Concept Introduction:

Future value:

Future value refers to the amount to be received in future time. In other words we can say that money that will be received after some time which is calculated with the help of interest rate and number of period interest compunded is known as future value.

Requirement 1:

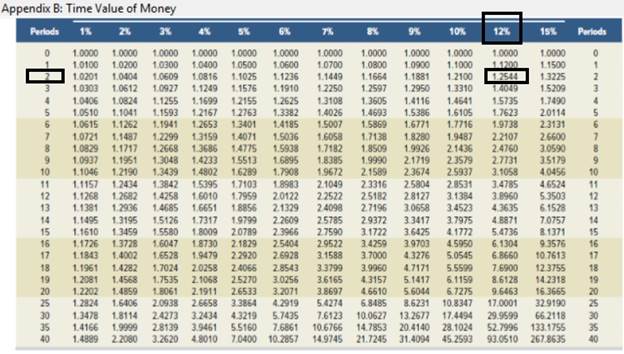

Interest rate column and number-of-periods row when 12% annual rate, compounded annually.

Answer to Problem 1QS

Interest rate column = 12th column (Which is given under 12% interest rate).

Number-of-periods row = 3rd row (Which is given in front of 2 number period).

Explanation of Solution

Future value is calculated with the help of following formula;

Interest rate is given = 12%

Number of periods are given = 2

As per Table B.2, we will use column and row as follow;

Thus,

Interest rate column = 12th column (Which is given under 12% interest rate).

Number-of-periods row = 3rd row (Which is given infront of 2 number period).

Concept Introduction:

Future value:

Future value refers to the amount to be received in future time. In other words we can say that money that will be received after some time which is calculated with the help of interest rate and number of period interest compunded is known as future value.

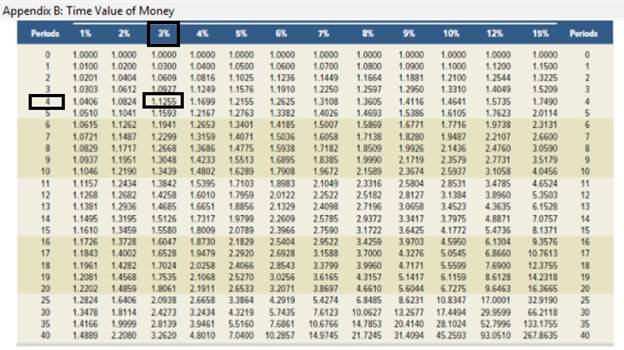

Requirement 2:

Interest rate column and number-of-periods row when 6% annual rate, compounded semiannually.

Answer to Problem 1QS

Interest rate column = 3rdcolumn (Which is given under 3% interest rate).

Number-of-periods row = 5th row (Which is given infront of 4 number period).

Explanation of Solution

Future value is calculated with the help of following formula;

Interest rate (6% / 2) = 3%

Number of periods (2 x 2) = 4

As per Table B.2, we will use column and row as follow;

Thus,

Interest rate column = 3rd column (Which is given under 3% interest rate).

Number-of-periods row = 5th row (Which is given infront of 4 number period).

Concept Introduction:

Future value:

Future value refers to the amount to be received in future time. In other words we can say that money that will be received after some time which is calculated with the help of interest rate and number of period interest compunded is known as future value.

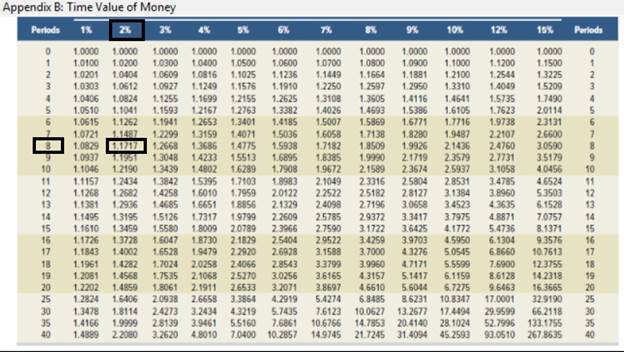

Requirement 3:

Interest rate column and number-of-periods row when 8% annual rate, compounded quarterly.

Answer to Problem 1QS

Interest rate column = 2nd column (Which is given under 2% interest rate).

Number-of-periods row = 9th row (Which is given infront of 8 number period).

Explanation of Solution

Future value is calculated with the help of following formula;

Interest rate per period (8% / 4) = 2%

Number of periods (2 x 4) = 8

As per Table B.2, we will use column and row as follow;

Thus,

Interest rate column = 2nd column (Which is given under 2% interest rate).

Number-of-periods row = 9th row (Which is given infront of 8 number period).

Concept Introduction:

Future value:

Future value refers to the amount to be received in future time. In other words we can say that money that will be received after some time which is calculated with the help of interest rate and number of period interest compunded is known as future value.

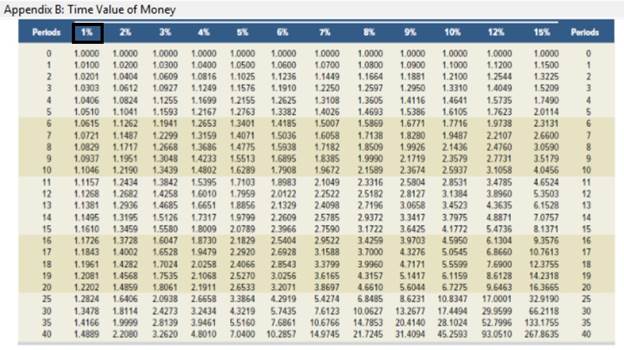

Requirement 4:

Interest rate column and number-of-periods row when 12% annual rate, compounded monthly.

Answer to Problem 1QS

Interest rate column = 1stcolumn (Which is given under 1% interest rate).

Number-of-periods row = Not given in the table (n = 24).

Explanation of Solution

Future value is calculated with the help of following formula;

Interest rate per period (12% / 12) = 1%

Number of periods (2 x 12) = 24

As per Table B.2, we will use column and row as follow;

Thus,

Interest rate column = 1st column (Which is given under 1% interest rate).

Number-of-periods row = Not given in the table (n = 24)

Want to see more full solutions like this?

Chapter B Solutions

FUNDAMENTAL ACCT PRINCIPLES LL W CONNECT

- Faith Industries purchased a crane for $78,000 on January 1, 2021. The crane has an expected salvage value of $6,000 and is expected to be used for 120,000 hours over its estimated useful life of 8 years. Actual usage was 13,800 hours in 2021 and 15,400 hours in 2022. Calculate depreciation expense per hour under the units-of-activity method. (Round the answer to 2 decimal places.)arrow_forwardAccurate Answerarrow_forwardKellogg Corporation uses a single raw material in its production process. The standard price for a unit of material is $3.25. During the month, the company purchased and used 680 units of this material at a price of $3.40 per unit. The standard quantity required per finished product is 2 units, and during the month, the company produced 325 finished units. How much was the material quantity variance?arrow_forward

- I am searching for the accurate solution to this financial accounting problem with the right approach.arrow_forwardgeneral accounting questionarrow_forwardHendrix Plumbing Services purchased machinery for $18,400 on March 1, 2022. The machinery has an estimated useful life of 8 years and a residual value of $1,600. Hendrix uses the straight-line method to calculate depreciation and records depreciation expense at the end of every month. As of September 30, 2022, the book value of this machinery shown on its balance sheet will be: A. $17,175 B. $16,800 C. $16,550 D. $18,400arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education