventory of materials for the month.

18

G

$8.10

11.00

3.55

$22.65

$1.05

H

I

23 (Use cells A5 to G14 and cell B16 from the given information, as well as cells A27 to D62 to complete this question. All formulas must return positive values. For each variance,

24 select either "Favorable" or "Unfavorable".)

Transcribed Image Text:F27

A

B

D

17 variable overnead is assigned to products based on direct lapor nours. There was no beginning or ending inventory of materials for the month.

18

19 Required:

20 Using formulas, compute the following. Input all numbers as positive amounts.

21 (Hint: This can be done using the ABS function).

22

26 Standard Cost Variance Analysis - Direct Materials

27 Standard Quantity Allowed for Actual Output at Standard Price

28

23 (Use cells A5 to G14 and cell B16 from the given information, as well as cells A27 to D62 to complete this question. All formulas must return positive values. For each variance,

24 select either "Favorable" or "Unfavorable".)

25

Actual Quantity of Input, at Standard Price

29 Actual Quantity of Input, at Actual Price

30

31 Materials quantity variance

32

Materials price variance

33

34 Standard Cost Variance Analysis - Direct Labor

35

36

37

38

39

40

41

Standard Hours Allowed for Actual Output at Standard Rate

46

47

48

Actual Hours of Input, at Standard Rate

Actual Hours of Input, at Actual Rate

Labor efficiency variance

Labor rate variance

42 Standard Cost Variance Analysis - Variable Manufacturing Overhead

43

Standard Hours Allowed for Actual Output at Standard Rate

44

45

Actual Hours of Input, at Standard Rate

Actual Hours of Input, at Actual Rate

variable overhead efficiency variance

Variable overhead rate variance

52 Materials:

53 Quantity variance

54 Price variance

55 Labor:

56 Efficiency variance

$89,100

$111,375

$109,350

57

Rate variance

58 variable overhead:

59

Efficiency variance

60

Rate variance

61

62 Excess of actual over standard cost per unit

63

$22,275 Unfavorable

$2,025 Favorable

$145,800

$121,500

$148,500

$24,300 Favorable

$27,000 Unfavorable

$56,700

$47,250

$47,925

49

50 Using formulas, compute the amount of the unit cost difference that is traceable to each of the variances computed above.

51

$9,450 Favorable

$675 Unfavorable

Unfavorable

H

Favorable

I

J

K

L

M

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

I need help filling out the rest of the empty cells

Transcribed Image Text:F27

A

B

D

17 variable overnead is assigned to products based on direct labor nours. There was no beginning or ending inventory of materials for the month.

18

19 Required:

20 Using formulas, compute the following. Input all numbers as positive amounts.

21 (Hint: This can be done using the ABS function).

22

26 Standard Cost Variance Analysis - Direct Materials

27 Standard Quantity Allowed for Actual Output at Standard Price

28

23 (Use cells A5 to G14 and cell B16 from the given information, as well as cells A27 to D62 to complete this question. All formulas must return positive values. For each variance,

24 select either "Favorable" or "Unfavorable".)

25

Actual Quantity of Input, at Standard Price

29 Actual Quantity of Input, at Actual Price

30

31 Materials quantity variance

32

Materials price variance

33

34 Standard Cost Variance Analysis - Direct Labor

35

36

37

38

39

40

41

Standard Hours Allowed for Actual Output at Standard Rate

46

47

48

Actual Hours of Input, at Standard Rate

Actual Hours of Input, at Actual Rate

Labor efficiency variance

Labor rate variance

42 Standard Cost Variance Analysis - Variable Manufacturing Overhead

43

Standard Hours Allowed for Actual Output at Standard Rate

44

45

Actual Hours of Input, at Standard Rate

Actual Hours of Input, at Actual Rate

variable overhead efficiency variance

Variable overhead rate variance

52 Materials:

53 Quantity variance

54 Price variance

55 Labor:

56 Efficiency variance

$89,100

$111,375

$109,350

57

Rate variance

58 Variable overhead:

59

Efficiency variance

60

Rate variance

61

62 Excess of actual over standard cost per unit

63

$22,275 Unfavorable

$2,025 Favorable

$145,800

$121,500

$148,500

$24,300 Favorable

$27,000 Unfavorable

$56,700

$47,250

$47,925

49

50 Using formulas, compute the amount of the unit cost difference that is traceable to each of the variances computed above.

51

$9,450 Favorable

$675 Unfavorable

Unfavorable

H

Favorable

I

J

K

L

M

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education