MANAGERIAL ACCT(LL)+CONNECT+PROCTORIO PL

17th Edition

ISBN: 9781265574826

Author: Garrison

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter IE, Problem 3IE

INTEGRATION EXERCISE 3 Absorption Costing. Variable Costing. Cost-Volume-Profit-Relationships LO5-4, LO5-5, LO5-7, LO6-1, LO6-2

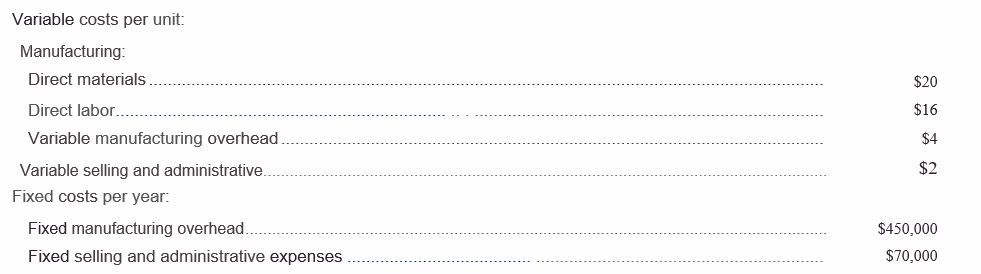

Newton Company manufactures and sells one product The companyassembled the following projections for its first year of operations:

During its first year of operations Newton expects to produce 25,000 units and sell 20,000 units. The budgeted selling price of the company's only product is $66 per unit.

Required(answer each question independently by referring to the original data):

- Assuming that Newton’s projections are accurate, what will be its absorption costing net operating income in its first year of operations?

- Newton is considering investing in a higher quality raw material that will increase its direct materials cost by $1per unit.Itestimates that the higher quality raw material will increase sales by1,000 units. What will be the company’s revised absorption costing net operating income if it invests in the higher quality raw material and continues to produce25,000 units?

- Newton is considering raising its selling price by $1.00 per unit with an expectation that it will lower unit sales by 1,500 units. What wall be the company’s revised absorption costing net operating income if itraises its price by $1.00 and continues to produce 25,000 units?

- Assuming that Newton’s projections are accurate, what will be its variable costing net operating income in its first year ofoperations?

- Newton is considering investing in a higher quality raw material that will increase its direct materials cost by $1 per unit. It estimates that the higher quality raw material will increase sales by1,000 units. What will be the company’s revised variable costing net operating income if it invests in the higher quality raw material and continues to produce25,000 units?

- Newton is considering raising its selling price by $1.00 per unit with an expectation that it will lower unit sales by 1,500 units. What will be the company’s revised variable costing net operating income if it raises its price by $1.00 andcontinues to produce 25,000 units? 7. What is Newton's break-even point in unit sales? What is its break-even point in dollar sales?

8. Whatis the company’s projected margin of safety in its first year of operations?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I need the correct answer to this financial accounting problem using the standard accounting approach.

I need the correct answer to this general accounting problem using the standard accounting approach.

How much did they charge for each watch?

Chapter IE Solutions

MANAGERIAL ACCT(LL)+CONNECT+PROCTORIO PL

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you solve this financial accounting question with the appropriate financial analysis techniques?arrow_forwardBianca Electronics manufactures smartphones. For the last quarter, the company reported the following costs: direct materials $235,000, direct labor $320,000, variable manufacturing overhead $185,000, fixed manufacturing overhead $150,000, and selling and administrative expenses (all fixed) $210,000. If the company produced 20,000 units and sold 18,000 units during the quarter, what is the difference between the operating income under absorption costing and variable costing? Need helparrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY