Concept explainers

Critical Thinking: Analyzing the Effects of

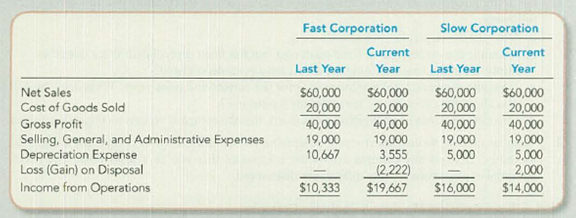

As an aspiring financial analyst, you have applied to a major Wall Street firm for a summer job. To screen potential applicants, the firm provides you a short case study and asks you to evaluate the financial success of two hypothetical companies that started operations last year on January 1. Both companies operate in the same industry, use very similar assets, and have very similar customer bases. Among the additional information provided about the companies are the following comparative income statements.

Required:

Prepare an analysis of the two companies with the goal of determining which company is better managed. If you could request two additional pieces of information from these companies’ financial statements, describe specifically what they would be and explain how they would help you to make a decision.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Loose-leaf for Fundamentals of Financial Accounting with Connect

- When a company pays rent in advance, it should record:A. Rent ExpenseB. Unearned Rent RevenueC. Prepaid Rent (Asset)D. Accrued Rentarrow_forwardIf total liabilities are $25,000 and owner’s equity is $15,000, total assets equal:A. $10,000B. $25,000C. $40,000D. $15,000arrow_forwardDon't use chatgpt When a company pays rent in advance, it should record:A. Rent ExpenseB. Unearned Rent RevenueC. Prepaid Rent (Asset)D. Accrued Rentarrow_forward

- No Chatgpt please 5. What is the normal balance of the Dividends account?A. DebitB. CreditC. Zero balanceD. Depends on the type of dividendarrow_forwardDon't use ai tool 4. A purchase of equipment for cash will:A. Increase assetsB. Decrease total assetsC. Have no effect on assetsD. Increase liabilitiesarrow_forwardNo AI tool 5. What is the normal balance of the Dividends account?A. DebitB. CreditC. Zero balanceD. Depends on the type of dividendarrow_forward

- Don't use AI Which account is not closed at the end of the accounting period?A. RevenueB. ExpenseC. DividendsD. Suppliesarrow_forwardNo use chatgpt Which financial statement reports cash inflows and outflows?A. Balance SheetB. Statement of Cash FlowsC. Income StatementD. Statement of Retained Earningsarrow_forwardNo Chatgpt When a company collects cash from a customer in advance, it should:A. Recognize revenue immediatelyB. Record a liabilityC. Record it as equityD. Ignore it until revenue is earnedarrow_forward

- Please don't use ai 5. What is the normal balance of the Dividends account?A. DebitB. CreditC. Zero balanceD. Depends on the type of dividendarrow_forwardDon't use ChatGPT! 5. What is the normal balance of the Dividends account?A. DebitB. CreditC. Zero balanceD. Depends on the type of dividendarrow_forwardNo chatgpt 5. What is the normal balance of the Dividends account?A. DebitB. CreditC. Zero balanceD. Depends on the type of dividendarrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning