Concept explainers

Compute

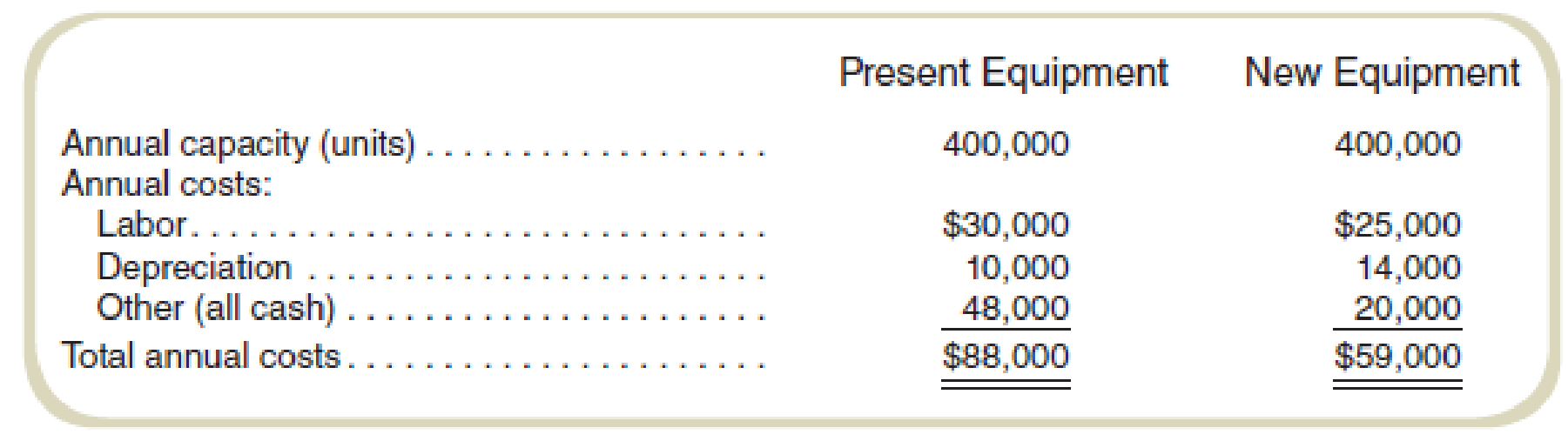

Dungan Corporation is evaluating a proposal to purchase a new drill press to replace a less efficient machine presently in use. The cost of the new equipment at time 0, including delivery and installation, is $200,000. If it is purchased, Dungan will incur costs of $5,000 to remove the present equipment and revamp its facilities. This $5,000 is tax deductible at time 0.

Depreciation for tax purposes will be allowed as follows: year 1, $40,000; year 2, $70,000; and in each of years 3 through 5, $30,000 per year. The existing equipment has a book and tax value of $100,000 and a remaining useful life of 10 years. However, the existing equipment can be sold for only $40,000 and is being

Management has provided you with the following comparative

The existing equipment is expected to have a salvage value equal to its removal costs at the end of 10 years. The new equipment is expected to have a salvage value of $60,000 at the end of 10 years, which will be taxable, and no removal costs. No changes in

Required

- a. Calculate the removal costs of the existing equipment net of tax effects.

- b. Compute the depreciation tax shield.

- c. Compute the forgone tax benefits of the old equipment.

- d. Calculate the

cash inflow , net of taxes, from the sale of the new equipment in year 10. - e. Calculate the tax benefit arising from the loss on the old equipment.

- f. Compute the annual differential

cash flows arising from the investment in years 1 through 10. - g. Compute the net present value of the project.

a.

Compute the removal costs of the existing equipment net of tax effects.

Explanation of Solution

Net of tax:

Net of tax is the resultant amount that determines the final amount of the accounting period for the tax savings. The net of tax is determined by taking gross figures in the account.

Compute the equipment removal net of tax effects:

Thus, the value of equipment removal net of tax effects is $3,000.

b.

Compute the depreciation tax shield.

Explanation of Solution

Depreciation:

Depreciation is the method of calculating the value of the assets for the current accounting period. The value of any capital asset cannot be accounted for the total cost it has incurred in the period that it has been bought in. The value of the asset is distributed over different accounting periods according to the utility of the asset.

