1,000 shares of Buck's Inc. Buck's

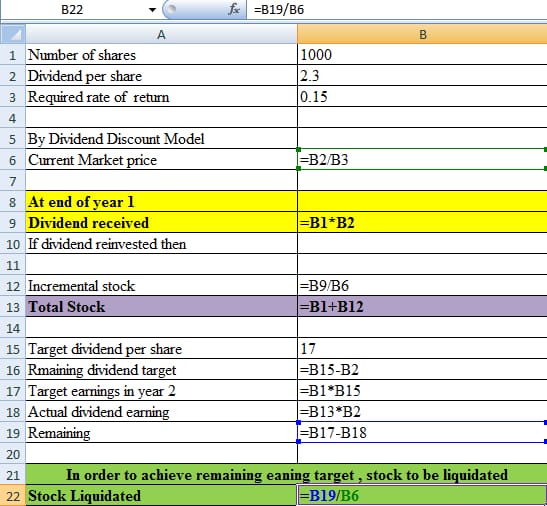

Joel own 1,000 shares of Buck's Inc. Buck's follows a constant dividend policy, implying that it will pay the same dividend per share each year indefinitely. The dividend per share is $2.30 per year. You intend to invest in Buck’s stock and hold it for 2 years. At the same time, you would like to receive at least $17 per share as dividend in the second year. You wish to achieve your goal by following the homemade dividends strategy in a world without taxes. Will you be able to do so? Substantiate your answer through relevant computations. Investors require a return of 15% on Buck’s stock.

For the following case, DDM model should be used for the purpose of predicting stock’s price on the basis that the present value of the stock is the sum of all future dividends when discounted back to their present value.

Step by step

Solved in 2 steps with 2 images