Managerial Accounting

16th Edition

ISBN: 9781260153132

Author: Ray H Garrison, Eric Noreen, Peter C. Brewer Professor

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Question

Chapter IE, Problem 10IE

1)

To determine

Introduction:

Cash Flow Statements:

- Cash flow statements are an integral part of the financial statements of a company. They reflect the direction and movement of the

cash inflows and outflows during a reporting period. The cash inflows and outflows are segregated into the following activities:

Cash flows from Operating activities- Cash flows from Investing activities

- Cash flows from Financing activities

There are two methods of preparing cash flow statements:

- Direct Method − It measures the actual cash inflows and

cash outflows that are affected during a particular reporting period. The actual cash flows do not include non-cash items and items that are recorded owing to the accrual principle.

- Indirect Method −It measures the cash inflows and cash outflows that are affected during a particular reporting period including the non-cash items and items that are recorded owing to the accrual principle.

To Prepare:

Cash flow from operating activities.

1)

Expert Solution

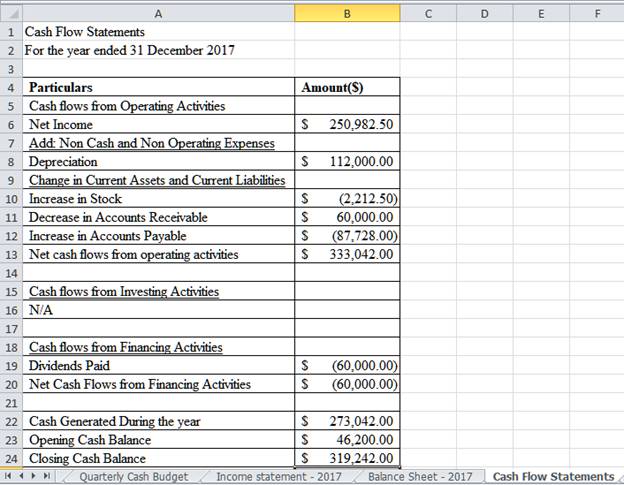

Answer to Problem 10IE

Solution:

Cash flow from operating activities is $333,042.

Explanation of Solution

| Particulars | Amount($) |

| Cash flows from Operating Activities | |

| Net Income | $ 250,982.50 |

| Add: Non-Cash and Non-Operating Expenses | |

| | $ 112,000.00 |

| Change in Current Assets and Current Liabilities | |

| Increase in Stock | $ (2,212.50) |

| Decrease in Accounts Receivable | $ 60,000.00 |

| Decrease in Accounts Payable | $ (87,728.00) |

| Net cash flows from operating activities | $ 333,042.00 |

- The Cash flow statements measure the cash inflows and cash outflows that are affected during a particular reporting period including the non-cash items and items that are recorded owing to the accrual principle.

- Cash inflows and outflows from both

balance sheet accounts such as accounts receivable, accounts payable, inventory, etc. as well as income statement accounts such as Sales, Depreciation Expense, etc. and the changes in the values from the preceding period and the effect of the same on the net income is detailed in the cash flow statement of the current year.

- Operating Activities refer to the results from operations of the business. This includes cash inflows from sale of goods and services and cash outflows to fund the expenses of the operations. The operating activities also capture change in balance sheet accounts such as change in values of inventory or change in closing balances of accounts payables, etc.

- The net income from operations is the starting point to prepare the cash flow statements. The net income is calculated after giving effect to the non-cash expenses and hence, the same must be added back to arrive at the actual Net Income. Hence, the Depreciation Expenses are added.

- The next step is to ascertain the effect of changes to the current assets and current liabilities. Increase in current liabilities means a positive effect on the cash flows and are hence, added to the net income for the year. Hence, the Change in beginning and ending balances of accounts payable is added to the income for the year.

- The next step is to ascertain the effect of changes to the current assets and current liabilities. Increase in current assets means an adverse effect on the cash flows and are hence, deducted from the net income for the year. Decrease in current assets means a positive effect on the cash flows and are hence, added to the net income for the year.

- Hence, the Change in beginning and ending balances of Inventory is reduced from the income for the year and Change in beginning and ending balances of Accounts receivable are added back to the income for the year.

Conclusion

Hence, the cash flows from operating activities has been calculated.

