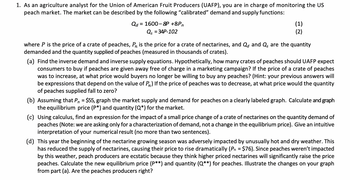

1. As an agriculture analyst for the Union of American Fruit Producers (UAFP), you are in charge of monitoring the US peach market. The market can be described by the following "calibrated" demand and supply functions: Qd = 1600-8P +8Pn Qs =34P-102 (1) (2) where P is the price of a crate of peaches, Pn is the price for a crate of nectarines, and Qd and Q, are the quantity demanded and the quantity supplied of peaches (measured in thousands of crates). (a) Find the inverse demand and inverse supply equations. Hypothetically, how many crates of peaches should UAFP expect consumers to buy if peaches are given away free of charge in a marketing campaign? If the price of a crate of peaches was to increase, at what price would buyers no longer be willing to buy any peaches? (Hint: your previous answers will be expressions that depend on the value of Pn) If the price of peaches was to decrease, at what price would the quantity of peaches supplied fall to zero? (b) Assuming that P = $55, graph the market supply and demand for peaches on a clearly labeled graph. Calculate and graph the equilibrium price (P*) and quantity (Q*) for the market. (c) Using calculus, find an expression for the impact of a small price change of a crate of nectarines on the quantity demand of peaches (Note: we are asking only for a characterization of demand, not a change in the equilibrium price). Give an intuitive interpretation of your numerical result (no more than two sentences). (d) This year the beginning of the nectarine growing season was adversely impacted by unusually hot and dry weather. This has reduced the supply of nectarines, causing their price to rise dramatically (P = $76). Since peaches weren't impacted by this weather, peach producers are ecstatic because they think higher priced nectarines will significantly raise the price peaches. Calculate the new equilibrium price (P**) and quantity (Q**) for peaches. Illustrate the changes on your graph from part (a). Are the peaches producers right?

1. As an agriculture analyst for the Union of American Fruit Producers (UAFP), you are in charge of monitoring the US peach market. The market can be described by the following "calibrated" demand and supply functions: Qd = 1600-8P +8Pn Qs =34P-102 (1) (2) where P is the price of a crate of peaches, Pn is the price for a crate of nectarines, and Qd and Q, are the quantity demanded and the quantity supplied of peaches (measured in thousands of crates). (a) Find the inverse demand and inverse supply equations. Hypothetically, how many crates of peaches should UAFP expect consumers to buy if peaches are given away free of charge in a marketing campaign? If the price of a crate of peaches was to increase, at what price would buyers no longer be willing to buy any peaches? (Hint: your previous answers will be expressions that depend on the value of Pn) If the price of peaches was to decrease, at what price would the quantity of peaches supplied fall to zero? (b) Assuming that P = $55, graph the market supply and demand for peaches on a clearly labeled graph. Calculate and graph the equilibrium price (P*) and quantity (Q*) for the market. (c) Using calculus, find an expression for the impact of a small price change of a crate of nectarines on the quantity demand of peaches (Note: we are asking only for a characterization of demand, not a change in the equilibrium price). Give an intuitive interpretation of your numerical result (no more than two sentences). (d) This year the beginning of the nectarine growing season was adversely impacted by unusually hot and dry weather. This has reduced the supply of nectarines, causing their price to rise dramatically (P = $76). Since peaches weren't impacted by this weather, peach producers are ecstatic because they think higher priced nectarines will significantly raise the price peaches. Calculate the new equilibrium price (P**) and quantity (Q**) for peaches. Illustrate the changes on your graph from part (a). Are the peaches producers right?

Chapter1: Making Economics Decisions

Section: Chapter Questions

Problem 1QTC

Related questions

Question

100%

Transcribed Image Text:1. As an agriculture analyst for the Union of American Fruit Producers (UAFP), you are in charge of monitoring the US

peach market. The market can be described by the following "calibrated" demand and supply functions:

Qd = 1600-8P +8Pn

Qs = 34P-102

(1)

(2)

where P is the price of a crate of peaches, Pn is the price for a crate of nectarines, and Qd and Q, are the quantity

demanded and the quantity supplied of peaches (measured in thousands of crates).

(a) Find the inverse demand and inverse supply equations. Hypothetically, how many crates of peaches should UAFP expect

consumers to buy if peaches are given away free of charge in a marketing campaign? If the price of a crate of peaches

was to increase, at what price would buyers no longer be willing to buy any peaches? (Hint: your previous answers will

be expressions that depend on the value of P) If the price of peaches was to decrease, at what price would the quantity

of peaches supplied fall to zero?

(b) Assuming that P₁ = $55, graph the market supply and demand for peaches on a clearly labeled graph. Calculate and graph

the equilibrium price (P*) and quantity (Q*) for the market.

(c) Using calculus, find an expression for the impact of a small price change of a crate of nectarines on the quantity demand of

peaches (Note: we are asking only for a characterization of demand, not a change in the equilibrium price). Give an intuitive

interpretation of your numerical result (no more than two sentences).

(d) This year the beginning of the nectarine growing season was adversely impacted by unusually hot and dry weather. This

has reduced the supply of nectarines, causing their price to rise dramatically (P₁ = $76). Since peaches weren't impacted

by this weather, peach producers are ecstatic because they think higher priced nectarines will significantly raise the price

peaches. Calculate the new equilibrium price (P**) and quantity (Q**) for peaches. Illustrate the changes on your graph

from part (a). Are the peaches producers right?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 1 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

please answer part d

Transcribed Image Text:1. As an agriculture analyst for the Union of American Fruit Producers (UAFP), you are in charge of monitoring the US

peach market. The market can be described by the following "calibrated" demand and supply functions:

Qd = 1600-8P +8Pn

Qs = 34P-102

(1)

(2)

where P is the price of a crate of peaches, Pn is the price for a crate of nectarines, and Qd and Q, are the quantity

demanded and the quantity supplied of peaches (measured in thousands of crates).

(a) Find the inverse demand and inverse supply equations. Hypothetically, how many crates of peaches should UAFP expect

consumers to buy if peaches are given away free of charge in a marketing campaign? If the price of a crate of peaches

was to increase, at what price would buyers no longer be willing to buy any peaches? (Hint: your previous answers will

be expressions that depend on the value of P) If the price of peaches was to decrease, at what price would the quantity

of peaches supplied fall to zero?

(b) Assuming that P = $55, graph the market supply and demand for peaches on a clearly labeled graph. Calculate and graph

the equilibrium price (P*) and quantity (Q*) for the market.

(c) Using calculus, find an expression for the impact of a small price change of a crate of nectarines on the quantity demand of

peaches (Note: we are asking only for a characterization of demand, not a change in the equilibrium price). Give an intuitive

interpretation of your numerical result (no more than two sentences).

(d) This year the beginning of the nectarine growing season was adversely impacted by unusually hot and dry weather. This

has reduced the supply of nectarines, causing their price to rise dramatically (Pn = $76). Since peaches weren't impacted

by this weather, peach producers are ecstatic because they think higher priced nectarines will significantly raise the price

peaches. Calculate the new equilibrium price (P**) and quantity (Q**) for peaches. Illustrate the changes on your graph

from part (a). Are the peaches producers right?

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-…

Economics

ISBN:

9781259290619

Author:

Michael Baye, Jeff Prince

Publisher:

McGraw-Hill Education