Cengagenowv2, 1 Term Printed Access Card For Warren/reeve/duchac's Financial Accounting, 15th

15th Edition

ISBN: 9781337272353

Author: WARREN, Carl; Reeve, James M.; Duchac, Jonathan

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter MJ, Problem 1IFRS

IFRS Activity 1

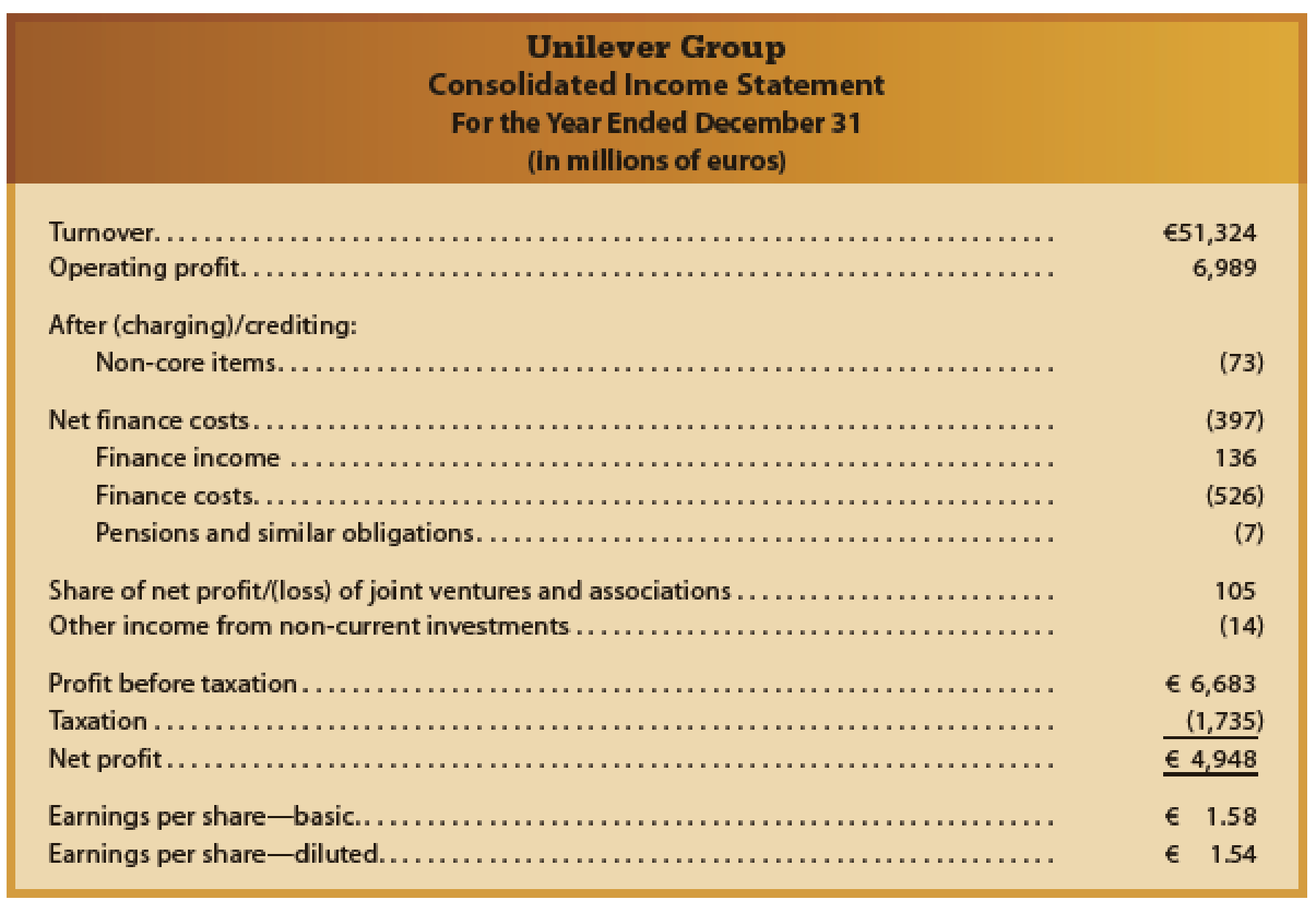

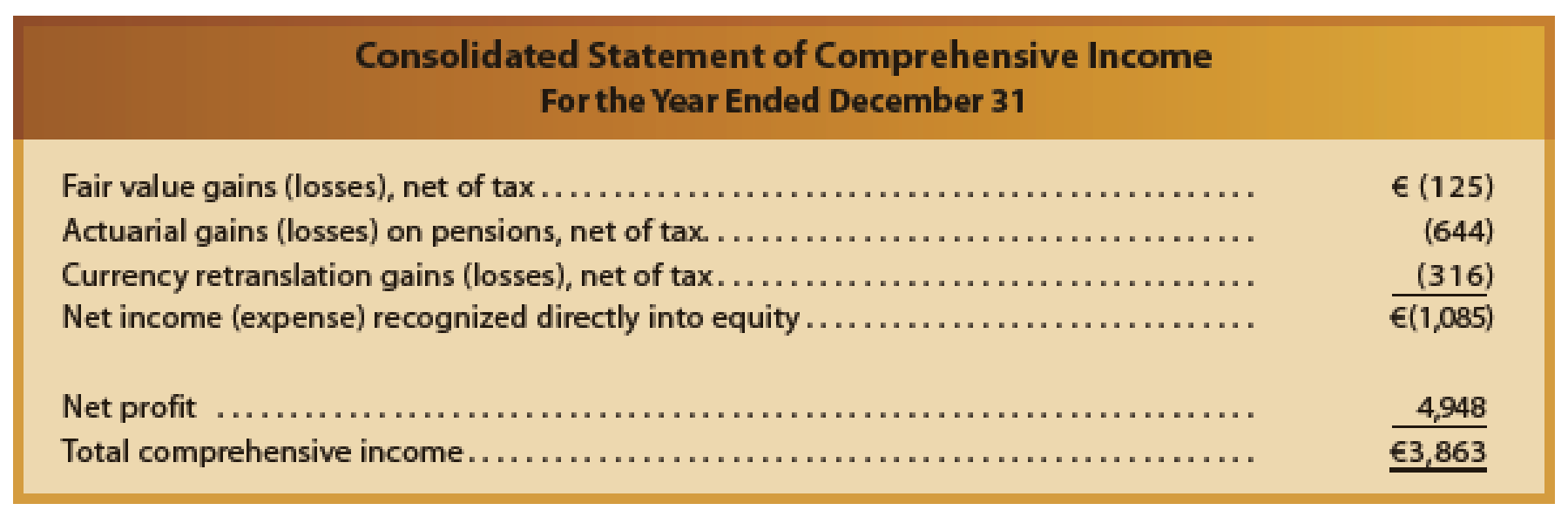

Unilever Group is a global company that markets a wide variety of products, including Lever® soap, Breyer’s® ice cream, and Hellman’s® mayonnaise. A recent income statement and statement of comprehensive income for the Dutch company, Unilever Group, follow:

- a. What do you think is meant by “turnover”?

- b. How does Unilever’s income statement presentation differ significantly from that of Mornin’ Joe?

- c. How is the total for net finance costs presented differently from what typically would be found under U.S. GAAP?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I need help with accounting question

None

Please provide the answer to this general accounting question using the right approach.

Chapter MJ Solutions

Cengagenowv2, 1 Term Printed Access Card For Warren/reeve/duchac's Financial Accounting, 15th

Ch. MJ - Prob. 1DQCh. MJ - What is the difference between classifying an...Ch. MJ - If a functional expense classification is used for...Ch. MJ - Prob. 4DQCh. MJ - What are two main differences in inventory...Ch. MJ - Prob. 6DQCh. MJ - Prob. 7DQCh. MJ - Prob. 8DQCh. MJ - Prob. 9DQCh. MJ - IFRS Activity 1

Unilever Group is a global company...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardPlease provide the correct answer to this general accounting problem using valid calculations.arrow_forwardPlease explain the solution to this general accounting problem using the correct accounting principles.arrow_forward

- I need help finding the accurate solution to this financial accounting problem with valid methods.arrow_forwardI am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forwardCan you help me find the accurate solution to this financial accounting problem using valid principles?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Accounting (Text Only)

Accounting

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License