2)

To determine

Introduction:

Cash Flow Statements:

- Cash flow statements are an integral part of the financial statements of a company. They reflect the direction and movement of the cash inflows and outflows during a reporting period. The cash inflows and outflows are segregated into the following activities:

- Cash flows from Operating activities

- Cash flows from Investing activities

- Cash flows from Financing activities

There are two methods of preparing cash flow statements:

- Direct Method − It measures the actual cash inflows and cash outflows that are affected during a particular reporting period. The actual cash flows do not include non-cash items and items that are recorded owing to the accrual principle.

- Indirect Method −It measures the cash inflows and cash outflows that are affected during a particular reporting period including the non-cash items and items that are recorded owing to the accrual principle.

To Prepare:

Cash flow statements using Indirect Method.

2)

Expert Solution

Explanation of Solution

- The Cash flow statements measure the cash inflows and cash outflows that are affected during a particular reporting period including the non-cash items and items that are recorded owing to the accrual principle.

- Cash inflows and outflows from both balance sheet accounts such as accounts receivable, accounts payable, inventory, etc. as well as Income statement accounts such as Sales, Depreciation Expense, etc. and the changes in the values from the preceding period and the effect of the same on the net income is detailed in the cash flow statement of the current year.

- Operating Activities refer to the results from operations of the business. This includes cash inflows from sale of goods and services and cash outflows to fund the expenses of the operations. The operating activities also capture change in balance sheet accounts such as change in values of inventory or change in closing balances of accounts payables, etc.

- The net income from operations is the starting point to prepare the cash flow statements. The net income is calculated after giving effect to the non-cash expenses and hence, the same must be added back to arrive at the actual Net Income. Hence, the Depreciation Expenses are added.

- The next step is to ascertain the effect of changes to the current assets and current liabilities. Increase in current liabilities means a positive effect on the cash flows and are hence added to the net income for the year. Hence, the Change in beginning and ending balances of accounts payable is added to the income for the year.

- The next step is to ascertain the effect of changes to the current assets and current liabilities. Increase in current assets means an adverse effect on the cash flows and are hence deducted from the net income for the year. Decrease in current assets means a positive effect on the cash flows and are hence, added to the net income for the year.

- Hence, the Change in beginning and ending balances of Inventory is reduced from the income for the year and Change in beginning and ending balances of Accounts receivable are added back to the income for the year.

- Cash flows from investing activities are calculated by considering changes in the fixed and non-current assets of the business such as changes in values of plant and investments. There are no changes or cash flows from investing activities for the year.

- Cash flows from financing activities are calculated by considering changes in the long term and non-current liabilities of the business such as changes in value of notes payable, common stock and cash dividends paid. Dividends paid every year are a part of financing activities.

- The sum of the net results of cash flows from operating, investing and financing activities results in the net cash generated/used up during the year. This is added to the opening balance of cash and cash equivalents and should match with the closing balance of cash and cash equivalents.

Conclusion

Hence, the cash flow statements have been prepared.

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

4.

(i)

SECTION B

The following information has been obtained from the financial statements of Outer

Scope Insurance Company and from discussions with the company's Budgeting and

Control Accountant.

claims Commissions Operating

Month

Gross

premiums

Net

payable

payable

expenses

December 2017 83,000,000

21,000,000

7,500,000

26,400,000

January 2018

88,000,000

26,200,000

8,250,000

30,500,000

February 2018

92,000,000

36,400,000

8,800,000

33,400,000

March 2018

85,000,000

29,100,000

7,900,000

28,200,000

April 2018

104,000,000 44,500,000

11,500,000 36,900,000

May 2018

94,500,000

32,000,000

9,600,000

29,350,000

June 2018

90,800,000

26,700,000

7,700,000

31,600,000

(ii)

(iii)

(iv)

(v)

(vi)

The company's gross premium revenue is collected in full during the month the

policies are written but includes amounts due to reinsurers. Amounts paid to the

reinsurers average at 10% of the gross premium revenues and are paid out to the

reinsurers in the month the policies are written.

