Concept explainers

Concept Introduction:

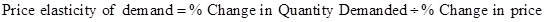

Price Electricity of demand: The price elasticity of demand is the measure of the change in the quantity sold or demanded of a product or service in relation to its price change. It is represented in percentage terms.

Profit-maximizing price: It is a process that an entity employs to find out the best output and price level in order to maximize its profit. Profit-maximizing price is the price at which the profit is maximized at a given quantity of output and where the marginal revenue is equal to the marginal cost.

(1)

The selling price at which the postal service of St. Vincent makes more money.

Explanation of Solution

The postal service of St. Vincent makes more money selling the souvenir sheets for $7.00 each. Calculations are given below:

| $7.00 Price | $8.00 Price | |

| (A) No of sheets sold | 100,000 | 85,000 |

| (B) Selling price per sheet | $7.00 | $8.00 |

| (C) Variable cost per sheet | $0.80 | $0.80 |

| Total Sales (A) x (B) | $700,000 | $680,000 |

| Less : Variable cost (A) x (C) | $80,000 | $68,000 |

| Contribution margin | $620,000 | $612,000 |

| Less: fixed cost | $675 | $675 |

| Net Income | $1,515 | $1,805.40 |

(2)

To compute:

The price elasticity of demand for the souvenir sheets.

Explanation of Solution

Price elasticity of demand for the souvenir sheets is -1.19 and is computed as below.

(3)

To compute:

The profit-maximizing price for souvenir sheets.

Explanation of Solution

Profit-maximizing price for souvenir sheets is $5.01 per souvenir sheet. Calculations are given below.

Price elasticity of demand = −1.19

Variable cost per unit = $0.80

(4)

To compute:

The profit-maximizing price for souvenir sheets if the variable cost is $1.00

Explanation of Solution

The postal service of St. Vincent should charge $6.26 per sheet if the variable cost is $1.00 per sheet.

Want to see more full solutions like this?

Chapter AA Solutions

ACC 202 Principles of Accounting 2 Ball State University

- What would be the average fixed inspectionarrow_forwardAmber Corp. bought $380,000 worth of furniture on July 15, 2014. On November 20, 2014, the company purchased $140,000 of used office equipment. If Amber Corp. Elects Section 179, what is the maximum write-off for these purchases in 2014?arrow_forwardNo AI please otherwise unhearrow_forward

- What is the manufacturing overhead of this general accounting question?arrow_forwardQuine Inc. reported sales of $8,500,000 for the month and incurred variable expenses totaling $6,300,000 and fixed expenses totaling $1,500,000. The company has no beginning or ending inventories. A total of 90,000 units were produced and sold last month. How many units would the company have to sell to achieve a desired profit of $1,200,000? (rounding up to the nearest whole unit)arrow_forwardPlease give me true answer this financial accounting questionarrow_forward

- Zorro Company has a delivery truck that is being sold after 5 years of use. The current book value of the delivery truck is $4,600. If Zorro Company sells the delivery truck for $9,500, what is the impact of this transaction?arrow_forwardD&P Corp. has current liabilities of $565,000, a quick ratio of 0.93, inventory turnover of 5.8, and a current ratio of 2.4. What is the cost of goods sold for the company?arrow_forwardFranco Corp. purchased an item for inventory that cost $30 per unit and was priced to sell at $50. It was determined that the disposal cost is $28 per unit. Using the lower of cost or net realizable value (LCM) rule, what amount should be reported on the balance sheet for inventory?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education