14. The Arabian Oil Company is considering an investment that can be undertaken this year or postponed one year. The investment cash flows if the investment is undertaken now would be as follows: period 0, −$100; period 1, $200. The cash flows if it is delayed one period would be as follows: period 1, −$100; period 2, $200. Assume a time value of money of 0.05. Should the company invest now or delay one year? First use the internal rate of return method and then use the net present value method.

14. The Arabian Oil Company is considering an investment that can be undertaken this year or postponed one year. The investment cash flows if the investment is undertaken now would be as follows: period 0, −$100; period 1, $200. The cash flows if it is delayed one period would be as follows: period 1, −$100; period 2, $200. Assume a

Should the company invest now or delay one year? First use the

The decision of company of investing now or delaying it by one year depends upon IRR or NPV.

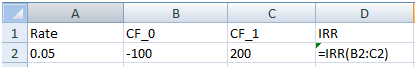

IF invested now,

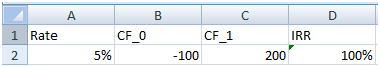

Using IRR by following method:

Result is:

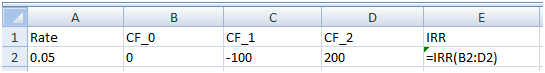

If invested one year later,

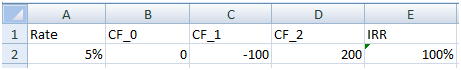

Using IRR by following method:

Result is:

IRR of both the cases is same. Therefore, no decision could be made on the basis of IRR.

Step by step

Solved in 2 steps with 8 images