11. If the daily, 95% confidence level value at risk (VaR) of a portfolio is correctly estimated to be USD 10,000, which of the following statements are correct: I. In 1 out of 20 days, the portfolio value will decline by USD 10,000 or less. II. In 1 out of 20 days, the portfolio value will decline by USD 10,000 or more. III. In 19 out of 20 days, the portfolio value will decline more than USD 10,000. IV. In 19 out of 20 days, the portfolio value will not decline by USD 10,000 or more. (a) I (b) II (c) I and III (d) II and IV

11. If the daily, 95% confidence level value at risk (VaR) of a portfolio is correctly estimated to be USD 10,000, which of the following statements are correct: I. In 1 out of 20 days, the portfolio value will decline by USD 10,000 or less. II. In 1 out of 20 days, the portfolio value will decline by USD 10,000 or more. III. In 19 out of 20 days, the portfolio value will decline more than USD 10,000. IV. In 19 out of 20 days, the portfolio value will not decline by USD 10,000 or more. (a) I (b) II (c) I and III (d) II and IV

MATLAB: An Introduction with Applications

6th Edition

ISBN:9781119256830

Author:Amos Gilat

Publisher:Amos Gilat

Chapter1: Starting With Matlab

Section: Chapter Questions

Problem 1P

Related questions

Question

Transcribed Image Text:**Question 11:**

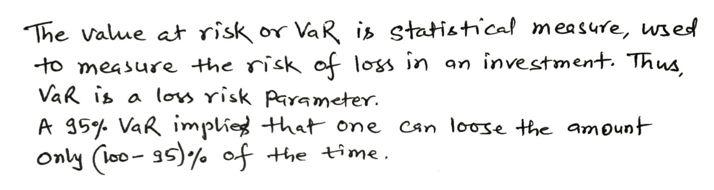

If the daily, 95% confidence level value at risk (VaR) of a portfolio is correctly estimated to be USD 10,000, which of the following statements are correct:

I. In 1 out of 20 days, the portfolio value will decline by USD 10,000 or less.

II. In 1 out of 20 days, the portfolio value will decline by USD 10,000 or more.

III. In 19 out of 20 days, the portfolio value will decline more than USD 10,000.

IV. In 19 out of 20 days, the portfolio value will *not* decline by USD 10,000 or more.

- (a) I

- (b) II

- (c) I and III

- (d) II and IV

**Question 12:**

Assume that portfolio daily returns are independently and identically normally distributed with mean zero. A new quantitative analyst has been asked by the portfolio manager to calculate portfolio VaRs for 10-, 15-, 20-, and 25-day periods. The portfolio manager notices something amiss with the analyst’s calculations. Assuming the annualized volatilities of daily returns for the four periods are equal, which of the following VaRs on this portfolio is inconsistent with the others?

- (a) VaR(10-day) = USD 316 million

- (b) VaR(15-day) = USD 426 million

- (c) VaR(20-day) = USD 447 million

- (d) VaR(25-day) = USD 500 million

**Question 13:**

A (possibly biased) coin is tossed twice. If the outcome is two heads, $5 is received. If *any* tail occurs a consolation prize of $1 is received. The fair price to play this game is $4. What is the implied probability of heads?

- (a) 0.87

- (b) 0.61

- (c) 0.71

- (d) 0.80

Expert Solution

Step 1

Disclaimer: "As per guideline we can do only one question."

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

Elementary Statistics: Picturing the World (7th E…

Statistics

ISBN:

9780134683416

Author:

Ron Larson, Betsy Farber

Publisher:

PEARSON

The Basic Practice of Statistics

Statistics

ISBN:

9781319042578

Author:

David S. Moore, William I. Notz, Michael A. Fligner

Publisher:

W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:

9781319013387

Author:

David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:

W. H. Freeman