Net claims to be settled…

Required information

Skip to question

[The following information applies to the questions displayed below.]Joe and Jessie are married and have one dependent child, Lizzie. Lizzie is currently in college at State University. Joe works as a design engineer for a manufacturing firm while Jessie runs a craft business from their home. Jessie’s craft business consists of making craft items for sale at craft shows that are held periodically at various locations. Jessie spends considerable time and effort on her craft business, and it has been consistently profitable over the years. Joe and Jessie own a home and pay interest on their home loan (balance of $220,000) and a personal loan to pay for Lizzie’s college expenses (balance of $35,000). Neither Joe nor Jessie is blind or over age 65, and they plan to file as married-joint. Assume that the employer portion of the self-employment tax on Jessie’s income is $831. Joe and Jessie have summarized the income and expenses they expect to report…

I need assistance with this financial accounting problem using appropriate calculation techniques.

Chapter IE Solutions

Managerial Accounting

Ch. IE - Prob. 10IECh. IE -

INTEGRATION EXERCISE 11 Financial Statement Ratio...Ch. IE - INTEGRATION EXERCISE 12 Cost-Volume-Profit...Ch. IE - INTEGRATION EXERCISE 13 Master Budgeting,...Ch. IE - Prob. 1IECh. IE - Prob. 2IECh. IE - INTEGRATION EXERCISE 3 Absorption Costing....Ch. IE - Prob. 4IECh. IE - Prob. 5IECh. IE - Prob. 6IE

Knowledge Booster

Similar questions

- I need help with this general accounting question using standard accounting techniques.arrow_forwardI need guidance in solving this financial accounting problem using standard procedures.arrow_forwardI am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forward

- Can you help me solve this general accounting problem using the correct accounting process?arrow_forwardHow can I solve this financial accounting problem using the appropriate financial process?arrow_forwardPlease provide the accurate answer to this general accounting problem using valid techniquesarrow_forward

- I need help with this general accounting question using the proper accounting approach.arrow_forwardCan you explain the correct methodology to solve this general accounting problem?arrow_forwardDetermine the amount of the Earned Income Credit in each of the following cases. Assume that the person or persons are eligible to take the credit. Calculate the credit using the formulas. A single person with earned income of $ 7 , 8 5 4 and no qualifying children. A single person with earned income of $ 2 7 , 5 0 0 and two qualifying children. A married couple filing jointly with earned income of $ 3 4 , 1 9 0 and one qualifying child.arrow_forward

- Please help me solve this general accounting question using the right accounting principles.arrow_forwardAssets Martinez Company Comparative Balance Sheets December 31 2025 2024 Cash $91,000 $52,000 Accounts receivable 52,000 36,400 Inventory 72,800 52,000 Property, plant, and equipment 156,000 202,800 Accumulated depreciation Total (83,200) [62,400) $288,600 $290,800 Liabilities and Stockholders' Equity Accounts payable $49,400 $ 39,000 Income taxes payable 18,200 20,800 Bonds payable 44,200 85,800 Common stock 46,900 36,400 Retained earnings 130,000 98,800 Total $288,600 $280,800 Martinez Company Income Statement For the Year Ended December 31, 2025 Sales revenue $629,200 Cost of goods sold 455,000 Gross profit 174,200 Selling expenses $46,800 Administrative expenses 15,600 62,400 Income from operations 111,800 Interest expense 7,800 Income before income taxes 104,000 Income tax expense 20,800 Net income $83,200 Additional data: 1. Depreciation expense was $45,500. 2. Dividends declared and paid were $52,000. 3. During the year, equipment was sold for $22,100 cash. This equipment…arrow_forwardagree or disagree with post The Stockholders' Equity section of a corporate balance sheet fundamentally differs from that of a single-owner business due to the inherent structure of a corporation versus a sole proprietorship. In a single-owner business, you'll usually see a single "Owner's Equity" account, which reflects the owner's investment, withdrawals, and accumulated profits or losses. Conversely, a corporation's Stockholders' Equity is more intricate, reflecting the contributions of multiple owners (stockholders) and the legal framework governing corporate capital. It's divided into contributed capital, which includes common and preferred stock, and retained earnings, which represents accumulated profits not yet distributed as dividends. Additionally, corporations may have accounts like "Additional Paid-in Capital" to capture amounts received above the par value of stock, and "Treasury Stock" to account for shares repurchased by the company. This detailed breakdown highlights…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education