MANAGERIAL ACCOUNTING W/CONNECT

16th Edition

ISBN: 9781260586916

Author: Garrison

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Question

Chapter IE, Problem 10IE

1)

To determine

Introduction:

Cash Flow Statements:

- Cash flow statements are an integral part of the financial statements of a company. They reflect the direction and movement of the

cash inflows and outflows during a reporting period. The cash inflows and outflows are segregated into the following activities:

Cash flows from Operating activities- Cash flows from Investing activities

- Cash flows from Financing activities

There are two methods of preparing cash flow statements:

- Direct Method − It measures the actual cash inflows and

cash outflows that are affected during a particular reporting period. The actual cash flows do not include non-cash items and items that are recorded owing to the accrual principle.

- Indirect Method −It measures the cash inflows and cash outflows that are affected during a particular reporting period including the non-cash items and items that are recorded owing to the accrual principle.

To Prepare:

Cash flow from operating activities.

1)

Expert Solution

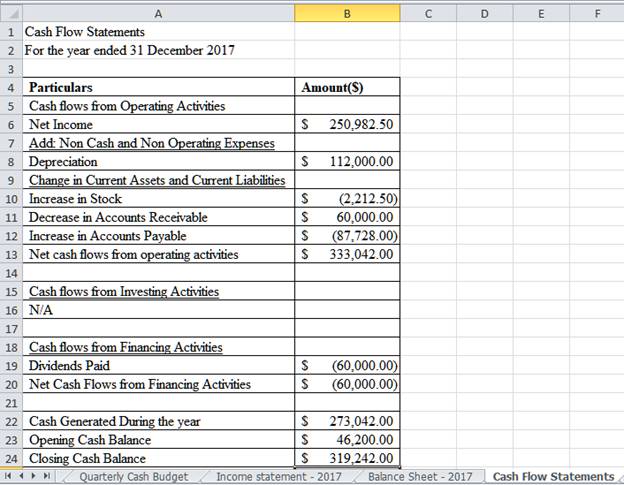

Answer to Problem 10IE

Solution:

Cash flow from operating activities is $333,042.

Explanation of Solution

| Particulars | Amount($) |

| Cash flows from Operating Activities | |

| Net Income | $ 250,982.50 |

| Add: Non-Cash and Non-Operating Expenses | |

| | $ 112,000.00 |

| Change in Current Assets and Current Liabilities | |

| Increase in Stock | $ (2,212.50) |

| Decrease in | $ 60,000.00 |

| Decrease in Accounts Payable | $ (87,728.00) |

| Net cash flows from operating activities | $ 333,042.00 |

- The Cash flow statements measure the cash inflows and cash outflows that are affected during a particular reporting period including the non-cash items and items that are recorded owing to the accrual principle.

- Cash inflows and outflows from both

balance sheet accounts such as accounts receivable, accounts payable, inventory, etc. as well as income statement accounts such as Sales, Depreciation Expense, etc. and the changes in the values from the preceding period and the effect of the same on the net income is detailed in the cash flow statement of the current year.

- Operating Activities refer to the results from operations of the business. This includes cash inflows from sale of goods and services and cash outflows to fund the expenses of the operations. The operating activities also capture change in balance sheet accounts such as change in values of inventory or change in closing balances of accounts payables, etc.

- The net income from operations is the starting point to prepare the cash flow statements. The net income is calculated after giving effect to the non-cash expenses and hence, the same must be added back to arrive at the actual Net Income. Hence, the Depreciation Expenses are added.

- The next step is to ascertain the effect of changes to the current assets and current liabilities. Increase in current liabilities means a positive effect on the cash flows and are hence, added to the net income for the year. Hence, the Change in beginning and ending balances of accounts payable is added to the income for the year.

- The next step is to ascertain the effect of changes to the current assets and current liabilities. Increase in current assets means an adverse effect on the cash flows and are hence, deducted from the net income for the year. Decrease in current assets means a positive effect on the cash flows and are hence, added to the net income for the year.

- Hence, the Change in beginning and ending balances of Inventory is reduced from the income for the year and Change in beginning and ending balances of Accounts receivable are added back to the income for the year.

Conclusion

Hence, the cash flows from operating activities has been calculated.

2)

To determine

Introduction:

Cash Flow Statements:

- Cash flow statements are an integral part of the financial statements of a company. They reflect the direction and movement of the cash inflows and outflows during a reporting period. The cash inflows and outflows are segregated into the following activities:

- Cash flows from Operating activities

- Cash flows from Investing activities

- Cash flows from Financing activities

There are two methods of preparing cash flow statements:

- Direct Method − It measures the actual cash inflows and cash outflows that are affected during a particular reporting period. The actual cash flows do not include non-cash items and items that are recorded owing to the accrual principle.

- Indirect Method −It measures the cash inflows and cash outflows that are affected during a particular reporting period including the non-cash items and items that are recorded owing to the accrual principle.

To Prepare:

Cash flow statements using Indirect Method.

2)

Expert Solution

Explanation of Solution

- The Cash flow statements measure the cash inflows and cash outflows that are affected during a particular reporting period including the non-cash items and items that are recorded owing to the accrual principle.

- Cash inflows and outflows from both balance sheet accounts such as accounts receivable, accounts payable, inventory, etc. as well as Income statement accounts such as Sales, Depreciation Expense, etc. and the changes in the values from the preceding period and the effect of the same on the net income is detailed in the cash flow statement of the current year.

- Operating Activities refer to the results from operations of the business. This includes cash inflows from sale of goods and services and cash outflows to fund the expenses of the operations. The operating activities also capture change in balance sheet accounts such as change in values of inventory or change in closing balances of accounts payables, etc.

- The net income from operations is the starting point to prepare the cash flow statements. The net income is calculated after giving effect to the non-cash expenses and hence, the same must be added back to arrive at the actual Net Income. Hence, the Depreciation Expenses are added.

- The next step is to ascertain the effect of changes to the current assets and current liabilities. Increase in current liabilities means a positive effect on the cash flows and are hence added to the net income for the year. Hence, the Change in beginning and ending balances of accounts payable is added to the income for the year.

- The next step is to ascertain the effect of changes to the current assets and current liabilities. Increase in current assets means an adverse effect on the cash flows and are hence deducted from the net income for the year. Decrease in current assets means a positive effect on the cash flows and are hence, added to the net income for the year.

- Hence, the Change in beginning and ending balances of Inventory is reduced from the income for the year and Change in beginning and ending balances of Accounts receivable are added back to the income for the year.

- Cash flows from investing activities are calculated by considering changes in the fixed and non-current assets of the business such as changes in values of plant and investments. There are no changes or cash flows from investing activities for the year.

- Cash flows from financing activities are calculated by considering changes in the long term and non-current liabilities of the business such as changes in value of notes payable, common stock and cash dividends paid. Dividends paid every year are a part of financing activities.

- The sum of the net results of cash flows from operating, investing and financing activities results in the net cash generated/used up during the year. This is added to the opening balance of cash and cash equivalents and should match with the closing balance of cash and cash equivalents.

Conclusion

Hence, the cash flow statements have been prepared.

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

Hi expert please help me this question general accounting

MCQ

Depreciation rate?

Chapter IE Solutions

MANAGERIAL ACCOUNTING W/CONNECT

Ch. IE - Prob. 10IECh. IE -

INTEGRATION EXERCISE 11 Financial Statement Ratio...Ch. IE - INTEGRATION EXERCISE 12 Cost-Volume-Profit...Ch. IE - INTEGRATION EXERCISE 13 Master Budgeting,...Ch. IE - Prob. 1IECh. IE - Prob. 2IECh. IE - INTEGRATION EXERCISE 3 Absorption Costing....Ch. IE - Prob. 4IECh. IE - Prob. 5IECh. IE - Prob. 6IE

Knowledge Booster

Similar questions

- Provide answerarrow_forwardUltra Core Mining Ltd. acquired mineral rights for $48,000,000. The mineral deposit is estimated at 32,000,000 tons. During the current year, 5,000,000 tons were mined and sold. Determine the amount of depletion expense for the current year.arrow_forwardPlease help me solve this general accounting question using the right accounting principles.arrow_forward

- Westride Transport Co. uses the units-of-activity method in depreciating its fleet. One bus was purchased on January 1, 2020, at a cost of $145,000. Over its 5-year useful life, the bus is expected to be driven 250,000 miles. The salvage value is expected to be $10,000. Compute the depreciation cost per unit (per mile).arrow_forwardCompute the depreciation cost per unitarrow_forwardNeed help this questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education