a.

To determine: The betas for the stocks

Introduction: Systematic risk is also known as volatility or non- diversifiable risk. It is the risk that is assumed by everyone before investing in a market. This kind of risk is unpredictable.

a.

Answer to Problem 9PS

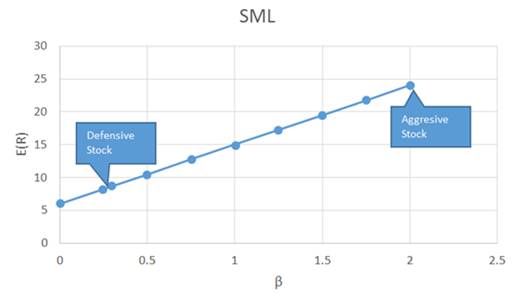

The beta value for aggressive and defensive stock is 2.00 and 0.30 respectively

Explanation of Solution

Given Information: Market return, aggressive stock and the defensive stock is given

Beta measures an investment’s volatility as it correlates to market volatility. When beta value more than 1, it means the investment has more systematic risk than the market. If beta less than 1, it means less systematic risk. When beta equals to 0, the investment has same systematic risk as the market.

So, the beta value is 2.00 and 0.30 for aggressive and defensive stock respectively.

b.

To determine: The expected

Introduction: Systematic risk is also known as volatility or non- diversifiable risk. It is the risk that is assumed by everyone before investing in a market. This kind of risk is unpredictable.

b.

Answer to Problem 9PS

The expected rate of return for aggressive stock and for the defensive stock is 18% and 9% respectively.

Explanation of Solution

Given Information: Market return, aggressive stock and the defensive stock is given

The

Calculation of expected rate of return (Aggressive Stock),

By substituting the value of 2% and 38%,

The expected rate of return (aggressive stock) is 18%

Calculation of expected rate of return (Defensive Stock),

The expected rate of return (Defensive stock) is 9%

c.

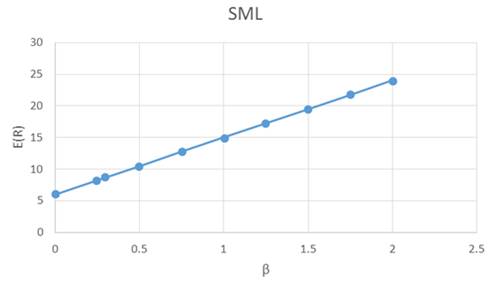

To determine: The SML for the economy

Introduction: Systematic risk is also known as volatility or non- diversifiable risk. It is the risk that is assumed by everyone before investing in a market. This kind of risk is unpredictable.

c.

Answer to Problem 9PS

The SML for the economy is shown in the graph

Explanation of Solution

Given Information: Market return, aggressive stock and the defensive stock is given

The capital asset pricing model describes the expected return on beta based security. This model is used for determine the expected return on asset, which is based on systematic risk.

The expected rate of return of each stock,

Now substituting the value of Expected rate of return on market,

So, SML is,

The SML with the market return in the graph is,

d.

To determine: The alphas of each stock

Introduction: Systematic risk is also known as volatility or non- diversifiable risk. It is the risk that is assumed by everyone before investing in a market. This kind of risk is unpredictable.

d.

Answer to Problem 9PS

The alpha of defensive stock is 8.7% and for the aggressive stock is (-6%)

Explanation of Solution

Given Information: Market return, aggressive stock and the defensive stock is given

The capital asset pricing model describes the expected return on beta based security. This model is used for determine the expected return on asset, which is based on systematic risk.

The stocks on SML graph,

Calculation of alpha value for defensive stock,

Calculation of alpha value for aggressive stock,

So, the value of alpha is (-6%) for aggressive stock

e.

To determine: The hurdle rate used by the management for a project

Introduction: Systematic risk is also known as volatility or non- diversifiable risk. It is the risk that is assumed by everyone before investing in a market. This kind of risk is unpredictable.

e.

Answer to Problem 9PS

8.7% is the hurdle rate for the project

Explanation of Solution

Given Information: Market return, aggressive stock and the defensive stock is given

The capital asset pricing model describes the expected return on beta based security. This model is used for determine the expected return on asset, which is based on systematic risk.The hurdle rate can be calculated by the beta value of the project. The hurdle rate is the expected rate of return for the defensive stock.

Calculate the discount rate for the project,

By substituting the value of expected rate of market and beta value,

So, the hurdle rate is 8.7%

Want to see more full solutions like this?

Chapter 9 Solutions

Investments

- What is the full form of "NYSE"? a.Net uield Security Exchnage b.National Stock Exchange c.Net Asset Value d.New York Stock Exchnagearrow_forwardThe method of converting the amount of future cash into an amount of cash and cash equivalents value in present is known as: a.Annuity b.Compounding c.None of these d.Discountingarrow_forwardThe risk that arises due to use of debt by the firm causing variability of return for creditors and shareholders is: a.Liquidity Risk b.Call Risk c.Default Risk d.Financial Riskarrow_forward

- 47. The value of holding period return is always show: a.Greater than 0 b.Less than 0 c.Negative d.Equal to 0arrow_forwardCurrent yield is equal to What? a.Market yield b.Any of these c.Income yield d.Running Yieldarrow_forwardExplain. The financial activities which are performed regularly are known as: a.Recurring Finance b.None of these c.Non-recurring finance functions d.Both a and barrow_forward

- The risk in terms of variability in security’s total return due to some exogenous factors is known as: a.systematic risk b.Unsystematic risk c.None of these d.Non diversifiable riskarrow_forwardThe Wildcat Oil Company is trying to decide whether to lease or buy a new computer-assisted drilling system for its oil exploration business. Management has decided that it must use the system to stay competitive; it will provide $3 million in annual pretax cost savings. The system costs $8.9 million and will be depreciated straight-line to zero over five years. Wildcat's tax rate is 21 percent, and the firm can borrow at 7 percent. Lambert Leasing Company is willing to lease the equipment to Wildcat. Lambert's policy is to require its lessees to make payments at the start of the year. Suppose it is estimated that the equipment will I have an aftertax residual value of $900,000 at the end of the lease. What is the maximum lease payment acceptable to Wildcat? Note: Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89. Maximum lease paymentarrow_forwardThe price of a security at the beginning of year is 100, the price at the end of the year is 125 and dividend paid at the end of the year is Rs.5. The current return of the security is: a.10% b.5% c.2.50% d.15%arrow_forward

- The financial activities which are performed regularly are known as: a.Recurring Finance b.None of these c.Non-recurring finance functions d.Both a and barrow_forwardThe shares of well-established, financially strong and big companies having remarkable Record of dividends and earnings are known as: a.Growth shares b.Cyclical shares c.Blue chip shares d.Income sharesarrow_forwardFinancial controller is responsible a.Cash Management b.Securities Management c.None of these d.Credit Managementarrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT