(a) Consider a model of market equilibrium in which the current supply of firms is a function of the price that is expected to prevail when the product is sold. Assume that the market supply equation is q³ (t) = F + Gpe and pe is the expected price and F and G are constant parameters of the supply equation. Assume further that suppliers use information about the actual current price and its first and second derivatives with respect to time to form their prediction of the price that will prevail when their product reaches the market. In particular, assume that pe=p+b- dp d²p dt² +c. dt and b> c> 0. If the current price is constant, so that = 0, then suppliers expect the prevailing price to equal the current price. If the current price is rising, so that > 0, then suppliers expect the prevailing price to be higher than the current price. How much higher depends on whether the current price is rising at an increasing rate, > 0; or at a decreasing rate, <0. The remainder of the market equilibrium model is a linear demand equation = qD = A + Bp and a linear price-adjustment equation that says that price rises when there is excess demand and falls when there is excess supply: dp = a(qº - q¹) and a > 0 is a constant which determines how rapidly price adjusts when the market is out of equilibrium and A and B are constant parameters of the demand equation. (1) Derive the linear second-order differential equation implied by this model. 3

(a) Consider a model of market equilibrium in which the current supply of firms is a function of the price that is expected to prevail when the product is sold. Assume that the market supply equation is q³ (t) = F + Gpe and pe is the expected price and F and G are constant parameters of the supply equation. Assume further that suppliers use information about the actual current price and its first and second derivatives with respect to time to form their prediction of the price that will prevail when their product reaches the market. In particular, assume that pe=p+b- dp d²p dt² +c. dt and b> c> 0. If the current price is constant, so that = 0, then suppliers expect the prevailing price to equal the current price. If the current price is rising, so that > 0, then suppliers expect the prevailing price to be higher than the current price. How much higher depends on whether the current price is rising at an increasing rate, > 0; or at a decreasing rate, <0. The remainder of the market equilibrium model is a linear demand equation = qD = A + Bp and a linear price-adjustment equation that says that price rises when there is excess demand and falls when there is excess supply: dp = a(qº - q¹) and a > 0 is a constant which determines how rapidly price adjusts when the market is out of equilibrium and A and B are constant parameters of the demand equation. (1) Derive the linear second-order differential equation implied by this model. 3

Advanced Engineering Mathematics

10th Edition

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Erwin Kreyszig

Chapter2: Second-order Linear Odes

Section: Chapter Questions

Problem 1RQ

Related questions

Question

100%

Transcribed Image Text:(a) Consider a model of market equilibrium in which the current supply of firms is a

function of the price that is expected to prevail when the product is sold. Assume

that the market supply equation is

q' (t) = F + Gpe

and p² is the expected price and F and G are constant parameters of the supply

equation. Assume further that suppliers use information about the actual current

price and its first and second derivatives with respect to time to form their

prediction of the price that will prevail when their product reaches the market. In

particular, assume that

dp

d²p

dt²

pe=p+b-

and b> c> 0. If the current price is constant, so that

= 0, then suppliers

dt

expect the prevailing price to equal the current price. If the current price is rising, so

+ c

that > 0, then suppliers expect the prevailing price to be higher than the current

dt

price. How much higher depends on whether the current price is rising at an

increasing rate, d²p > 0; or at a decreasing rate, < 0.

The remainder of the market equilibrium model is a linear demand equation

qD = A + Bp

and a linear price-adjustment equation that says that price rises when there is

excess demand and falls when there is excess supply:

dp

dt

= a (qº - qs)

and a > 0 is a constant which determines how rapidly price adjusts when the

market is out of equilibrium and A and B are constant parameters of the demand

equation.

(1)

Derive the linear second-order differential equation implied by this model.

3

لا

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

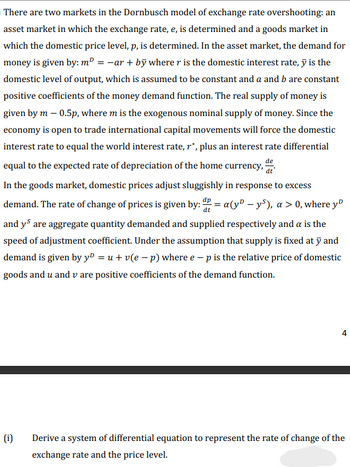

Transcribed Image Text:There are two markets in the Dornbusch model of exchange rate overshooting: an

asset market in which the exchange rate, e, is determined and a goods market in

which the domestic price level, p, is determined. In the asset market, the demand for

money is given by: m² = −ar + by where r is the domestic interest rate, y is the

domestic level of output, which is assumed to be constant and a and b are constant

positive coefficients of the money demand function. The real supply of money is

given by m - 0.5p, where m is the exogenous nominal supply of money. Since the

economy is open to trade international capital movements will force the domestic

interest rate to equal the world interest rate, r*, plus an interest rate differential

equal to the expected rate of depreciation of the home currency, t

dt

In the goods market, domestic prices adjust sluggishly in response to excess

demand. The rate of change of prices is given by: P = a(y-ys), a > 0, where yº

and ys are aggregate quantity demanded and supplied respectively and a is the

speed of adjustment coefficient. Under the assumption that supply is fixed at y and

demand is given by yº = u + v(e − p) where e - p is the relative price of domestic

goods and u and v are positive coefficients of the demand function.

(i)

4

Derive a system of differential equation to represent the rate of change of the

exchange rate and the price level.

Solution

Recommended textbooks for you

Advanced Engineering Mathematics

Advanced Math

ISBN:

9780470458365

Author:

Erwin Kreyszig

Publisher:

Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:

9780073397924

Author:

Steven C. Chapra Dr., Raymond P. Canale

Publisher:

McGraw-Hill Education

Introductory Mathematics for Engineering Applicat…

Advanced Math

ISBN:

9781118141809

Author:

Nathan Klingbeil

Publisher:

WILEY

Advanced Engineering Mathematics

Advanced Math

ISBN:

9780470458365

Author:

Erwin Kreyszig

Publisher:

Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:

9780073397924

Author:

Steven C. Chapra Dr., Raymond P. Canale

Publisher:

McGraw-Hill Education

Introductory Mathematics for Engineering Applicat…

Advanced Math

ISBN:

9781118141809

Author:

Nathan Klingbeil

Publisher:

WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:

9781337798310

Author:

Peterson, John.

Publisher:

Cengage Learning,