Compute the depreciation tax shield:

| Year | Depreciation | Tax shield | PV factor | Present value |

| 1 | $40,000 | $16,000 | 0.862 | $13,792 |

| 2 | $70,000 | $28,000 | 0.743 | $20,804 |

| 3 | $30,000 | $12,000 | 0.641 | $7,692 |

| 4 | $30,000 | $12,000 | 0.552 | $6,624 |

| 5 | $30,000 | $12,000 | 0.476 | $5,712 |

| Total | $200,000 | $80,000 | $54,624 |

Table: (1)

Thus, the PV of the depreciation schedule is $54,624.

c.

Compute the foregone tax benefits of the old equipment.

Explanation of Solution

Tax shield:

Tax shield refers to a reduction in taxable income. The reduction in taxable income is achieved by claiming the allowable deductions.

Compute the foregone tax benefits of the old equipment:

Thus, the value of foregone tax benefits is $4,000.

d.

Compute the cash inflow, net of taxes, from the sale of the new equipment in year 10.

Explanation of Solution

Gain:

Gain is the resultant value of the difference between revenue earned on sale and the cost of the same.

Compute gain from salvage of new equipment:

Thus, the value of gain from salvage of new equipment is $36,000.

e.

Compute the tax benefit arising from the loss on the old equipment.

Explanation of Solution

Tax shield:

Tax shield refers to a reduction in taxable income. The reduction in taxable income is achieved by claiming the allowable deductions.

Compute the tax benefit arising from a loss on old equipment:

Thus, the value of the tax benefit is $24,000.

f.

Compute the annual differential cash flows arising from the investment in years 1 through 10.

Explanation of Solution

Differential cash flow:

Differential cash flow is the difference between several options of businesses’ cash flows.

Compute the differential cash flows:

Thus, the value of differential cash flows is $19,800.

g.

Compute the net present value of the project.

Explanation of Solution

Net present value (NPV):

Net present value (NPV) is a type of intrinsic valuation analysis. NPV is the sum total of all the future cash flows (inflows/outflows) that will occur over the lifetime of a project discounted to the present.

| Year | |||||||||||

| Particulars | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Investment flows: | |||||||||||

| Equipment cost | ($200,000) | ||||||||||

| Removal | ($3,000) | ||||||||||

| Salvage of old equipment | $40,000 | ||||||||||

| Tax benefit-sale of old equipment | $24,000 | ||||||||||

| Periodic operating flows | $19,800 | $19,800 | $19,800 | $19,800 | $19,800 | $19,800 | $19,800 | $19,800 | $19,800 | $19,800 | |

| Tax shield from depreciation: | |||||||||||

| Year 1 | $16,000 | ||||||||||

| Year 2 | $28,000 | ||||||||||

| Year 3-5 | $12,000 | $12,000 | $12,000 | ||||||||

| Old equipment (forgone) | ($4,000) | ($4,000) | ($4,000) | ($4,000) | ($4,000) | ($4,000) | ($4,000) | ($4,000) | ($4,000) | ($4,000) | |

| Disinvestment: | |||||||||||

| Proceeds of disposal | $60,000 | ||||||||||

| Tax on gain | ($24,000) | ||||||||||

| Total cash flows | ($139,000) | $31,800 | $43,800 | $27,800 | $27,800 | $27,800 | $15,800 | $15,800 | $15,800 | $15,800 | $51,800 |

| PV factor | $1.000 | $0.862 | $0.743 | $0.641 | $0.552 | $0.476 | $0.410 | $0.354 | $0.305 | $0.263 | $0.227 |

|

Present value | ($139,000) | $27,412 | $32,543 | $17,820 | $15,346 | $13,233 | $6,478 | $5,593 | $4,819 | $4,155 | $11,759 |

| Net present value | $157 | ||||||||||

Table: (1)

Thus, the NPV of the project is $157.

Want to see more full solutions like this?

Chapter A Solutions

FUND.OF COST ACCT >CUSTOM<

- Evergreen Corporation (calendar-year-end) acquired the following assets during the current year: (Use MACRS Table 1 and Table 2.) Date Placed in Asset Machinery Service October 25 Original Basis $ 120,000 Computer equipment February 3 47,500 Used delivery truck* August 17 Furniture April 22 60,500 212,500 The delivery truck is not a luxury automobile. Note: Do not round intermediate calculations. Round your answers to the nearest whole dollar amount. a. What is the allowable depreciation on Evergreen's property in the current year, assuming Evergreen does not elect §179 expense and elects out of bonus depreciation?arrow_forwardAssume that TDW Corporation (calendar-year-end) has 2024 taxable income of $952,000 for purposes of computing the §179 expense. The company acquired the following assets during 2024: (Use MACRS Table 1, Table 2, Table 3, Table 4, and Table 5.) Asset Machinery Computer equipment Furniture Total Placed in Service September 12 February 10 April 2 Basis $ 2,270,250 263,325 880,425 $ 3,414,000 a. What is the maximum amount of §179 expense TDW may deduct for 2024? Maximum §179 expense deductiblearrow_forwardhelparrow_forward

- Identify and discuss at least 7 problems with the Jamaican tax system and then provide recommendations to alleviate the problems.arrow_forwardOn 17-Feb of year 1, Javier purchased a building, including the land it was on, to assemble his new equipment. The total cost of the purchase was $1,302,500; $295,000 was allocated to the basis of the land and the remaining $1,007,500 was allocated to the basis of the building. (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) Note: Do not round intermediate calculations. Round your answers to the nearest whole dollar amount. d. Assume the building was purchased and placed in service on 17-Feb of year 1 and is residential property. Depreciation Expense Year 1 Year 2 $ 36,632 Year 3 $ 36,632arrow_forwardOn 17-Feb of year 1, Javier purchased a building, including the land it was on, to assemble his new equipment. The total cost of the purchase was $1,302,500; $295,000 was allocated to the basis of the land and the remaining $1,007,500 was allocated to the basis of the building. (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) Note: Do not round intermediate calculations. Round your answers to the nearest whole dollar amount. a. Using MACRS, what is Javier's depreciation deduction on the building for years 1 through 3? Year 1 Depreciation Expense Year 2 Year 3arrow_forward

- On 17-Feb of year 1, Javier purchased a building, including the land it was on, to assemble his new equipment. The total cost of the purchase was $1,302,500; $295,000 was allocated to the basis of the land and the remaining $1,007,500 was allocated to the basis of the building. (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) Note: Do not round intermediate calculations. Round your answers to the nearest whole dollar amount. c. Assume the building was purchased and placed in service on 22-Nov instead of 17-Feb. Using MACRS, what is Javier's depreciation deduction on the building for years 1 through 3? Year 1 Year 2 Year 3 Depreciation Deductionarrow_forward1) Evaluate the progress and challenges in achieving a single set of global accounting standards. 2) Discuss the benefits and drawbacks of globalization in accounting, providing relevant examples.arrow_forwardWanting to finalize a sale before year-end, on December 29, WR Outfitters sold to Bob a warehouse and the land for $140,000. Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. a. What is Bob's basis in the warehouse and in the land if the appraised value of the warehouse was $100,750 and the appraised value of the land was $115,000? Bob's Basis Warehouse Landarrow_forward

- On 17-Feb of year 1, Javier purchased a building, including the land it was on, to assemble his new equipment. The total cost of the purchase was $1,302,500; $295,000 was allocated to the basis of the land and the remaining $1,007,500 was allocated to the basis of the building. (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) Note: Do not round intermediate calculations. Round your answers to the nearest whole dollar amount. e. What would be the depreciation for 2024, 2025, and 2026 if the property were nonresidential property purchased and placed in service 17-Feb, 2007 (assume the same original basis)? Depreciation Year Expense 2024 2025 2026arrow_forwardWhat percentage of RBC’s total assets is held in investments (at October 31, 2020 and 2019)? refer to the 2020 financial statements and accompanying notes of Royal Bank of Canada (RBC). Note that RBC also holds a significant loan portfolio. What is the business reason for holding loans versus securities? Comment on how the investments are classified and presented on the balance sheet. What percentage of total interest income comes from securities (2020 and 2019)? Are there any other lines on the income statement or in OCI) relating to the securities? What percentage of net income (include any relevant OCI items) relates to securities (2020 versus 2019)? Calculate an approximate return on the investments in securities.arrow_forwardYou are the partner-in-charge of a large metropolitan office of a regional public accounting firm. Two members of your professional staff have come to you to discuss problems that may affect the firm's independence. Neither of these situations has been specifically answered by the AICPA Professional Ethics Division. Case 1: Don Moore, a partner in the firm, has recently moved into a condominium that he shares with his girlfriend, Joan Scott. Moore owns the condominium and pays all the expenses relating to its maintenance. Otherwise, the two are self-supporting. Scott is a stockbroker, and recently she has started acquiring shares in one of the audit clients of this office of the public accounting firm. The shares are held in Scott's name. At present, the shares are not material in relation to her net worth. 1. What arguments would indicating that the firm's independence has not been impaired? 2. What arguments would indicating that the firm's independence has been impaired? 3. Which…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning